Credit Note is a document issued to a party stating that you are crediting their Account in your Books of Accounts for the stated reason or vise versa. It is commonly used in case of Sales Returns, Escalation/De-escalation in price etc.

All features and functions of Sales Voucher and Credit Note Voucher are same. So just like Sale Voucher, you can record transaction in Credit Note either in Accounting Invoice or Item Invoice.

A Credit Note can be entered in voucher or Invoice mode (either Accounting / Items).

To go to Credit Note Entry Screen :

- Gateway of Tally> Vouchers > F10 (Other Vouchers) > type or select Credit Note > and press Enter.

Alternatively, press Alt+G (Go To) > Create Voucher > F10 (Other Vouchers) > type or select Credit Note.

- Press Ctrl+H(Change Mode) and select Item invoice or Accounting Invoice mode as per your business needs.

[85-Sales Process in TallyPrime-3 & Higher]

(A) Item Invoice Mode

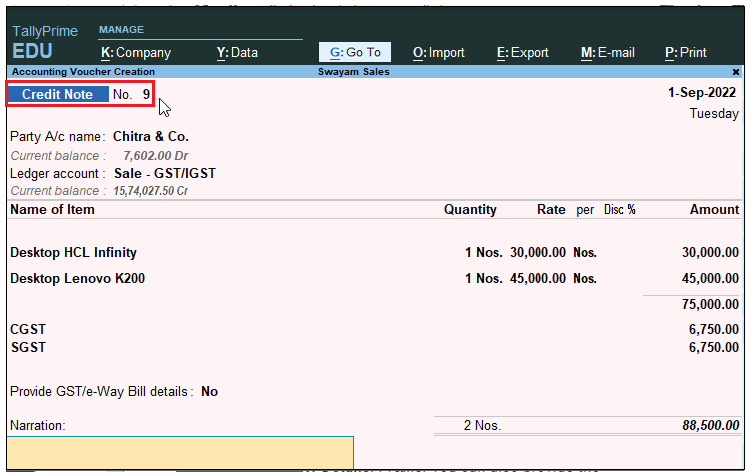

Pass an entry for goods sold returned from Customer Chitra & Co. just like Sale Voucher :

This Credit Note will pass through Item Invoice ( by pressing ALT+F6).

[86-Sales Process in TallyPrime-3 & Higher]

(B) Accounting Invoice Mode

Pass the Credit Note Entry for Price De-escalation for the month of March 2023 of Rs. 10,000 with GST @18% Adjustment to Chitra & Co.

This Credit Note will pass through Accounting Invoice ( by pressing ALT+F6).

[87-Sales Process in TallyPrime-3 & Higher]

Note : The Ledger ‘ Price De-escalation’ should be created under Sale Account Group with Inventory Option – No, GST Applicable with all GST Details @18% .

[88-Sales Process in TallyPrime-3 & Higher]

[Practical Assignment]

(Sales Return / Credit Note Transactions)

Record the following Sales Return Transactions under Credit Note ( ALT+F6) with GST Adjustment

CREDIT NOTE / SALE RETURN [Ctrl + F8]

Sl. No. Date Transactions

[A] Item Invoice (Alt+F6>Ctrl+H)

- 13/4/2023 Following goods has been returned by Lexsite Pvt. Ltd

Cabinet 2 Nos. 5000

[ Invoice Value Rs. 11,200 ]

- 28/4/2023 Shwetha &Co has returned the goods given

Anti Virus Norton 5 Nos. 2160

[ Invoice Value Rs. 12,744 ]

- 9/5/2023 Goods Sold to Sodexo Gift Voucher has returned back.

Processor Intel 2 Nos. 5175

[ Invoice Value Rs. 12,213 ]

- 2/6/2023 Adarsh Tiles Pvt. Ltd. has Returned the following goods

Processor Intel Celeron Dual Core E1200 1 Nos. 3300

[ Invoice Value Rs. 3,894 ]

- 9/6/2023 Goods returned by Mr. Sachar.

Laptop ACER 4720Z 1 Nos. 35000

[ Invoice Value Rs. 44,800 ]

- 30/6/2023 The given goods returned by Shrinivas Pvt. Ltd. (Outside – IGST)

Laptop Compaq A901TU 1 Nos. 40000

[ Invoice Value Rs. 51,200 ]

- 11/7/2023 Sold the following Items to Laxmi & Com which was returned back.

Microsoft Office 2003 1 Nos. 1200

[ Invoice value Rs. 1,260]

[B] Accounting Invoice (Alt+F6>Ctrl+H)

- 10/7/2023 There is a Price De-escalation (IGST-18%) of Rs. 20,000 given to Shrinivas Pvt. Ltd. with IGST Adjustment @18%.

[ Invoice Value Rs. 23,600 ]

( Note : Create a Ledger ‘Price De-escalation (IGST-18%)’ under Sale Account Group with GST Details Taxable @ 18%)