Who should deduct TDS u/s 194Q?

You should deduct TDS under provision 194Q if the annual turnover of your business exceeds Rs 10 crore in the previous financial year.

What types of purchases you need to deduct TDS u/s 194Q?

You need to deduct TDS if you purchase goods worth more than Rs 50 lakhs from a single vendor in the same financial year. Apart from this, there are other conditions such as purchases should be from a resident and TDS has not been deducted under any other provisions of the Income Tax Act

What is the rate of TDS?

You need to deduct TDS at 0.1% if the seller has a PAN, or at 5%, if the seller does not have a PAN.

Example ?

if you purchase goods worth Rs. 60 lakhs from a seller with a PAN, TDS is deducted on Rs. 10 lakhs (the amount above Rs. 50 lakhs i.e. Rs. 60 Lakh – Rs. 50 Lakh) at 0.1% which comes Rs.1,000.

Exemptions :

It is to be noted that, the following entities are exempted from TDS deduction under Section 194Q.

- Government Entities

- Entities charging TCS under section 206C (Except 206C(1H))

- e-Commerce Operator u/s 194O

- NRI Entities

What is the time or point at which TDS needs to be deducted?

TDS is required to be deducted at the time of credit of such sum to the account of the seller or at the time of payment whichever is earlier. In other words, if you are making payments to the party or while booking the purchase invoice, whichever is earlier, you have to deduct TDS and pay the remainder of the amount to the seller.

Updated in TallyPrime 5.0

In TallyPrime 5.0 and onwards, you can calculate TDS automatically for Section 194Q by configuring the nature of payment with the required threshold limit and choosing to calculate tax on values exceeding the threshold or exemption limit.

While recording vouchers, you can access the TDS – Tax Analysis report to view the assessable value, exemption value, and taxable value, and TDS on the transaction calculated, based on these values.

Exemptions under 194Q are also addressed and can be easily managed while recording transactions.

Form 26Q in TallyPrime provides you with all the Deduction Details. You can view the transaction in its respective section of the report and file your TDS Returns right from TallyPrime 5.0.

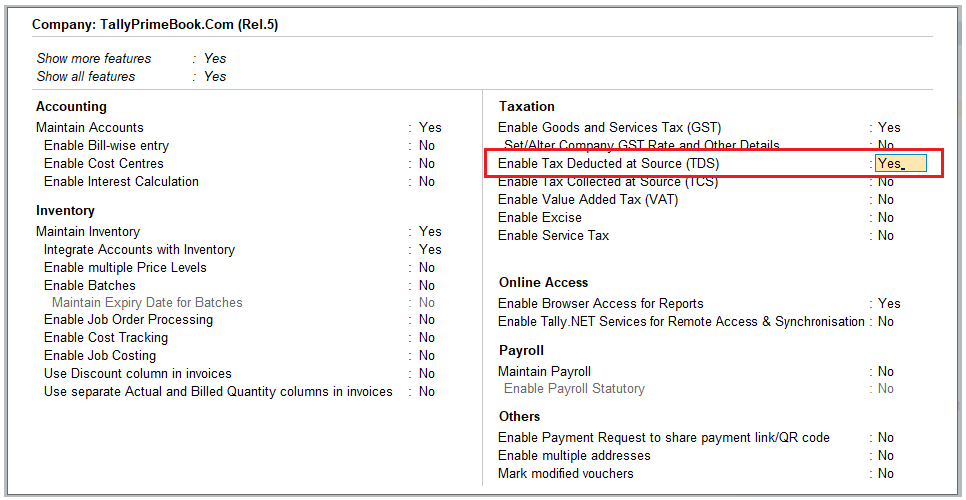

1. Enabling TDS in TallyPrime 5

1. Press F11(Features) > set Enable Tax Deducted at Source (TDS) to Yes.

If you do not see this option:

- Set Show more features to Yes.

- Set Show all features to Yes.

