This is called Recording Sales of Composite Supply under GST (Expenses Apportioning).

Composite supply means a supply is comprising two or more goods/services, which are naturally bundled and supplied in with each other in the ordinary course of business, one of which is a principal supply. The items cannot be supplied separately.

Illustration in Revised GST law : Where goods are packed, and transported with insurance, the supply of goods, packing materials, transport and insurance is a composite supply. Insurance, transport cannot be done separately if there are no goods to supply. Thus, the supply of goods is the principal supply

You can record the sales of a composite supply using a sales invoice. The rate of tax applicable on the principal supply will be considered as the rate of tax for the composite supply.

Example:

Transactions : Sold the following Goods to Chitra & Co. (within state customer) on Credit on 01/04/2023 with Packing Charges of Rs.500, Delivery Charges with Rs.300 and there is a Discount of Rs.400 on total Sales value .

| Name of Product | Qty. | Rate | Value |

| Desktop HCL Infinity (GST-18%) | 1 Nos. | 30,000 | 30,000 |

| Desktop Lenovo K200 (GST-18%) | 1 Nos. | 45,000 | 45,000 |

To create a ‘Discount on Sale’ / ‘Packing Charges’ & ‘Delivery Charges’ Ledger:

- Gateway of Tally > Create > type or select Ledger and press Enter.

Alternatively, press Alt+G (Go To) > Create Master > type or select Ledger and press Enter.

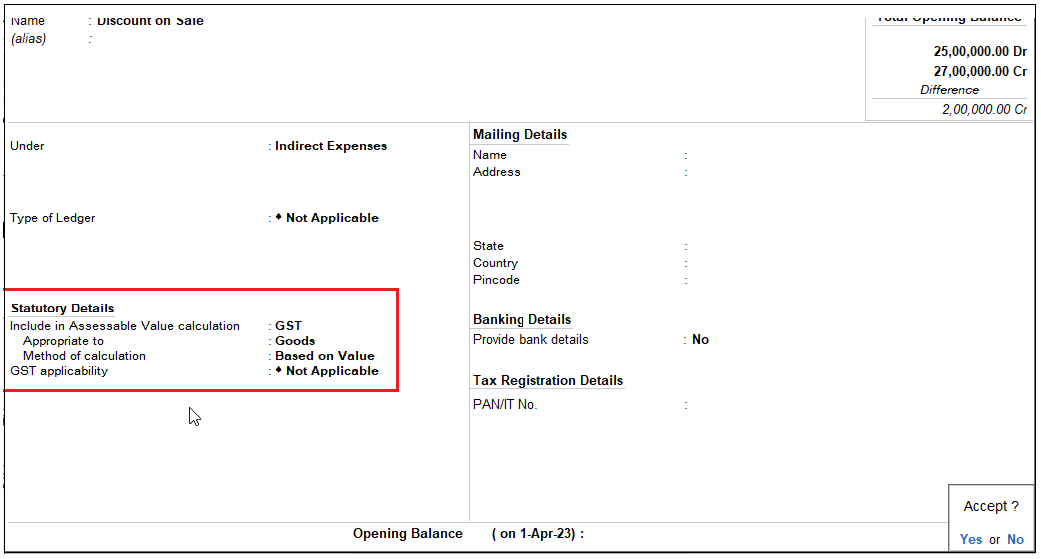

- Enter the Name of the ledger ‘Discount on Sale’

- Select Indirect Expenses as the group name in the Under field.

- Set the option Inventory Values are affected to No.

- Select GST in the Include in assessable value calculation for: field.

[48-Sales Process in TallyPrime-3 & Higher]

[ Automatically, the option GST Applicable will become Not Applicable by default]

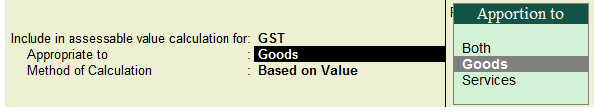

- Select Goods in the Appropriated to field.

[49-Sales Process in TallyPrime-3 & Higher]

- Select Based on Value in the Method of Calculation field.

