The supplier can cancel the e-invoice that is already reported to the IRP system and for which IRN is generated. The supplier can cancel the e-invoice for any of the reasons listed below:

- Order cancellation by the buyer

- Incorrect or wrong entry in the e-invoice

- Mistakes in e-invoice

- Duplicate entry and so on.

To overcome such situations, a provision is provided to the taxpayer to cancel the invoice reference number (IRN). As per department regulations, invoice cancellation has to be done within 24 hours of IRN generation.

Just like you can generate e-invoice using the various mode, e-invoice cancellation can also be done using different modes such as from e-invoice portal or from TallyPrime Accounting software that use API’s to directly interact with the portal.

- Press Alt+G (Go To) > type or select e-Invoice > press Enter.

Alternatively, Gateway of Tally > Display More Reports > GST Reports > e-Invoice > press Enter.

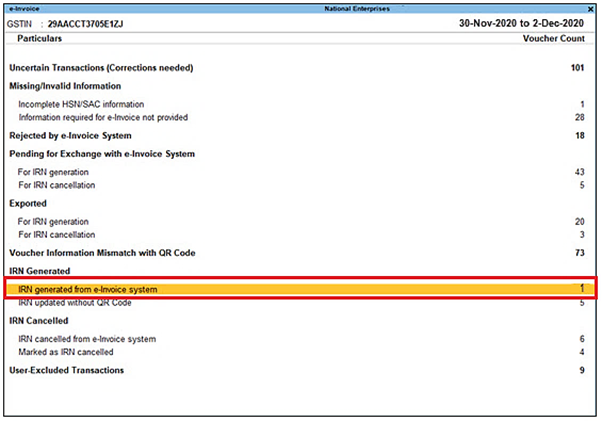

[Fig-26-e-Invoice Process in TallyPrime]

- Drill down from the IRN generated from e-Invoice system section to open the e-Invoice – Voucher Register screen.

[Fig-27-e-Invoice Process in TallyPrime]

- Select the voucher for which e-invoice needs to be cancelled, and press F10 (Cancel IRN).

| Note :

Press Ctrl+F10 (Mark as Cancelled) when the e-invoice is cancelled through some other medium on IRP, and you want to update the status in TallyPrime. When you mark the IRN as cancelled, then this invoice will appear in the Marked as IRN Cancelled section under IRN Cancelled, instead of the For IRN Cancellation section under Pending. |

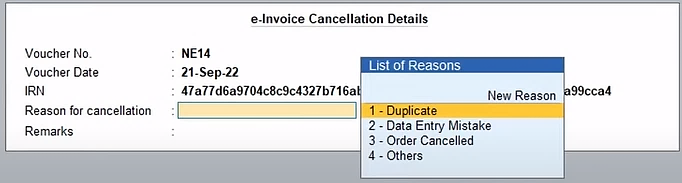

[Fig-28-e-Invoice Process in TallyPrime]

- Scroll down to choose cancel reason and to enter remarks.

- Under ‘Cancel Reason’, you will find four options – 1.Duplicate, 2.Data Entry Mistake, 3. Order Cancelled and 4. Others

iii. Choose anyone based on your reason (In most cases, it would be ‘Data Entry Mistake’ because there is no chance of duplication in the e-invoicing framework)

- In the ‘Remarks’ column, name the information that was entered incorrectly. Example unit change, item change, price change, etc. which is mandatory.

- As always, press Ctrl+A to save the details.

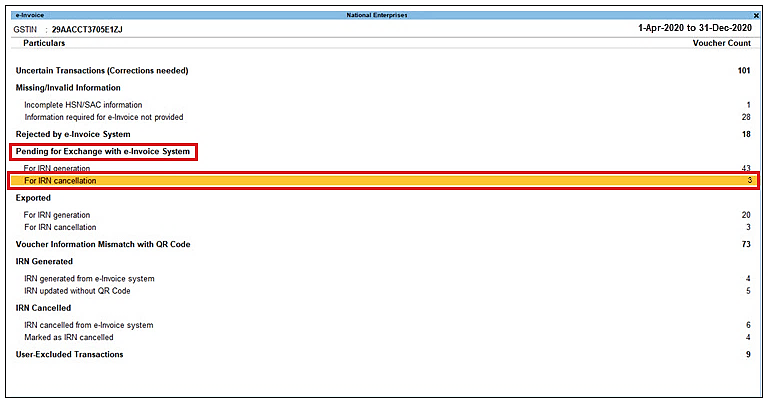

The voucher will move to the For IRN Cancellation section under Pending.

[Fig-29-e-Invoice Process in TallyPrime]

Now, you can send the e-Invoice for cancellation from the Exchange menu.

