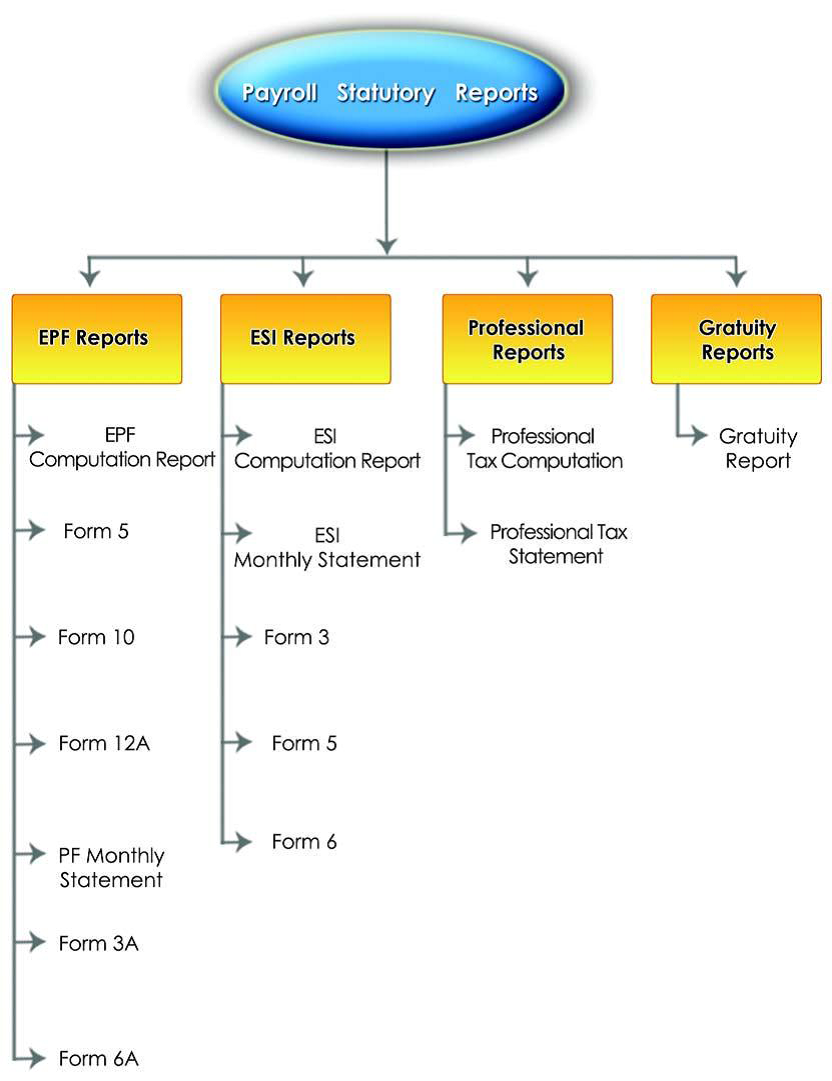

In TallyPrime 4, you can display, print statutory forms and reports for Provident Fund (EPF), Employee State Insurance (ESI) and Professional Tax (PT) in the prescribed format as required by the statutes. The following Statutory reports are available in TallyPrime 4:

[154-Payroll Management using TallyPrime]

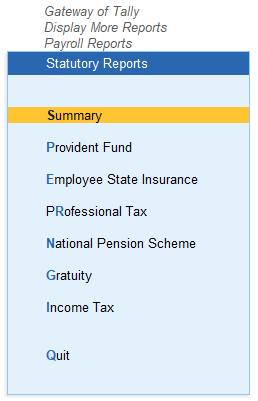

- Gateway of Tally > Display More Reports > Payroll Reports > Statutory Reports

[155-Payroll Management using TallyPrime]

- Summary

- Provident Fund

o Monthly

-

-

-

- Form 5

- Form 10

- Form 12A

- Monthly Statement

-

-

o Annual

-

-

-

- Form 3A

- Form 6A

-

-

- Employee State Insurance

o Monthly

-

-

-

- ESI Form 3

- Monthly Statement

- E-Return

-

-

o Annual

-

-

-

- Form 5

- Form 6

-

-

- Professional Tax

o Computation Report

o Statement

- National Pension Scheme (NPS)

o Subscriber Contribution Details

o NPS Summary

o PRAN Not Available

- Gratuity

- Income Tax

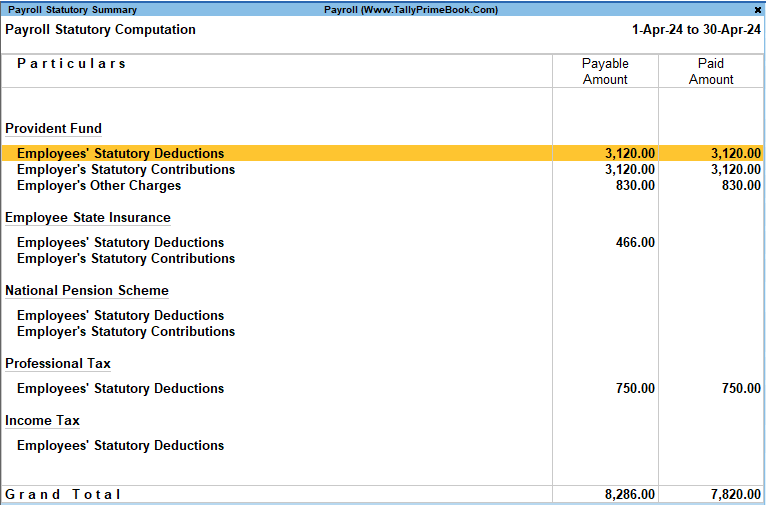

Payroll Statutory Summary Report

Payroll Statutory Summary displays the various statutory Pay Head types under PF, ESI, NPS, and PT with the details of Payable and Paid amounts for a given period.

- Gateway of Tally> Display More Reports > Payroll Reports > Statutory Reports > Summary.

Or - Gateway of Tally> Display More Reports > Statutory Reports > Payroll Reports > Summary.

[156-Payroll Management using TallyPrime]

The user can drill down to a corresponding Payroll Voucher from the Computation report.