[153-New Updates in TallyPrime Release 5]

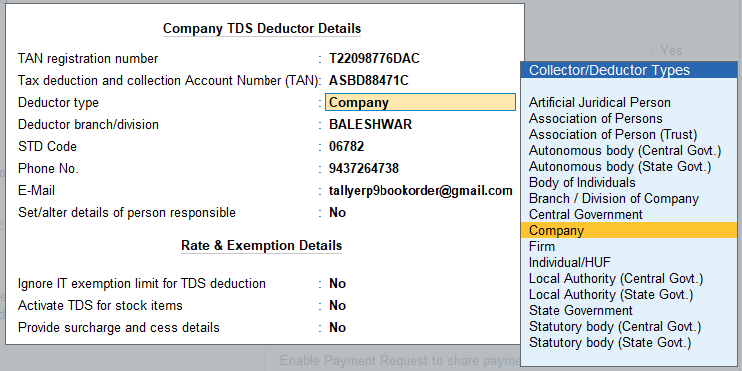

2. Enable the option Set/alter TDS details ? to display TDS Deductor Details screen as below :

[154-New Updates in TallyPrime Release 5]

Please enter all details in Company TDS Deductor Details as above and Press Ctrl+A .

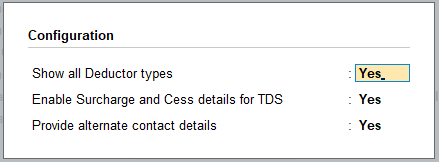

Press F12 : Advanced Configure in above Screen for Configure TDS as below :

[155-New Updates in TallyPrime Release 5]

>> All the organisation types will appear in the Collector/Deductor Type list for the option Deductor Type

>> All Surcharges details applicable to TDS will be enable in second option

>> The Third Option is to enable display of the alternate contact details of TDS

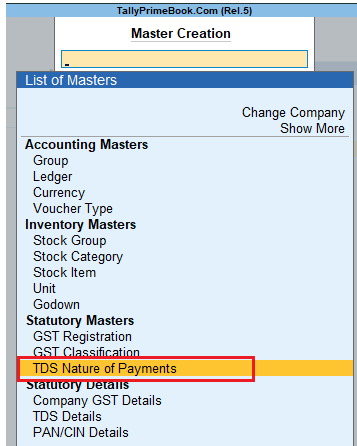

2. Create a TDS Nature of Payment with the Threshold Limit of Rs. 50 Lakhs.

- You can enable the TDS feature in TallyPrime and create masters like the Nature Of Payment (NOP), TDS Duty Ledger, Purchase Ledger, and so on to record TDS transactions.

- For Section 194Q, you can enable the option to calculate tax above the threshold limit in the NOP master and TDS will be calculated accordingly.

- TallyPrime 5.0 gives you the option of whether or not to calculate TDS only above the threshold limit in the NOP master. Consequently, while dealing with Section 194Q, you can configure the NOP to calculate tax on value exceeding the threshold/exemption limit of Rs. 50 lakhs.

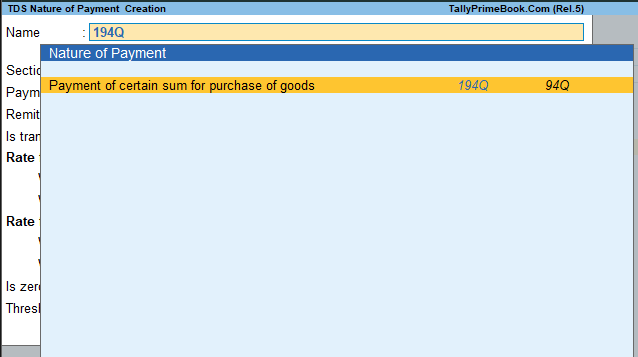

1. Press Alt+G (Go To) > Create Master > type or select TDS Nature of Payments.

Alternatively, Gateway of Tally > Create > type or select TDS Nature of Payments.

[156-New Updates in TallyPrime Release 5]

2. Press Alt+H(Helper) to view the list of Nature of Payment.

3. Type or select 194Qand press Enter.

[157-New Updates in TallyPrime Release 5]

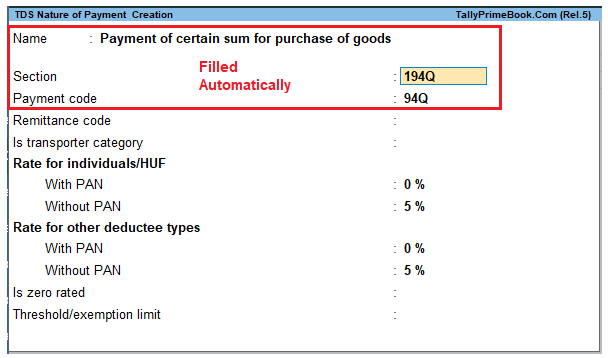

4. Enter the required fields in the TDS Nature of Payment Creation screen, as applicable.

[158-New Updates in TallyPrime Release 5]

