Handling tax liability can be tricky, especially if your business deals with numerous buyers. But TallyPrime has just the report for you, where you can view the ITC requirements for one or even a hundred buyers, from a single screen!

There’s no need to spend your time and efforts in collecting data across multiple reports or tools. The Bills Receivable report provides a clear picture of whether you have uploaded the vouchers on the GST portal, along with the appropriate tax amounts. You can easily figure out any discrepancy with any party using the Difference in Tax (Liability) column.

In this way, you will great clarity about any balance liability that has to be paid to the department. Moreover, your buyers can also seamlessly avail Input Tax Credit as per the Invoice Amount.

1. View Tax Liability using Bills Receivable – GST (Predefined)

With the Bills Receivable -GST Report, you will get to know :

- The Mismatch in the Books and Portal Data

- The transactions yet to be Uploaded on the GST Portal

Therefore, you will know the balance liability to be paid to the Department.

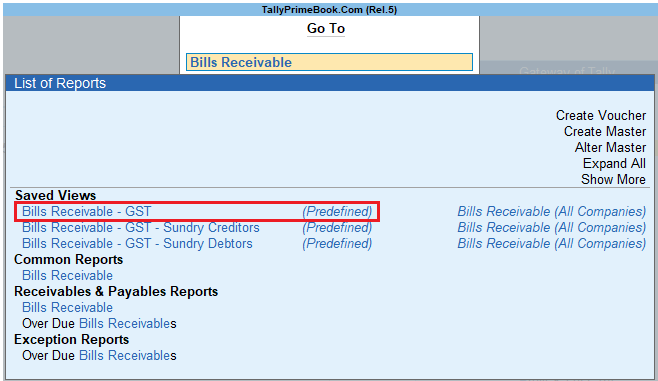

1. Press Alt+G(Go To) > Bills Receivable – GST (Predefined).

[121-New Updates in TallyPrime Release 5]

Which will open a saved view of Bills Receivable considering GST requirements.

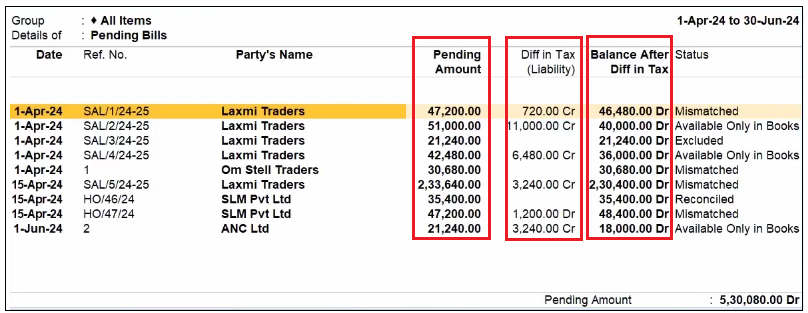

For your bills, you will have a clear view of the Difference in Tax (Liability) as well as the Balance After Difference in Tax.

[122-New Updates in TallyPrime Release 5]

This will help you in easily identifying and rectifying any discrepancies, and uploading any missing invoices.

Once you address the discrepancies and upload the missing invoices, if any, the buyer will be able to claim the ITC and you will receive the payments on time.

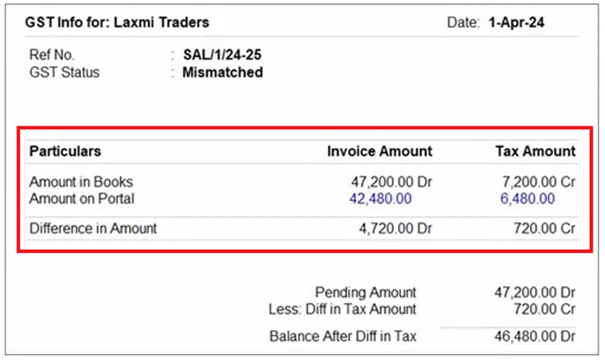

2. Press F7(GST Info) for a detailed picture of the difference between the amounts.

[123-New Updates in TallyPrime Release 5]

The Difference in Amount between the Amount in Books and Amount on Portal is the balance amount that has to be reported on the GST portal.

