The Salary Details masters contain information on the Employee Group/ individual employee pay structure, comprising of both earnings and deductions pay components for the applicable period.

Businesses having a common pay structure for a particular department or division or set of employees can define salary details for an employee group and classify individual employees under the specified group to inherit the parent pay values. The Employee Group master prefills the parent group values to the individual employee masters created under them. It reduces the possibility of erroneous data entry and expedites data entry. This categorisation also helps in generation of Group-wise reporting.

Pay structure constituting the Pay Heads and basis of calculation should be similar for the employees falling under the same group, but pay values need not be the same.

TallyPrime also allows you to set up individual employee salary details with all parameters applicable for Employee groups. The individual employee masters with separate pay structures are usually created on a case-to-case basis.

To Define Salary Details for employees,

Go to Gateway of Tally > Alter > type or select Define Salary.

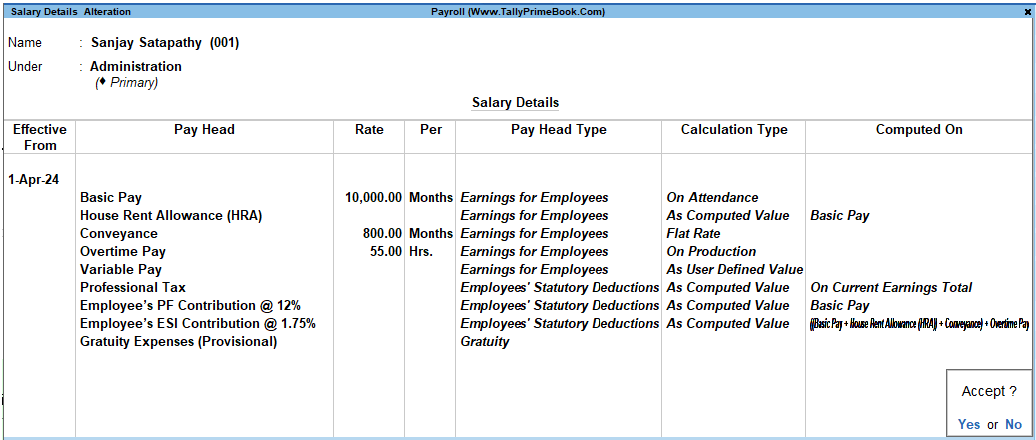

- Select Sanjay Satapathy from the List of Employees and press Enter

In the Salary Details screen,

-

-

- The Effective date is entered as 15-01-2024 by default based on the Date of Joining entered in the Employee Master

- Select Basic Pay as the Pay Head from the List of Pay Heads

- Specify 10,000 as Rate

- The Attendance units, Pay Head Type and Calculation Type appear by default, based on the pay head definitions.

-

The Salary Details Creation screen is displayed as shown:

[31-Payroll Management using TallyPrime]

- Select House Rent Allowance as the second Pay Head and press Enter

- Select Conveyance as the next Pay Head

- Specify 800 as Rate and press Enter

- Select Overtime Pay as the Pay Head

- Specify 55 as the Rate and press Enter

- Select Variable Pay as the Pay Head and press Enter

- Select Professional Tax against the Pay Head and press Enter

- Select Employee’s PF Contribution @ 12%, Employee’s ESI Contribution @ 1.75% as Pay Head and press Enter

- Select the Gratuity Expenses (Provisional) ledger and press Enter (In case of Employees eligible for Gratuity, the Gratuity Expenses ledger should be included in the Salary details of the respective Employee for provisional assessment of Gratuity)

The completed Salary Details Creation screen for Mr. Sanjay Satapathy is displayed as shown:

[32-Payroll Management using TallyPrime]

Similarly, create the pay structure for the other employees as per the details given in the following table:

EXAMPLE >>

| Pay Head | Rahul Sharma | Mahesh Pandit | Ajay Mishra |

| Basic Pay | 20,000 | 45,000 | 10,000 |

| House Rent Allowance | 40% | 40% | 20% |

| Conveyance | – | 1,000 | 2,000 |

| Overtime Pay | – | – | 100 |

| Variable Pay | User – Defined | ||

| Gratuity Expenses (Provisional) | Only for reporting purpose | ||

| Employee’s PF Contribution @ 12% | Applicable as Slab Rates | ||

| Employee’s ESI Contribution @ 1.75% | Applicable as Slab Rates | ||

| Professional Tax | Applicable as Slab Rates | ||

Salary Details for Ajay can be created similar to the Salary Details creation for Sanjay Satapathy.

Since Ajay and Mahesh are in Sales & Marketing Group, we can create the Salary Details for the Group and inherit the same for the Employees (Ajay and Mahesh) in that Group.