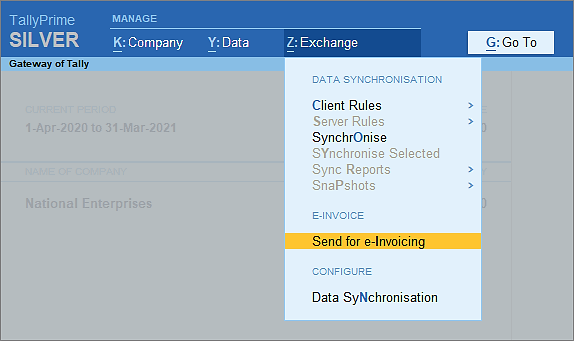

- Press Alt+Z (Exchange) > Send for e-Invoicing.

[Fig-30-e-Invoice Process in TallyPrime]

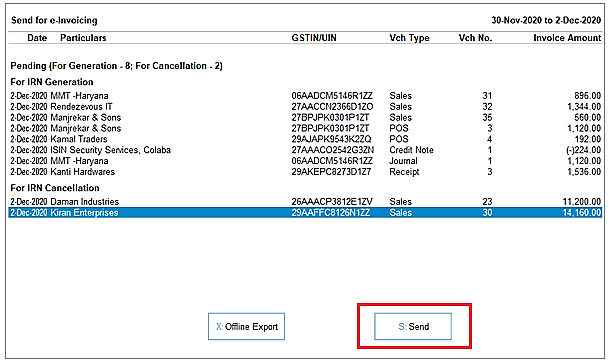

The Send for e-Invoicing screen appears. You can view the transactions that are pending for generation and cancellation.

| Note :

If you are unable to find the Transactions in the list, Press CTRL+B and Press Enter. On include Exported Transactions to set it As Yes. Already Exported Transactions will appear in the List. |

- Select the required transaction and press S (Send) to send the details.

If you press S without selecting any transaction, then all the transactions will be sent for e-Invoicing.

[Fig-31-e-Invoice Process in TallyPrime]

The following confirmation screen will appear, with the number of transactions lined up for IRN generation and cancellation.

[Fig-32-e-Invoice Process in TallyPrime]

- Press Enter to continue.

- Specify the e-Invoice Login details, and press Enter

[Fig-33-e-Invoice Process in TallyPrime]

The Exchange Summary will appear after the cancellation is completed, and you can view the number of e-Invoices that are cancelled.

[Fig-34-e-Invoice Process in TallyPrime]

The voucher will move to the IRN cancelled from e-Invoice system section in the e-Invoice report.

[Fig-35-e-Invoice Process in TallyPrime]

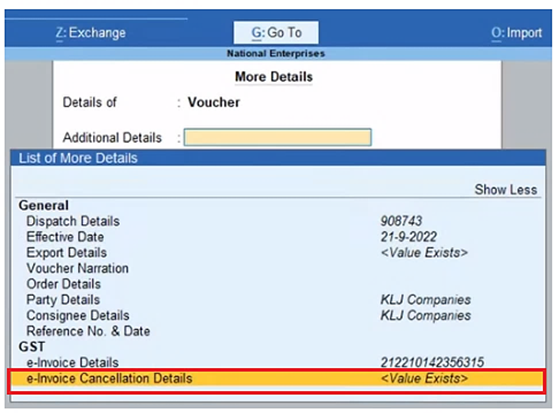

Even after cancellation, information like QR code and IRN details will be retained in the voucher for your reference in TallyPrime.

You can also view the remarks you had entered while cancellation, using More Details.

[Fig-36-e-Invoice Process in TallyPrime]

1. Important Points to Note About e-Invoice Cancellation

- e Invoice Amendment/Modification

Amendment, modification or editing of generated e-invoices is not possible on the e-invoice portal. However, the same can be done on the GST portal while filing GSTR-1. The ‘Amend Record Details’ option available during GSTR-1 filing allows you to make changes in the generated e-invoices.

- Cancel e-Invoice After the 24 Hours of Generation

As mentioned above, cancellation of e-invoices can be done only within 24 hours of generating the e-invoice. After 24 hours, if you wish to cancel an e-invoice, you need to generate a credit note in case the reason for cancellation is a sales return. For any other reasons, you cannot cancel an e-invoice except to edit it in the GST portal while filing GSTR-1.

- e-Invoice with Active e-Way Bill

e-Invoices with active or valid e-way bills cannot be cancelled within the 24-hour time frame. In order to cancel such an e-invoice, you first need to cancel the e-way bill and then cancel the e-invoice, provided the cancellation period is within 24 hours.

- Same Invoice Number

Once you cancel an e-invoice, you cannot use the same invoice number to generate another e-invoice. If you use the same number, it will be rejected when uploaded on the e-invoice portal. This is because IRN is a unique string based on the supplier’s GST number, document number, document type and financial year. Therefore, you must create a new invoice with a unique document number and report the same for e-invoice generation.

- Partial Cancellation

Partial cancellation of e-invoices is also not possible. You can only fully cancel the e-invoice within 24 hours from the time of generation.

- GSTR-1 Updating

In case an IRN is cancelled, then GSTR-1 will also be automatically updated with the cancelled status.