With the introduction of GST, the goods and services have been classified into Nil Rated, Exempted, Zero Rated and Non-GST supplies. The Purchase or Sales of these goods to a local or interstate customer does not attract GST, and can be recorded using a Purchase / Sales voucher. Let us take a look at what distinguishes each of them with some examples:

| Supply | GST Applicable | Type of Supply | Eligibility for ITC | Examples |

| NIL Rated | 0% | Everyday items | No | Grains, Salt, Jaggery, etc. |

| Exempted | – | Basis essentials | No | Bread, Fresh Fruits, Fresh Milk, Curd etc. |

| Non- GST | – | Supplies for which GST is not applicable but can attract other taxes | No | Petrol, Alcohol etc. |

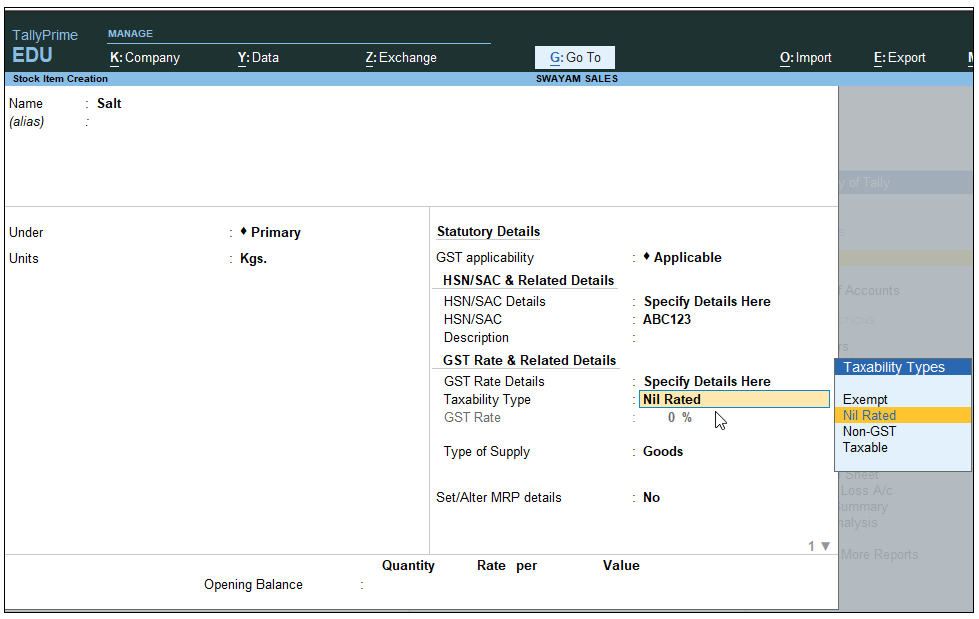

In case of above Items and Goods , the option Nil Rated / Exempt has to be selected as the Taxability in the GST Details screen of the item or item group master.

Some examples of Nil Rated supplies are Grains, Salt, and Jaggery.

Setting Nil-Rated & Exempted items and Goods :

[9-1-Purchase of Nil-Rated Exempted Items and Goods using TallyPrime-3]

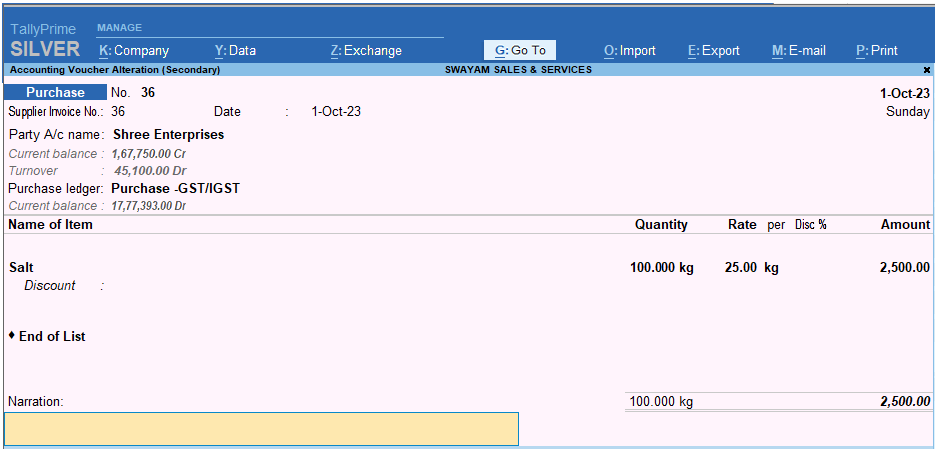

- Open a Purchase voucher in the Item Invoice mode.

- Press Alt+G (Go To) > Create Voucher > press F9 (Purchase).

Alternatively, Gateway of Tally > Vouchers > press F9 (Purchase).

- Press Ctrl+H (Change Mode) and select Item Invoice.

- Enter the Supplier Invoice No. and Date.

- In Party A/c name, select the supplier’s ledger.

- Select the applicable Purchase ledger.

- Enter stock item details.

- Name of Stock Item – Select the stock item.

- Specify Quantity and Rate.

[9-2-Purchase of Nil-Rated Exempted Items and Goods using TallyPrime-3]

- As always, press Ctrl+A to save the Purchase voucher.

Now that you have recorded a nil rated purchase voucher, you can see the transaction in GSTR-3B under Exempt, Nil rated, and Non-GST Inward Supplies.

[9-3-Purchase of Nil-Rated Exempted Items and Goods using TallyPrime-3]

[Practical Assignment]

( Purchase of -Nil Rated & Exempted Goods)

Swayam Sales deals the following Nil-Rated / Exempted Items and goods which purchased and sold in his business. Create the following Items as details given.

Name of Items Unit of Measurement Taxability of GST

Moong Dal (Unit is Kg. with Decimal 3) with Nil Rated GST

Salt (Unit is Kg. with Decimal 3) with Nil Rated GST

Bread ( Unit is Pcs.) with Exempt GST

Fruits ( Unit is Kg. with Decimal 3) with Exempt GST