[50-Sales Process in TallyPrime-3 & Higher]

[51-Sales Process in TallyPrime-3 & Higher]

- Press Enter to accept and save the ledger.

| Note : Like ‘Discount on Sale’ ledger as created above, you can create ‘‘Packing Charges’ & ‘Delivery Charges’ Ledger |

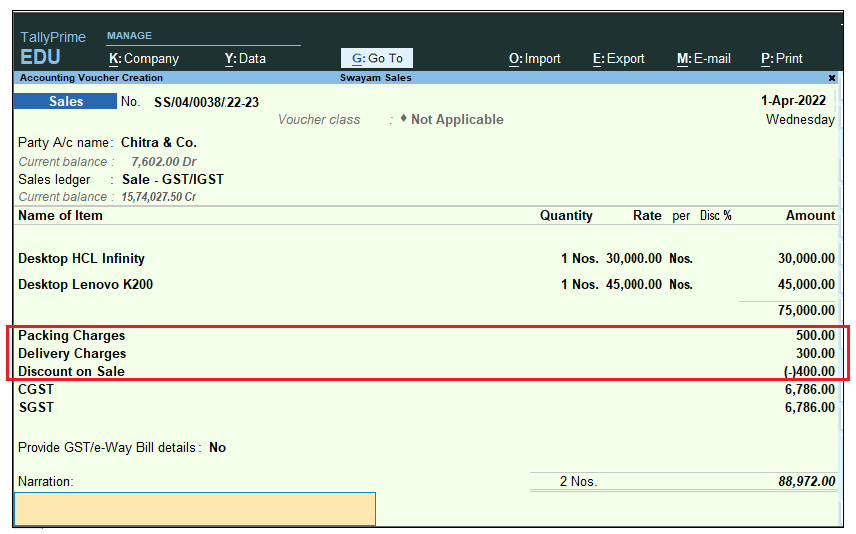

- Example of GST Sales Invoice having Packaging Charges, Delivery Charges and Discount on Sale as below…

[52-Sales Process in TallyPrime-3 & Higher]

| Note :

1. Remember, put the Discount on Sale Value with minus (-) symbol to deduct the amount form the invoice value. 2. All these Indirect Expenses can be given either in % or in Value. 3. Under Configure F12, Don’t forget to enable or set Yes to Calculate Tax on Current Subtotal-Yes

[53-Sales Process in TallyPrime-3 & Higher] |

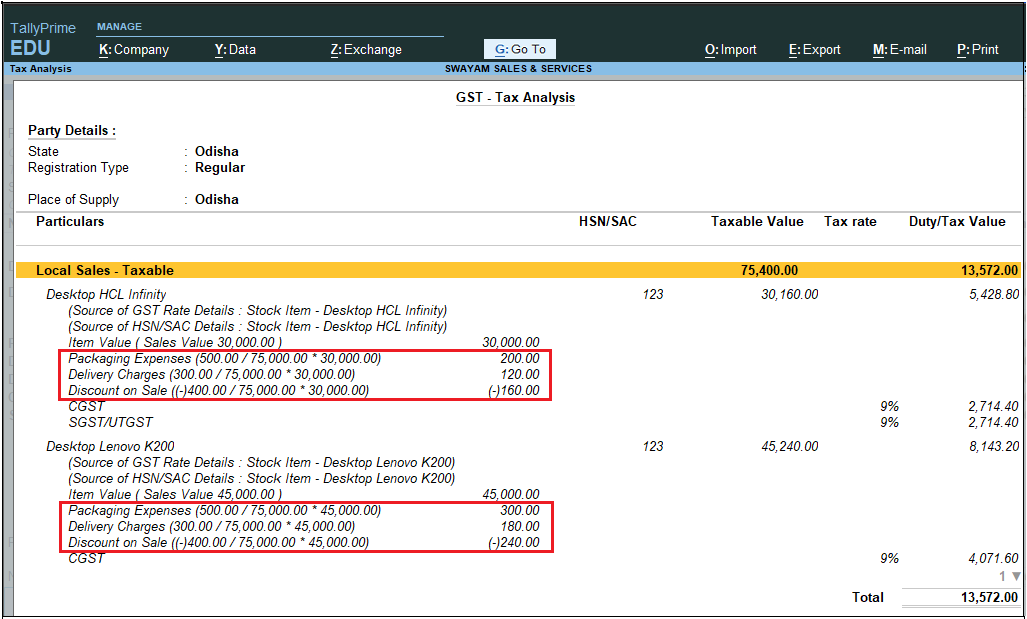

GST-breakup details are :

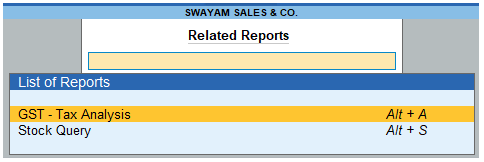

When you Press Press ALT+A to display GST-Tax Analysis Directly [ OR Press Ctrl + O (Related Reports) and select GST – Tax Analysis from Additional Details] and Press Alt + F1 or Alt+F5 for Details…you will see the GST Analysis as below by default.

[54-Sales Process in TallyPrime-3 & Higher]

[55-Sales Process in TallyPrime-3 & Higher] Note : Packing Charges, Delivery Charges and Discount on Sale is calculated Proportionately on the basis of Value of Goods. |