1. Salary Details Creation for the Employee Group

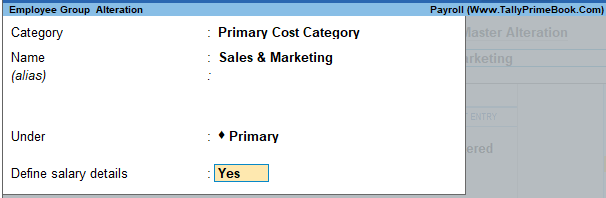

- Go to Gateway of Tally > Alter > type or select from the List of Employee Group Sales & Marketing

[33-Payroll Management using TallyPrime]

- Set the option Define Salary Details to Yes.

- Press Enter to view the Salary Details Creation screen.

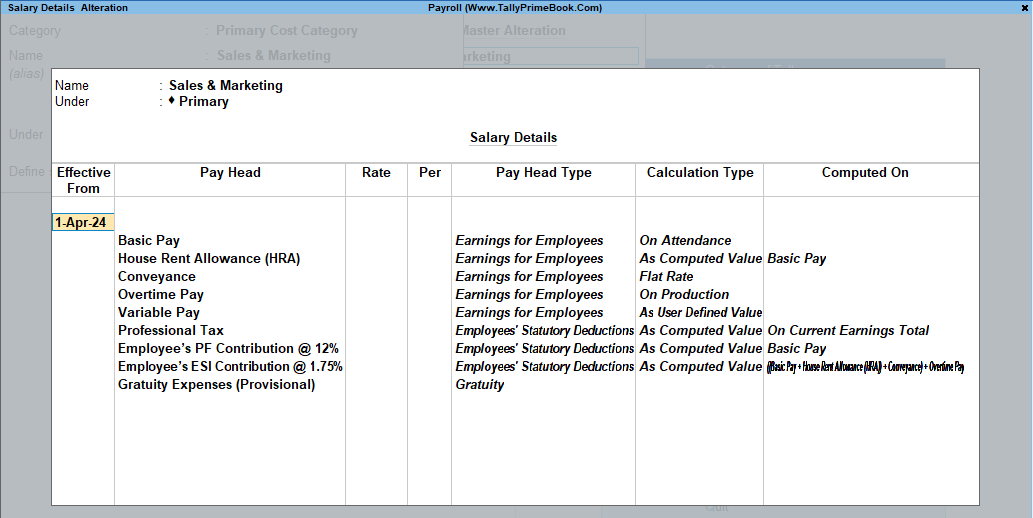

- Select the Pay Heads from the List of Pay Heads which are applicable to this group.

- Leave the Rate field empty if there is no standard rate.

The completed Salary structure for the Sales Group is as shown:

[34-Payroll Management using TallyPrime]

The Pay structure created above can be inherited for all the employees belonging to Sales & Marketing Group.

This feature helps in eliminating the repetitions while creating the Salary Details.

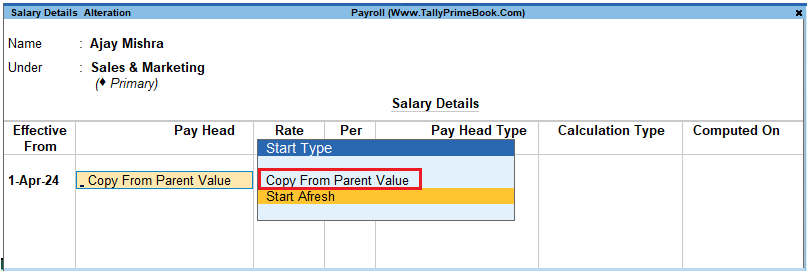

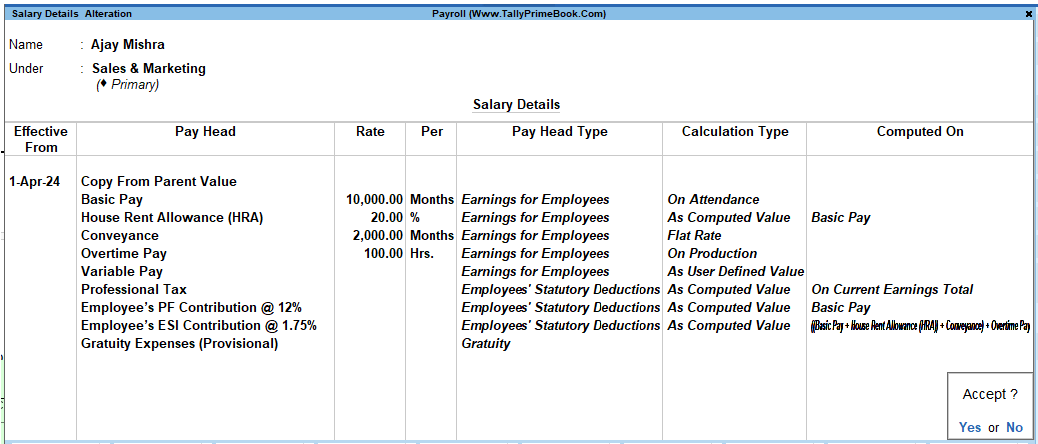

To define the Salary Details for Mr. Ajay Mishra belonging to Sales & Marketing Group, follow the steps given below:

Go to Gateway of Tally > Alter > type or select Define Salary.

