TallyPrime 4 helps you track Salary Advance / loans given to employees and provides the flexibility to specify simple to complex criteria for Recovery of Salary Advances or loans viz., Flat or manual deduction and provision of lumpsum loan recovery and so on. TallyPrime 4 also allows you to generate a Month wise break-up report for the amount of loan disbursed, recovery of instalments made and balance amount of Loan / Salary advance. Further, you can also use the Interest Calculation feature of TallyPrime 4 to compute interest on loans to employee etc.

In TallyPrime 4, tracking of Salary Advances / Loans paid to employees follow the steps given below:

- Creation of Masters

- Modify / Alter Salary Details

- Payment of Salary Advance

- Recovery of Salary Advance

1. Creation of Masters

TallyPrime 4 allows you to create different ledgers for different types of Loans / Salary Advances.

EXAMPLE >>

Create the following ledger:

| Ledger | Pay Head Type | Under |

| Staff Salary Advance | Loans and Advances | Loans and Advances (Asses) |

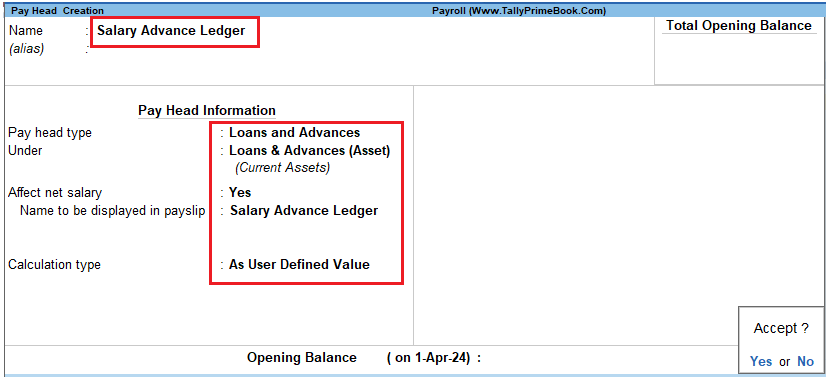

i. Create ‘Salary Advance Ledger’

- Go to Gateway of Tally > Create > type or select Pay Heads > and press Enter.

- Type Staff Salary Advance in the Name field

- Select Loans and Advances in the Pay Head Type field

- Specify the group as Loans and Advances (Asset) in the Under field and press Enter

- Set Affect Net Salary to Yes

- Type Staff Salary Advance in Name to Appear in Salary Slip field

- Select User Defined Value in the Calculation Type field

The completed Staff Salary Advance Ledger creation screen is displayed as shown:

[94-Payroll Management using TallyPrime]

- Press Enter to accept.

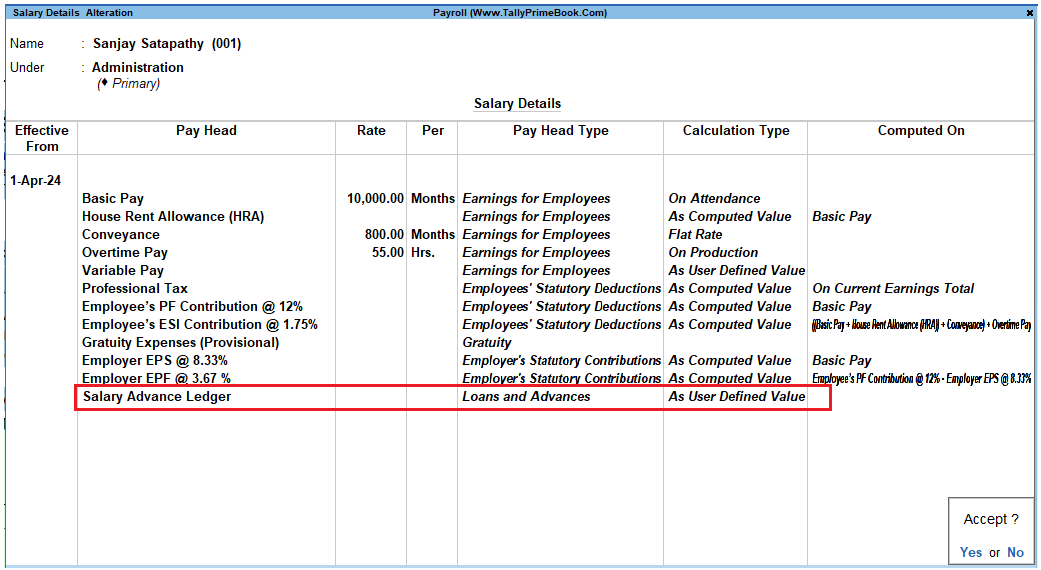

2. Modify / Alter Salary Details

In order to deduct instalments or for lumpsum recovery of Salary Advance from the monthly salaries of the employees, it is essential to include Salary Advance / Loans ledgers in the Salary Details master of the employees.

