Ledger Vouchers – GST provides a clear picture of whether your seller has uploaded the vouchers on the GST portal, along with the appropriate tax amounts. You can easily figure out any discrepancy with any party using the Diff in Tax Amount column.

Once you have a clear view of the tax requirements, you can take data-driven decisions while making payments to your sellers.

1. Knowing ITC at Risk Using Ledger Vouchers – GST Report

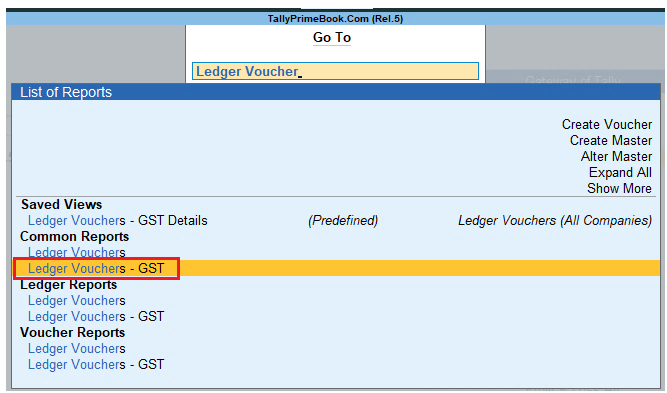

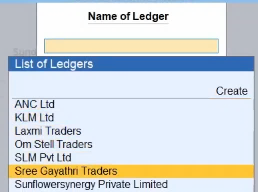

1. Press Alt+G (Go To) > Ledger Vouchers – GST and select the required party ledger.

[138-New Updates in TallyPrime Release 5]

[139-New Updates in TallyPrime Release 5]

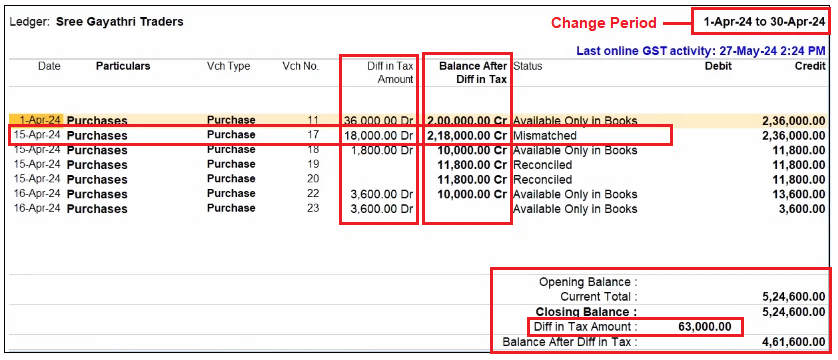

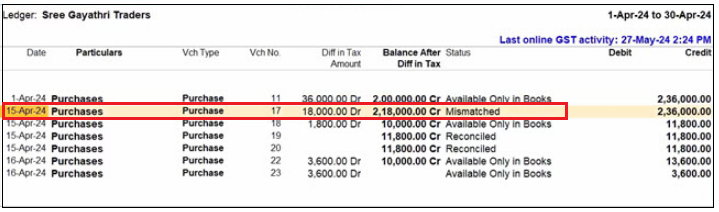

For your bills against the party, you will have a clear view of the Difference in Tax Amount (ITC at Risk), the Balance After Difference in Tax, and the GST Status.

This will help in easy settlement of the bills, without the need to manually calculate the amount after considering ITC at risk.

[140-New Updates in TallyPrime Release 5]

This will help in easy settlement of the transactions, without the need to manually calculate the amount after considering ITC at risk.

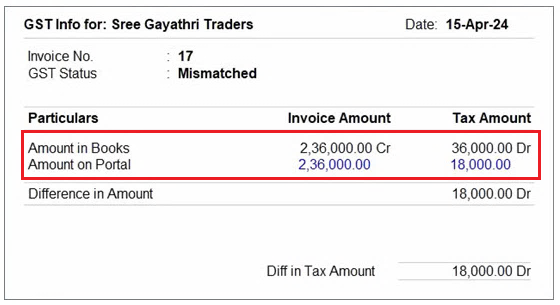

2. Press F7(GST Info) for a detailed picture of the difference between the amounts.

[141-New Updates in TallyPrime Release 5]