- Select Ajay Mishra from the List of Employees and press Enter

- Select Copy From parent Value from the Start Type options under Pay Head

The Salary Details Creation screen is displayed as shown:

[35-Payroll Management using TallyPrime]

- The Pay Structure (comprising of Earning & Deductions pay heads) defined for the Group is prefilled automatically.

- Enter the values for each Pay Head for Ajay Mishra as per the details mentioned earlier.

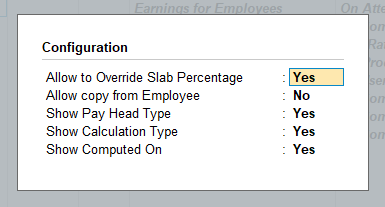

- Press F12: Configure

- Set the option Allow to Override Slab Percentage to Yes, since the HRA calculation percentage is 20%.

The Salary Details Configuration screen is displayed as shown:

[36-Payroll Management using TallyPrime]

- Press Enter to Accept

- Now, you will be able to enter the user-defined pay rates to compute the HRA, specify 20% and press Enter

The completed Salary Details screen of Mr. Ajay Mishra is displayed as shown:

[37-Payroll Management using TallyPrime]

- Press Enter to Accept the screen.

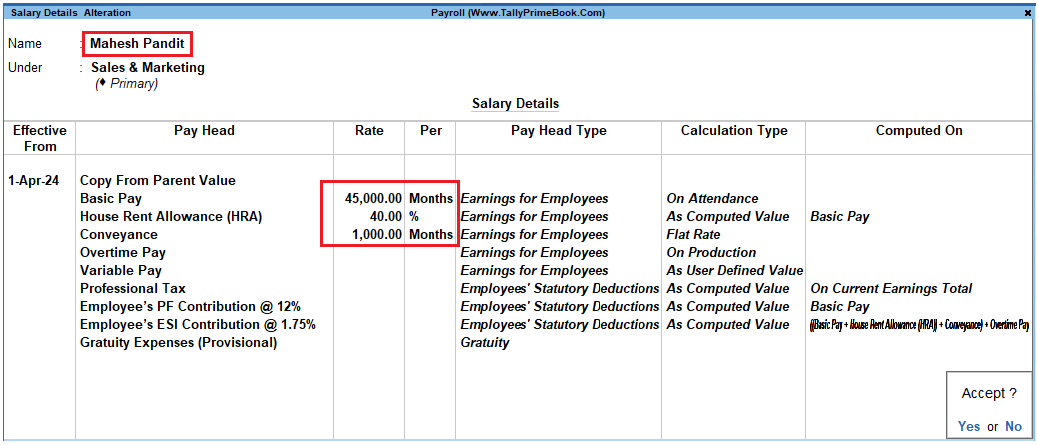

Similarly, you can create the Salary Details for Mr. Mahesh Pandit and others employees.

The completed Salary Details screen of Mr. Mahesh Pandit is displayed as shown:

[38-Payroll Management using TallyPrime]

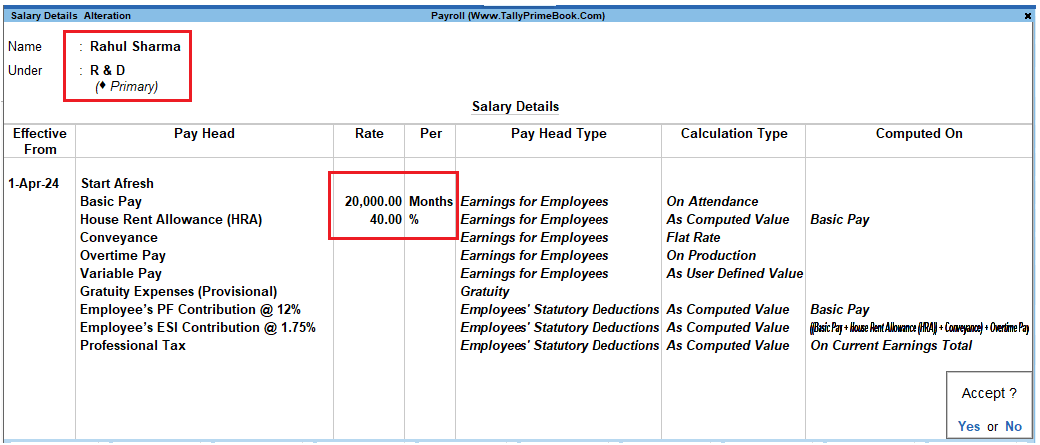

The completed Salary Details screen of Mr. Rahul Sharma is displayed as shown:

[39-Payroll Management using TallyPrime]