In this way, you can easily rectify discrepancies and upload any missing invoices. This will also help the buyer in claiming the ITC, after which you will receive the payments on time.

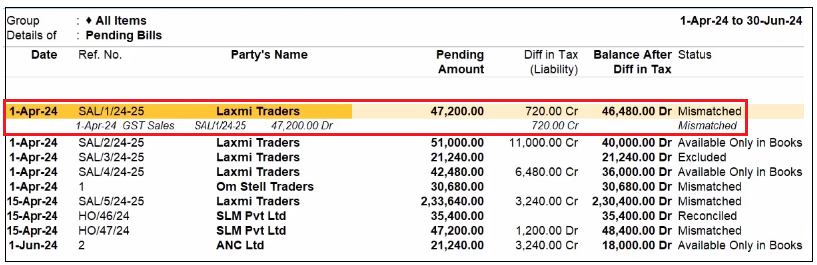

2. View Mismatches in Bills Receivable – GST Report

1. Press Alt+G(Go To) > Bills Receivable – GST (Predefined).

Under Status, you can view the Bills that are Reconciled, Mismatched, Available Only in Books, Excluded, and so on.

[124-New Updates in TallyPrime Release 5]

2. On the relevant Mismatched voucher, press Shift+Enterto view the voucher details.

[125-New Updates in TallyPrime Release 5]

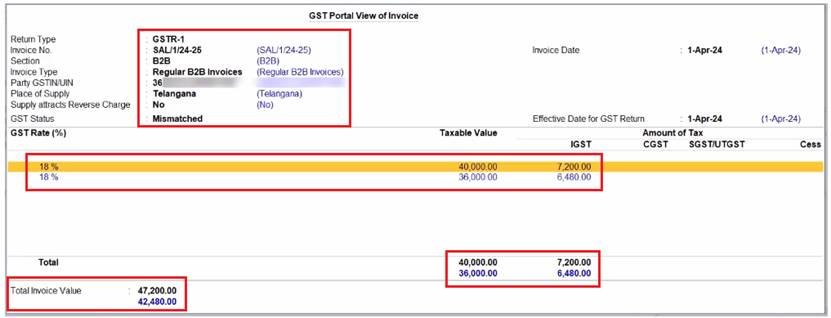

3. Press Alt+R (GST Portal View) to view the details available on the GST portal.

[125-A-New Updates in TallyPrime Release 5]

4. Press F8(Show Portal Value).

You will get a clearer idea about the reason of mismatch. You can also view the tax breakup along with the GST rates and amounts.

[126-1-New Updates in TallyPrime Release 5]

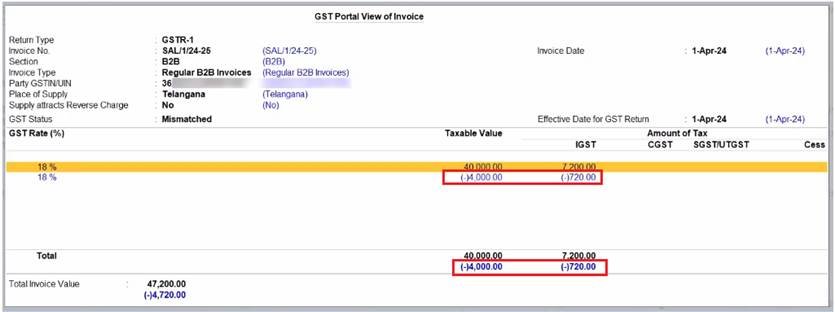

5. Press F9(Differential Mode).

[126-2-New Updates in TallyPrime Release 5]

In this way, you can view the difference between the transactions in your books and the transactions downloaded from the GST portal.

This helps you in identifying the amount that is pending to be reported on the GST portal.