3. Press Esc to return to Ledger Vouchers – GST.

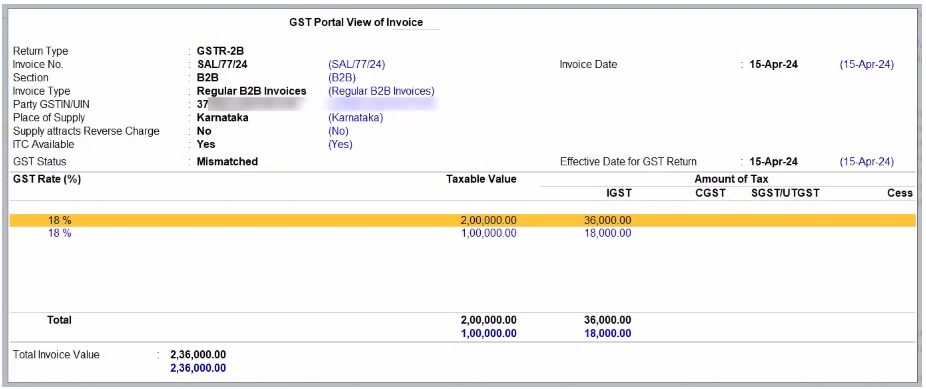

4. On the relevant voucher, press Alt+R (GST Portal View) to view the details available on the GST portal.

5. Press F8 (Show Portal Value).

You will get a clearer idea about the reason of mismatch. You can also view the tax breakup along with the GST rates and amounts.

[142-New Updates in TallyPrime Release 5]

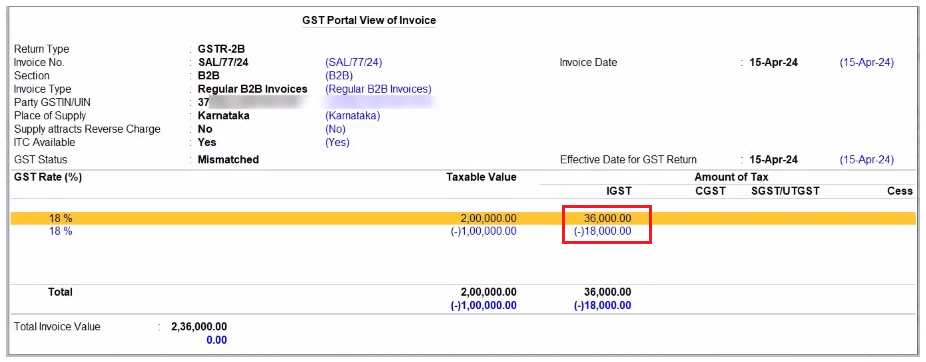

6. Press F9(Differential Mode).

[143-New Updates in TallyPrime Release 5]

In this way, you can view the difference between the transactions in your books and the transactions downloaded from the GST portal.

2. Setting GST Status of Vouchers

Ledger Vouchers – GST also provides you with the flexibility to set the required GST status for your vouchers.

You will want to marked the voucher as Reconciled in the following scenarios :

- The Bill is too Old, and the seller might not upload the vouchers in the future

- The difference in amount is minimal

- The Bill belongs to your won branch or a subsidiary company

In such scenarios, you can override the ITC at risk and reconcile the voucher.

1. Press Alt+G (Go To) > Ledger Vouchers – GST and select the required party ledger.

Under Status, you can view the Bills that are Mismatched.

[144-New Updates in TallyPrime Release 5]

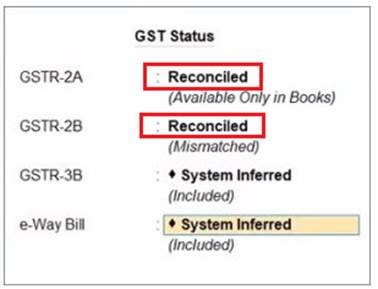

2. On the relevant voucher, press Alt+V(Set GST Status) and set the GST Status as Reconciled.

[145-New Updates in TallyPrime Release 5]

3. Press Ctrl+Ato save the status.

The transactions will be reconciled, and there will be no difference in the tax amount between the books and the portal.

In this way, Ledger Outstandings – GST provides you with great clarity about the ITC at risk.

This will help you in taking faster and more reliable business decisions.