Follow the steps given to update the Salary Details masters of the Employees:

- Go to Gateway of Tally > Alter > type or select Define Salary.

- Select Sanjay Satapathy from the List of Groups / Employees and press Enter, the Salary Details Alteration screen appears

- In the Salary Details Alteration screen,

- Tab down to the last line and select Staff Salary Advance ledger in the Pay Head field

- Select End of List and press Enter

The completed Salary Details screen is displayed as shown:

[95-Payroll Management using TallyPrime]

- Press Enter to accept.

3. Payment of Salary Advance

In TallyPrime 4, you may disburse the Salary advance / Loans to Employees using a Payment Voucher as shown:

EXAMPLE >>

On 2nd July, 2024 M/s. Swayam Software Solutions paid Salary Advance to the following Employees with the mode and amount of recovery.

| Employee Name | Salary Advance (Rs.) | Mode of Recovery | Recovery Amount (Rs.) per month |

| Rahul | 10,000 | Monthly Salary | 5,000 |

| Rajesh | 3,000 | Monthly Salary | 1,500 |

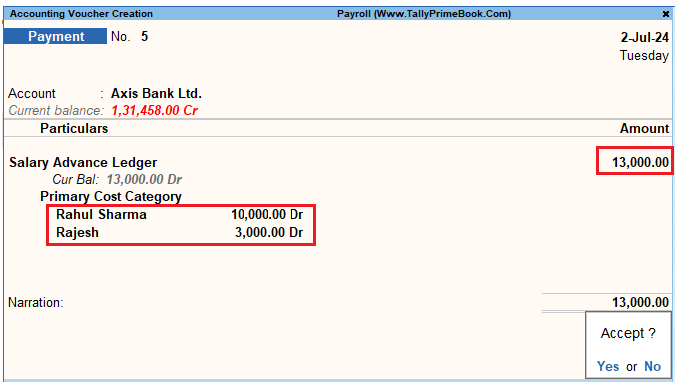

The same is accounted as shown:

i. Create Payment Voucher

Setup:

Go to Gateway of Tally > Vouchers > Press F5 for Payment Voucher

- Press F2 to change the date to 2-07-24

- In the Account field, select the Axis Bank Ltd. Ledger

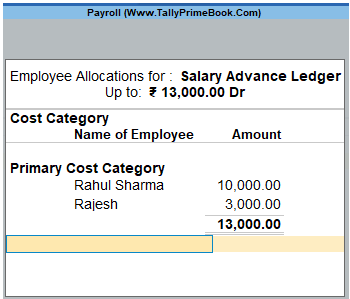

- Under Particulars, select the Salary Advance Ledger, and enter the corresponding Amounts of Rs. 13,000, the Cost Allocations for subscreen appears

- In the Cost Allocations for subscreen,

-

- Select Primary Cost category in the Employee Category field

- Select the required Employee (Rahul) from the list of Cost Centres and press Enter

- Specify 10000 in the Amount field

- Similarly, select other Employee (Rajesh) from the List of Cost Centres and specify the amount (i.e., 3,000)

The Completed Cost Allocation for subscreen is displayed as shown:

[96-Payroll Management using TallyPrime]

-

- Press Enter to accept and go back to the Payment Voucher

The completed Payment Voucher for Salary Advance is displayed as shown:

[97-Payroll Management using TallyPrime]

- Press Enter to accept.

4. Recovery of Salary Advance

In TallyPrime 4, you may deduct or recover Salary Advance / Loans from Employees in Installments by defining the criteria for deduction while creating the Salary Advance Pay Head; i.e., Flat rate or manual deduction by specifying a user-definable amount. To recover salary advance / loan, follow the steps given below:

Process the Attendance Vouchers for the month of July 2024 in the manner discussed in earlier chapters, based on the following details:

4.1. Attendance Voucher – Manual Entry

EXAMPLE >>

Attendance records for July 2024:

| Attendance/ Production Types | Sanjay Satapathy | Rahul | Mahesh | Ajay | Suresh | Rajesh |

| Present Days | 26 | 24 | 22 | 25 | 21 | 20 |

- Gateway of Tally > Vouchers > press F10 (Other Vouchers) > type or select Attendance.