5. Enter Other Details as applicable

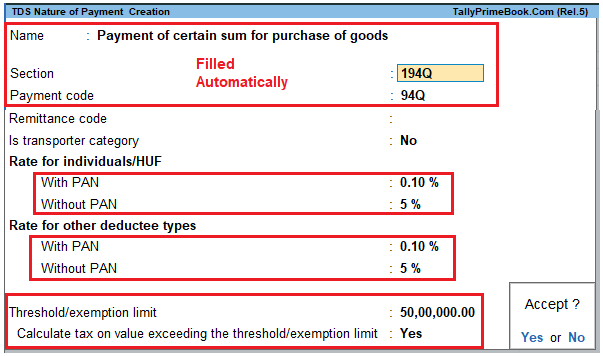

6. Configure the threshold/exemption limit.

- Enter the threshold/exemption limit.

7. Set Calculate tax on value exceeding the threshold/exemption limit to Yes.

[159-New Updates in TallyPrime Release 5]

8. Press Ctrl+A to save the nature of payment.

3. Creating Master Ledgers with TDS Applicability i.e. Party Ledger, Purchase Ledger & TDS Ledger.

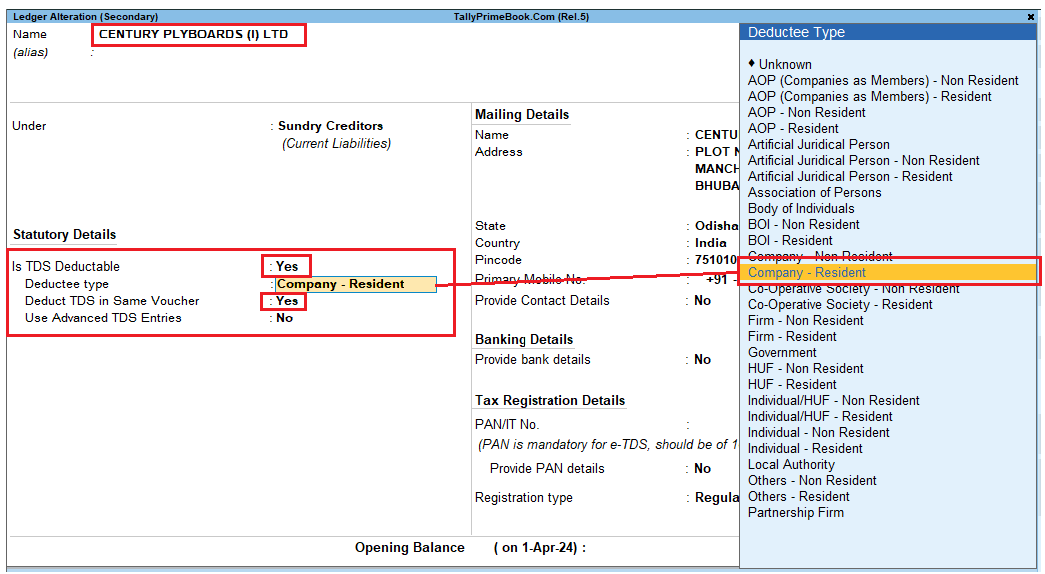

Step-1: Alter/Create Party Ledger i.e. CENTURY PLYBOARDS (I) LTD (Under Sundry Creditor) as below with TDS Applicability:

TDS will be deducted on the basis of the deductee type, which has to be defined in the party ledger.

1. Gateway of Tally > Create > type or select Ledger > and press Enter.

Alternatively, press Alt+G (Go To) > Create Master > Ledger > and press Enter.

Press F12 (Configure) and set the option Allow advanced entries in TDS masters to Yes.

