2.1. Activate GST for Your Company

To use TallyPrime for GST compliance, you need to activate the GST feature. Once activated, GST-related features are available in ledgers, stock items, and transactions, and GST returns can be generated.

GST Registrations are of two types…

1. GST Regular Scheme ( for Regular Dealer)

The GST regular scheme is for the general taxpayers whose turnover is above the threshold limit.

Under the GST regular scheme, all individuals with turnover above 40 lacs are required to take GST Registration. They are required to pay GST on goods & services as per the applicable rates and do regular GST return filing

2. GST Composition Scheme ( for Composite Dealer)

The composition scheme is meant for small businesses whose turnover of taxable goods not more than ₹1.5 crores (In case of North-Eastern states and Himachal Pradesh, the limit is now ₹. 75* lakh.), where GST has to be borne by the seller @1% of such turnover by traders, @2% by manufacturers, 5% for Restaurants & 6% for Service Providers.

A Composition Dealer has to issue Bill of Supply. They cannot issue a Tax Invoice. This is because the tax has to be paid by the dealer out of pocket. A Composition Dealer is not allowed to recover the GST from the customers.

2.1.1. Activate GST for Regular Dealers

To use TallyPrime for GST compliance, you need to activate the GST feature. Once activated, GST-related features are available in ledgers, stock items, and transactions, and GST returns can be generated.

1. Open the company for which you need to activate GST.

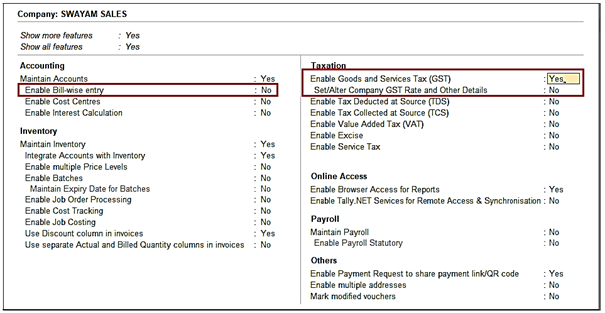

2. Press F11(Features) > set Enable Goods and Services Tax (GST) to Yes.

[19- GST Setup-TallyPrime Book]

[ Note : Enable Bill-wise Entry Option to – NO ]

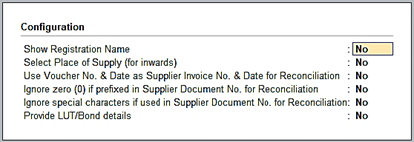

3. Press F12and enable the required options. You will find configurations related to Place of Supply, Reconciliation, LUT/Bond, and so on.

[20- GST Setup-TallyPrime Book]

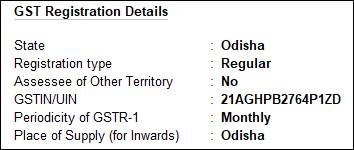

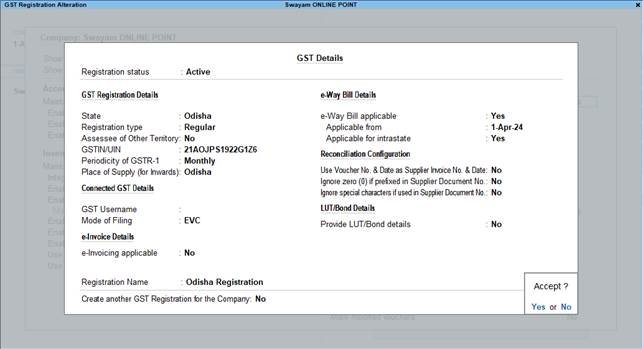

4. Fill in the relevant details for GST registration:

[21- GST Setup-TallyPrime Book]

[22- GST Setup-TallyPrime Book]

a. State: The State selected during Company Creation will be reflected here. If you update the State here, it will also be updated in the Company and existing transactions.

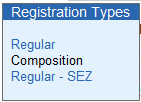

b. Registration type: You can select the Registration type as Regular, Composition, or Regular – SEZ, as per your original GST registration with the department.

[23- GST Setup-TallyPrime Book]

c. Assessee of Other Territory: If your business is located in an Exclusive Economic Zone (Other Territory). then you can enable this option. GST details will be applied accordingly in your masters and transactions.

d. Periodicity of GSTR-1: Select the Periodicity of GSTR1 as Monthly or Quarterly, based on the annual turnover of your business

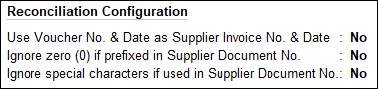

e. Reconciliation Configuration: A few options have been provided to help you with a smooth GST reconciliation. You can enable them based on your business preferences.

[24- GST Setup-TallyPrime Book]

i. Use Voucher No. & Date as Supplier Invoice No. & Date: Once you enable this option, the Voucher No. and Date will be considered as the Supplier Invoice No. and Date during reconciliation. In other words, even if you have not provided the Supplier Invoice No. and Date, then you don’t have to worry, as the Voucher No. and Date will be considered.

ii. Ignore zero (0) if prefixed in Supplier Document No.: If your business does not prefix zeroes in the Document No., but your supplier follows this practice, then this might lead to a mismatch during reconciliation. However, once you enable this option, then the prefixed zeroes will be ignored, and you won’t have to worry about a mismatch.

iii. Ignore special characters if used in Supplier Document No.: If your supplier prefers to use special characters, such as hyphen and slash, in the document number, then it might cause issues during reconciliation. However, once you enable this option, such special characters will be ignored and you will have a smooth reconciliation.

f. Registration Name: This will be derived from the State selected earlier. For example, if you have selected Karnataka, then the Registration Name will appear as Karnataka Registration for easy identification. However, you will have the option to rename the registration, as needed. For example, if you have many branches or GST registrations in Karnataka, you can name the branches as Bengaluru Branch, Mangalore Branch, and so on.

g. Create another GST Registration for the Company: Use this option to save multiple GST registrations within the same company. After saving the details, you can select the relevant registration while recording transactions, wherever needed. You can also create multiple registrations for your company from the Gateway of Tally or Go To > Create Master > GST Registration.

[25- GST Setup-TallyPrime Book]

5. Press Ctrl+A to save the details.

Anyone else tried out the q9betplataforma.net platform? Seems like a new betting spot, wanna know if its any good or just a scam. q9betplataforma

Epicwinph, what’s up! I’ve been playing on your platform for a while now, and the bonuses are insane! Sometimes the site lags a bit, but I’m still hooked. Keep it up! More promos, please! Click here for epicwinph.

Interesting read! Managing your bankroll is key with any online platform, and seeing PH889 prioritize KYC & transparent processes is good. Considering a calculated approach? Check out ph889 legit for data-driven options! 🧐

That’s a great point about blending tradition with tech! It’s cool to see platforms like luckyi online casino embracing Filipino culture – GCash & PayMaya are a smart move. Seamless deposits are key for a good experience! 👍

Just tried 789clubios, and wow, the interface is slick! Easy to navigate, and games load super fast. Definitely worth checking out if you’re looking for something new. Get your game on here! 789clubios

Comebet88 has a really solid reputation. Lots of my friends play here, and the feedback is always positive. I recommend giving it a whirl at comebet88