C O N T E N T S

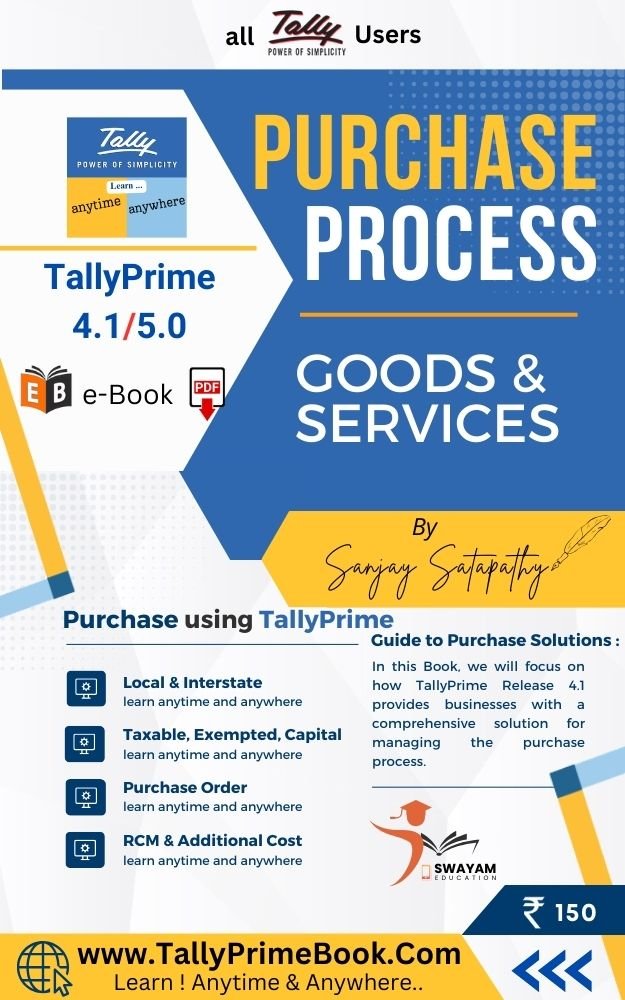

Purchase Process of Goods & Services

in TallyPrime 4.1/5.0

1. Purchase Process in TallyPrime 4/5

(ii) Bank Purchase (Cheque or Credit/Debit Card, UPI, Net Banking) :

Record additional charges, discounts, and free items:

Reports on Purchase of Goods and Services :

2. Local Purchase (within State) of Goods / Items in TallyPrime 4/5

2.1. Creation of Stock Items. 12

2.2. Apply GST Rate and HSN/SAC Details in Stock Item..

2.3. Setting MRP details in Stock Items.

Practical Assignment ( Creation of Stock Items)

Practical Assignment ( Local Purchase-Within State)

3. Local (within State) Purchase of Services in TallyPrime 4/5

3.1. Creating Service Ledger with GST Compliance.

4. Interstate (Outside State) Purchase of Goods & Items.

Practical Assignment ( Outside Purchase of Stock Items-Outside State)

5. Interstate (Outside State) Purchase of Services.

6. Purchase Voucher with some Additional Charges/ Discount etc.

>> Creation of Additional Charges Ledger included before GST in Purchase Bill

>> Creation of Additional Charges Ledger included after GST in Purchase Bill

>> Purchase Bill Voucher with Additional Charges / Discount both before and after GST.

Practical Assignment ( Purchase of Items & Goods with Additional Charges/ Discount etc. both Local and Outside State)

7. Purchase of Items with Trade Discount.

>> Enter the discount percentage against each item – without using the ledger account

>> Enter Discount percentage and amount on item rates – using the ledger account

8. Purchase of Free Items in TallyPrime 4/5

>> Account for free items using Actual and Billed quantities.

>> Account for free items using zero-valued transaction.

9. Purchase of ‘Nil-Rated’, ‘Exempted’, Items & Goods using TallyPrime 4/5

Practical Assignment ( Purchase of -Nil Rated & Exempted Goods)

10. Record Expenses with GST in Purchase Voucher.

(A) Create an Expenses Ledger.

Practical Assignment ( Expenses Ledger Creation with GST Compliance)

(B) Record an Expense in a Purchase voucher.

Practical Assignment ( EXPENSES in PURCHASE VOUCHER [F9] – Accounting Invoice ( Ctrl+H))

11. Purchase of Fixed Assets (Capital Goods) in TallyPrime 4/5

Practical Assignment ( Ledger Creation of Fixed Assets)

Record Purchase of Fixed Assets (Capital Goods)

Practical Assignment ( Capital Goods Purchase Voucher [F9] – Accounting Invoice ( Alt+H))

12. Purchase of Goods & Services under Reverse Charge Mechanism (RCM)

12.1. Set Up Goods / Services Under Reverse Charge Mechanism (RCM)

12.1.1. Configure Stock Item for RCM…

12.1.2. Configure Service Ledger for RCM…

12.1.3. Record inward supply of Goods under Reverse Charge Mechanism-RCM…

12.1.4. Record inward supply of Services under Reverse Charge Mechanism-RCM…

13. Purchase Order Processing in TallyPrime 4/5

13.1. Purchase Order (Ctrl+F9) Processing in TallyPrime-3 & Higher.

13.1.1. Receipt Note Voucher (GRN) (Alt+F9) against Purchase Order.

13.1.2. Purchase Voucher (F9) against Receipt Note Voucher (GRN)

13.1.3. Purchase Order Outstanding.

14. Purchase Return / Debit Note Voucher (Alt+F5) under GST in TallyPrime 4/5

Practical Assignment ( Debit Note / Purchase Return)

15. Change in the Assessable (Taxable) Value of Purchase Under GST in TallyPrime 4/5

16. GST Invoice Support for ‘Material in Voucher’ in TallyPrime 4/5

17. Record Purchase of Services as Expenses in TallyPrime 4/5

18. Additional Cost of Purchase on Stock Items in TallyPrime 4/5

-

- Configure Additional Cost ledger.

- Create a Purchase Voucher with an Additional Cost of Purchase on Stock Item in Invoice Mode.

18.2.1. Configure Purchase Voucher Type to Track Additional Cost for Voucher Mode.

18.2.2. Create a Purchase voucher with an additional cost of purchase on Stock Items in Voucher Mode

19. Credit Note for Increase in Purchase Value.

Record a Credit Note to increase the Purchase Value :