2. Enter the Name (CENTURY PLYBOARDS (I) LTD) and select Sundry Creditor in the Under field

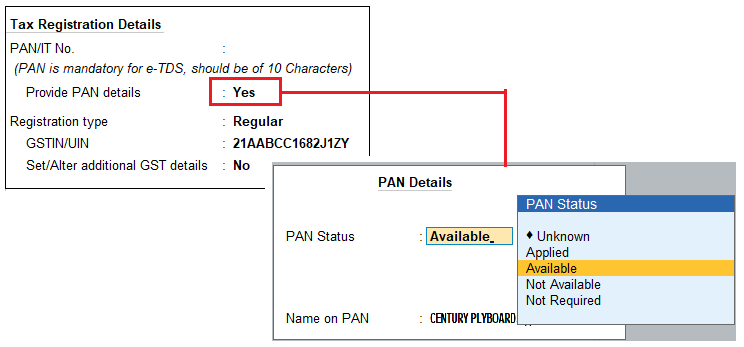

3. Enable the option Is TDS Deductible ? and Select a Deductee Type from the List and also Enable

[160-New Updates in TallyPrime Release 5]

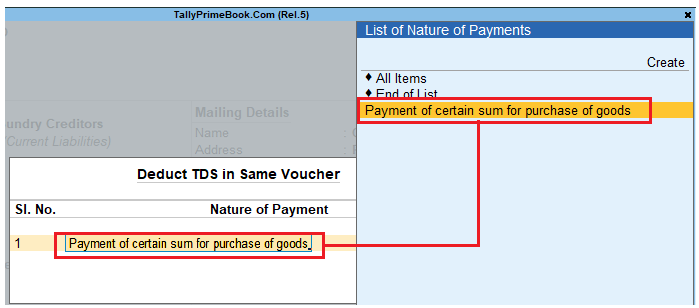

4. Deduct TDS in Same Voucher , if required, and select the TDS Nature of Payment. You can also select to All Items.

160A-New Updates in TallyPrime Release 5

[161-New Updates in TallyPrime Release 5]

Note: TDS Rate will be 0.10% due to PAN is available and mention here, otherwise 5% will be calculated.

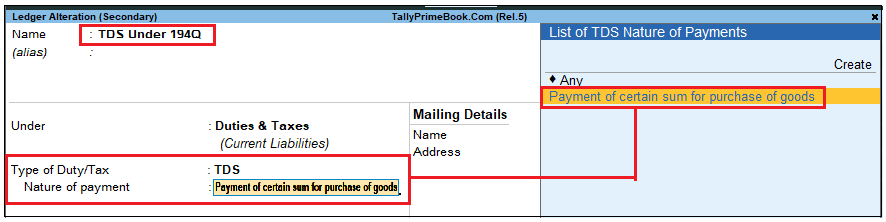

Step-2: Create TDS Ledger i.e. TDS under 194Q – with TDS Applicability

1. Go to Gateway of Tally> Accounts Info. > Ledgers > Create.

2. Enter the Name and Select Duties and Taxesas the group name in the Under field, then Select TDS as the Type of Duty/Tax.

3. Select a Nature of Payment from the List of Nature of Payments.

4. Press Enter. The Ledger Creation screen appears.

[162-New Updates in TallyPrime Release 5]

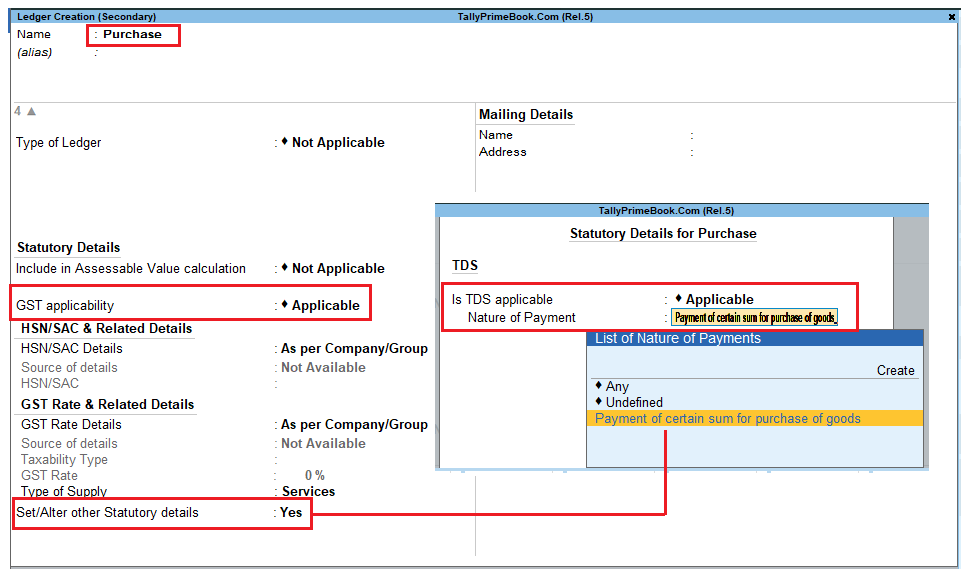

Step-3: Create ‘Purchase Ledger’ configured with TDS Applicability

Create or Alter Purchase Ledger with TDS Applicability as per image shown below :

[163-New Updates in TallyPrime Release 5]

4. Record TDS Purchase Above the Threshold Limit Under Section 194Q

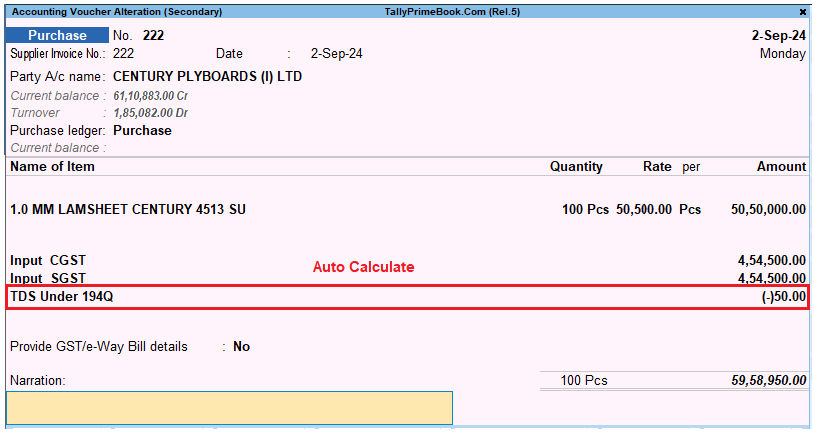

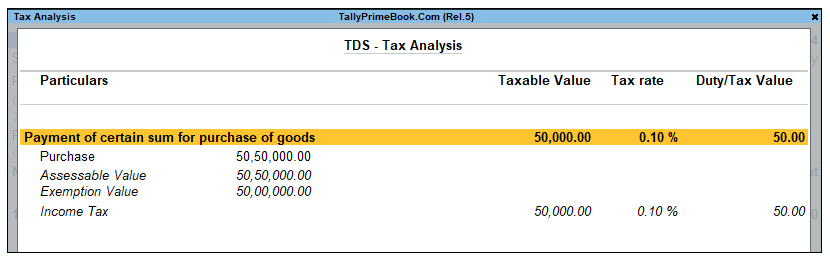

Once you have configured all the relevant masters for TDS (as already Discussed above), you can easily pass purchase transactions under TDS Section 194Q. TDS will be calculated automatically, if applicable. While passing the transaction, you can view the tax analysis report to get a detailed view of tax and understand the deductions.

If the purchase amount for a supplier crosses the threshold limit of Rs.50 lakhs in a financial year, then TDS will be calculated on the remaining amount above Rs. 50 lakhs.

1. While recording a Purchase voucher, select the common Purchase ledger configured for TDS applicability.

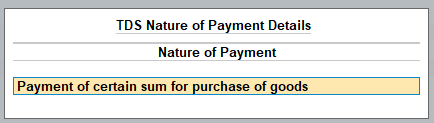

The TDS Nature of Payment Details screen appears.

[164-New Updates in TallyPrime Release 5]

2. Select the Nature of Payment configured for Section 194Q from the List of TDS Nature Of Pymt and press Enter.

3. Once you have entered the stock item details, select CGST, SGST, and TDS ledgers. The taxes get calculated automatically.

As the total purchase from Clean Plus Enterprises has crossed the threshold limit (Rs.50 lakhs), TDS will be calculated on the amount above Rs. 50 lakhs.

[165-New Updates in TallyPrime Release 5]

If you want to view Tax Analysis, press Ctrl+O (Related Reports) > TDS – Tax Analysis. Press Alt+F5 (Detailed) to view the detailed breakup of the tax.

[166-New Updates in TallyPrime Release 5]

4. Provide the Narration, if needed. As always, you can press Ctrl+A to save the voucher.