As discussed earlier, Professional Tax is applicable to those individuals or professionals in India who are involved in any profession or trade. The state government of each state governs and administers the levy and collection of Professional Tax in the respective State. The state is empowered with the responsibility of structuring as well as formulating the professional tax criteria for the respective state. Professional tax is charged on the incomes of Individuals, profits of business or gains in vocations as per the list II of the Indian Constitution.

In India, the professional tax slabs vary from state to state and some of the states have formulated different professional tax slabs for men, women and the senior citizens of the respective states. The rates depend upon the profession, years in the profession and the amount of income or turnover and so on.

In TallyPrime 4, the Professional Tax Report is generated based on the Slab Rates defined in the Professional Tax Ledger and it captures the amount of Professional Tax deducted under each slab rate.

i. Professional Tax Computation Report

Professional Tax (PT) Computation Report is monthly which provides the details of the PT amount that the employer is liable to pay to the professional Tax department during the given month.

- Gateway of Tally > Display More Reports > Payroll Reports > Statutory Reports > Professional Tax > Computation Report.

Or

- Gateway of Tally > Display More Reports > Statutory Reports > Payroll Reports > Professional Tax > Computation Report.

- Select Professional Tax Ledger and press Enter.

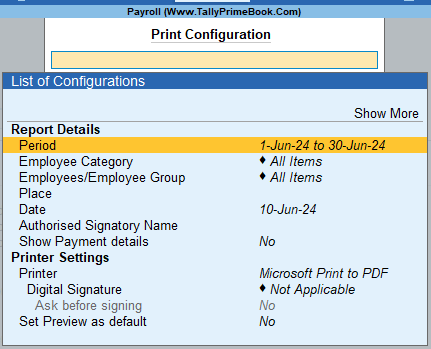

Press C (Configure) to view the Print Configuration for the PT Computation Report is as shown:

[184-Payroll Management using TallyPrime]

- Specify the Periodin the From and To fields as shown above.

- Employee Category: Select the required Category.

- Employee/Group: Select the required Employee Group or individual Employee.

- Place: Name of the Place where company located should be specified in this field.

- Date: The date of printing the PT Computation report needs to be specified. By default actual date of printing will be displayed.

- Authorised Signatory Name: Name of the Authorised Signatory should be entered in this field.

- Show Payment Details: Set this option to Yesto print the Professional Tax Payment Details like Cheque Number, Cheque Date and Drawn On (i.e. Employer Bank Name of which is used for making the payment).

- Press Esc and press P(Print) to print, The printed Computation Reportappears as shown:

[185-Payroll Management using TallyPrime]

Note: Professional Tax Computation Sheet may be used as PT Challan as this report provides the Payment Details.

Description of fields Professional Tax Computation Report Table

- Return of Tax payable for the period: The month for which the Professional tax is payable is printed based on the period entered in the print configuration screen.

- Name of the Employer: Name of the Company is printed here as mentioned in the company master.

- Address: Address of the Company as specified in the Company Master is printed here.

- Registration Certificate No.: The Professional tax Registration number for the Company as entered while creating the Professional Tax pay head is printed here.

Column Details in table

- Sl. No.: Displays the serial number.

- Employees whose monthly salary/wages / both are: Displays the professional Tax Slabs as specified while creating the Professional tax Pay Head.

- Number of Employees: Displays the number of employees falling under each slab.

- Rate of Tax per month Rs.: Displays the rate of Professional Tax for each slab.

- Amount of Tax deducted: Displays the amount of Tax deducted for the employees falling in each slab.

Details at the bottom after the table

- Amount Paid: Displays the total amount paid during the selected month.

- Amount in Words: Displays the amount in words that is paid for PT during the selected month.

- Place: Displays the name of the Place as entered in the Print Configuration screen.

- Date: Displays the date of printing as specified in the Print Configuration screen.

ii. Professional Tax Statement

The Professional Tax Statement provides the summary of Employee wise Gross Wages paid, No. of Working Days and the amount of Professional Tax deducted during the selected period. To generate the Professional Tax Statement for a month,

- Gateway of Tally > Display More Reports > Payroll Reports> Statutory Reports > Professional Tax > Monthly Statement.

- Select Professional Tax Ledgerand press Enter.

Or

- Gateway of Tally > Display More Reports > Statutory Reports> Payroll Reports > Professional Tax > Monthly Statement.

- Select Professional Tax Ledgerand press Enter.

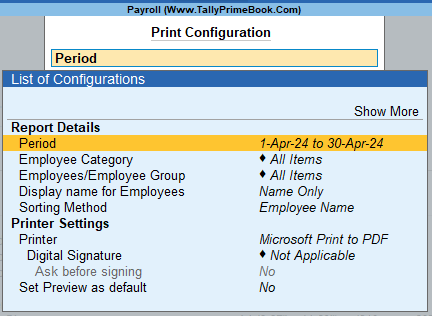

Press C (Configure) for print configurations, The print Configuration for the PT Statement is as shown:

[186-Payroll Management using TallyPrime]

- Period: Specify the Period in the From and To fields as shown above i.e. 1-4-2024 to 30-4-2024.

- Employee Category: Select the required Category.

- Employees/Employee Group: Select the required Employee Group or individual Employee.

Display name for Employees: Select the Display Style for the Employee Names, like Name Only, Alias Only, and so on.

- Sorting Method: Required sorting method for appearance of Employee Names can be selected.

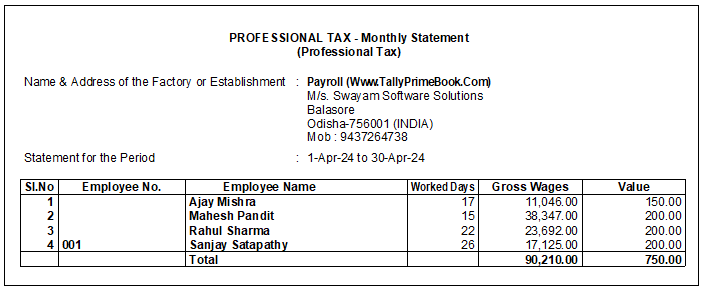

Press Esc and press P (Print) to print the PT Statement. The printed Professional Tax Statement will appear as shown:

[187-Payroll Management using TallyPrime]

- Name and Address of the Factory or Establishment: This field displays the Name and address of the Company as entered in the Company Master.

- Statement for the Period: Displays the period for which the PT statement.