You can record the sales of both goods and services in the same invoice by selecting the required sales ledger and GST ledgers (state tax and central tax for local sales; integrated tax for interstate sales)

Example:

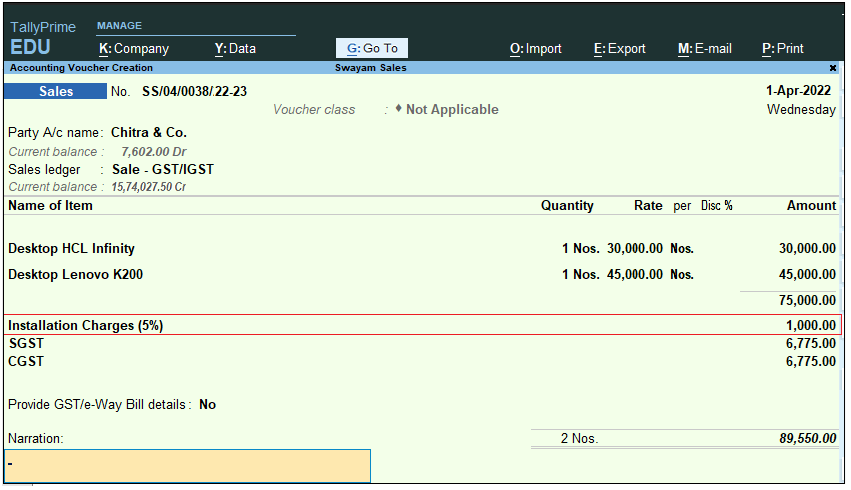

Transactions : Sold the following Goods to Chitra & Co. (within state customer) on Credit on 01/04/2023 with ‘Installation Charges’ Rs.1,000 extra which attracts GST 5% apart from Products GST.

| Name of Product | Qty. | Rate | Value | GST |

| Desktop HCL Infinity | 1 Nos. | 30,000 | 30,000 | (GST-18%) |

| Desktop Lenovo K200 (GST-18%) | 1 Nos. | 45,000 | 45,000 | (GST-18%) |

Setup :

Create a Ledger “Installation Charges” under ‘Direct Income’ with GST Applicable @ 5% as details below :

[45-Sales Process in TallyPrime-3 & Higher]

The Sales Invoice will be as shown as below :

[46-Sales Process in TallyPrime-3 & Higher]

GST -Tax Analysis :

When you Press Alt+A for GST-Tax Analysis and Press Alt + F1 for Details…you will see the GST Analysis as below by default.

[47-Sales Process in TallyPrime-3 & Higher]