You can record an interstate purchase of services in TallyPrime, using a Purchase voucher in Accounting Invoice mode.

- Open a purchase voucher in the Accounting Invoice mode.

- Press Alt+G (Go To) > Create Voucher > press F9 (Purchase).

Alternatively, Gateway of Tally > Vouchers > F9 (Purchase).

- Press Ctrl+H (Change Mode) and select Accounting Invoice.

- Enter the Supplier Invoice No. and Date.

- Provide the supplier details.

- Party A/c name: Select the supplier or cash ledger.

- Place of Supply: Select the location where services are supplied.

Under Party Details if the Place of Supply is different from the State address of your supplier, then only the purchase is considered as interstate under GST. It is to be noted that in Purchase vouchers, Place of Supply is picked automatically as the state of your company.

- Under Particulars, enter the name of service purchased, and specify the Amount.

- Select the tax ledger – interstate tax (IGST), for interstate purchase.

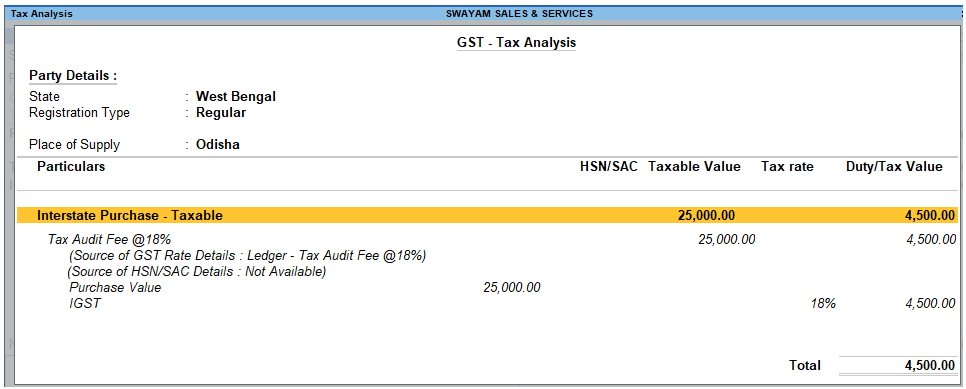

[5-1-Interstate (Outside State) Purchase of Services in TallyPrime-3]

GST will be calculated based on the IGST rate defined in the stock item ledger.

[5-2-Interstate (Outside State) Purchase of Services in TallyPrime-3]

| If you want to view Tax Analysis, press Ctrl+O (Related Reports) > GST Tax Analysis. OR Press Alt+A

Press Alt+F5 (Detailed) to view the detailed break-up of tax. |

- As always, press Ctrl+A to save the voucher.

1. Creating Service Ledger with GST Compliance

In case of Service oriented Business like…Chartered Accountant, Lawyer, Advertising Agency, Consultant, Architectures etc.. they provide Service to the customer and provide Bill / Invoice with GST Compliance. So in this case, TallyPrime provides Accounting Invoice with auto GST Calculations, provided all Service Ledgers has to be created with GST Rate ( as applicable).

For Example:

Create a Ledger – Audit Fee with GST 18%

Setup:

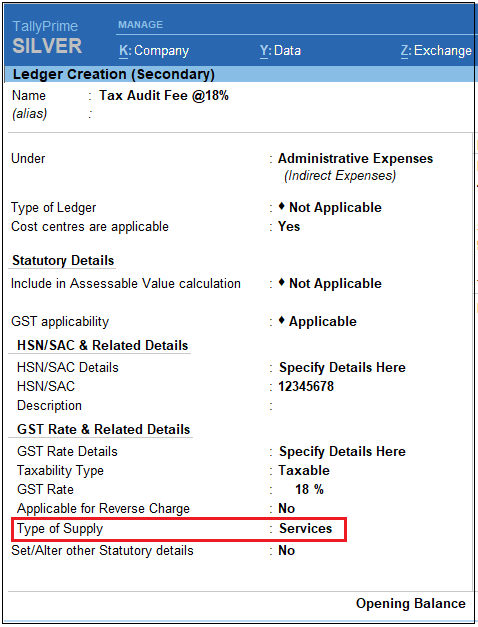

Create a Ledger, ‘Audit Fee’ under Direct Income with GST Applicable and the GST details will be applied seamlessly, with Type of Supply – Service as per screen below:

[5-3-Interstate (Outside State) Purchase of Services in TallyPrime-3]

- Press Alt+G(Go To) > Create/Alter Master > Ledger (under Accounting Master).

Alternatively, go to Gateway of Tally > Create/Alter > Ledger. - Select the required service ledgerfrom the List of Ledgers, or create a new one, as needed.

- Fill in the relevant details for HSN/SAC and GST.

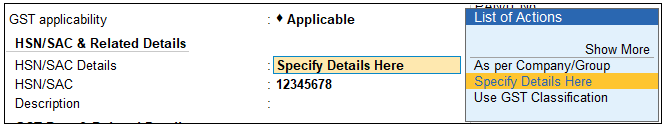

- HSN/SAC Details: You have three options to choose from.

- Specify Details Here: Once you select this option, you will be able to enter the details right here in the service ledger.

[5-4-Interstate (Outside State) Purchase of Services in TallyPrime-3]

- Use GST Classification: This option allows you to select a previously created GST Classification, or create one on the spot. The details will be applied accordingly.

- Specify in Voucher: If you are not aware of the details at the moment, and if you want to add the details directly in the transaction, then you can select this option.

- GST Rate Details: Like in the previous field (HSN/SAC Details), you have the same three options to choose from.

[Select Sales Exempt , if the type of supply is exempted from tax under GST, or select Sales Nil Rated , if the tax rate applicable to the type of supply is 0% under GST.]

- Type of supply – Services .

[5-5-Interstate (Outside State) Purchase of Services in TallyPrime-3]

5. Press Ctrl + A to save.