The Attendance Voucher Creation screen is displayed as shown:

[98-Payroll Management using TallyPrime]

- Press F2 (Date) to change the date to 30-July-24.

- Select the employee whose attendance you want to record from the List of Employees.

- Select the Attendance/Production Type from the list.

- Enter the Value.

- Select End of List from the List of Employees.

- Accept the screen. As always, you can press Ctrl+A to save.

4.2. Create Payroll Voucher

- Gateway of Tally > Vouchers > press F10 (Other Vouchers) > type or select Payroll.

- Alternately, Press Ctrl+F4 for Payroll Voucher

- Press F2, specify the date as 31-7-2024 and press Enter

- Press Ctrl+F (Payroll Auto Fill) to prefill employee payroll details

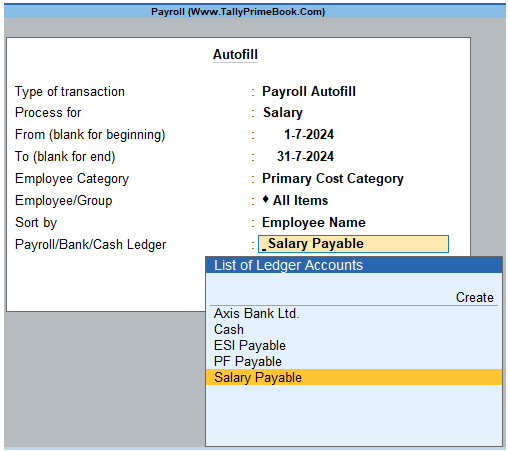

In the Employee Filters screen,

-

-

- Select Salary in the Process for field

- Specify 1-7-2024 in the From field

- Specify 31-7-2024 in the To field

- Select All Items as Employee/Group

- Select Salary Payable in the Payroll Ledger field

-

[99-Payroll Management using TallyPrime]

- Press Enter to accept the screen and go back to Payroll Voucher which can not be edited.

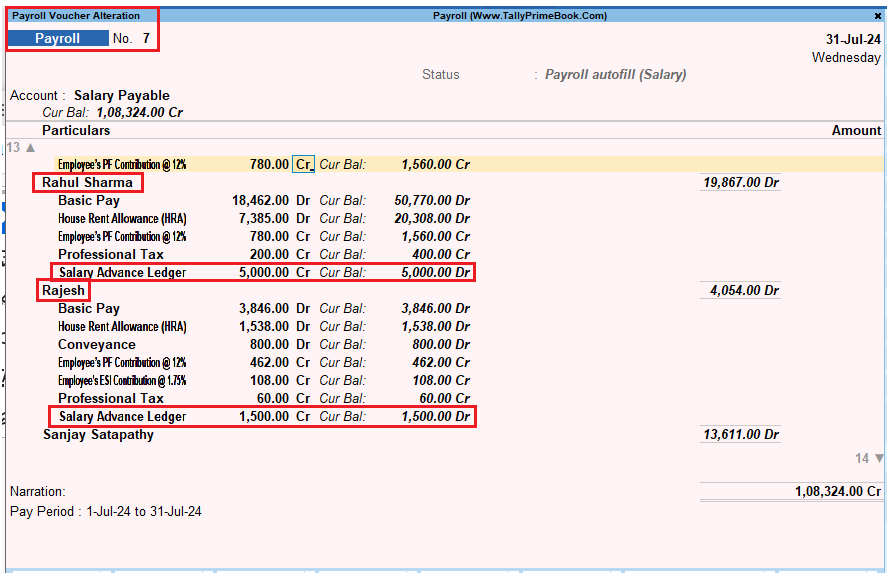

For adjusting Salary Advance in above Payroll Voucher, you have to Edit that Voucher by pressing Page Up button or edit that July 2024 Payroll Voucher…

The Payroll Voucher Alternation Screen is displayed as shown:

- Tab down to Staff Salary Advance ledger field of Rahul and specify 5000 as the amount to be deducted

- Similarly, tab down to Staff Salary Advance ledger field of Rajesh and specify 1500 as the amount to be deducted

The completed Payroll Voucher for July 2024 is displayed as shown:

[100-Payroll Management using TallyPrime]

- Press Enter to accept.