A business deals with customers, wholesalers, retailers, Suppliers and many such business parties on a day-to-day basis. You need to create party ledgers to record transactions that you make, which may involve Sales , Purchase, Receipts or Payments, or Sales or Purchase from these parties.

To create a Party Ledger:

- Gateway of Tally > Create > type or select Ledger and press Enter.

Alternatively, press Alt+G (Go To) > Create Master > type or select Ledger and press Enter.

- Enter the Name of the Party ledger

- Select Sundry Creditors / Sundry Creditors from the List of Groups in the Under field.

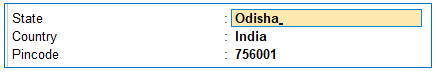

- In Mailing details, the State is your default local State. You can change name of State from the State List if your Suppliers belongs to Outside State.

[1-Sales Process in TallyPrime-3 & Higher]

- Enable the option Tax Registration Details? .

o Select the relevant Registration Type from the List of registration Types.

o Enter the 15-digit GSTIN or UIN issued by the tax authority.

o If the supplier is an e-commerce operator, then enable the option Behave as e-Commerce Operator?

The GST Details screen appears as shown below:

[2-Sales Process in TallyPrime-3 & Higher]

o Press Ctrl+A to accept.

The Ledger Creation screen displays as shown below:

[3-Sales Process in TallyPrime-3 & Higher]

Important Points:

- GST involves within State (Local) and Outside State (Outside).

- GST within State transactions are classified into CGST & SGST & Outside State transaction is IGST.

- TallyPrime will select CGST , SGST (with state transaction) or IGST (outside State transaction) on the basis of Party Ledger Address i.e. State & Party Registration type i.e. Composition or Consumer or Regular or Unregistered/Consumer. If Party is Registered either under Composition or Regular, then GSTIN / UIN No. has to be mentioned. TallyPrime will validate the GSTIN / UIN No. on the basis of State selection under Mailing details.

- So the most important part at the time creation of Party Ledger is its selection of State in Mailing Address and type of Registration under Tax Registration Details as per screen below:

[4-Sales Process in TallyPrime-3 & Higher]

- TallyPrime will calculate GST automatically on the basis of GST Rate given in Items & Goods in case of Accounts with Inventory and in case of Accounts only GST Rate given in Sales or Purchase Ledger: