In your business, if you purchase fixed assets like buildings, machinery, equipment, vehicles, tools, and more that you do not trade in, then you can record such purchases in TalllyPrime using a Purchase voucher.

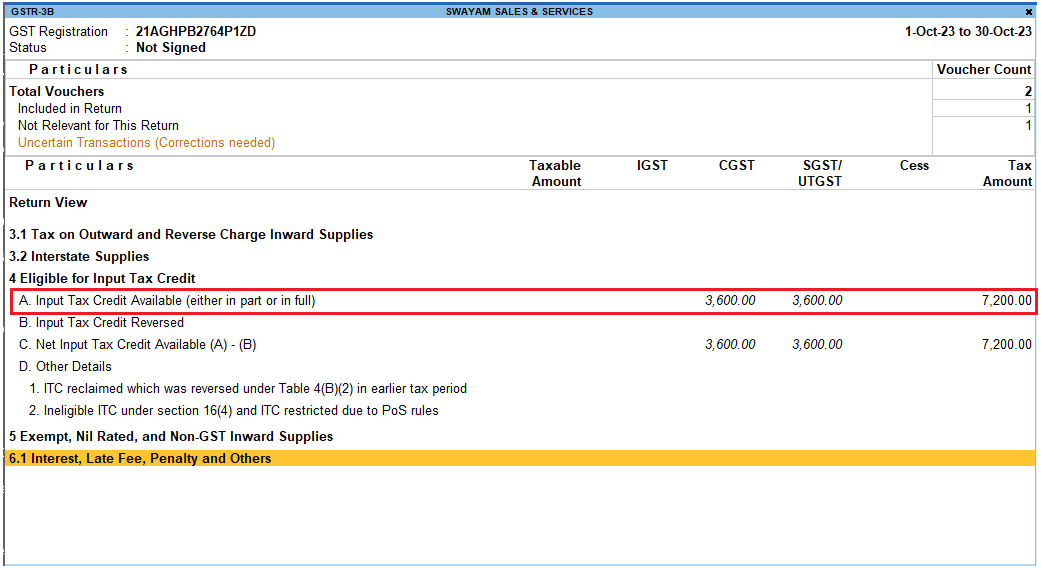

Purchase of capital goods are recorded as fixed assets and is taxable. Input tax credit can be availed and the impact of the transaction will be visible under the Eligible for Input Tax Credit section of GSTR-3B

You can record taxable purchases of fixed assets (capital goods).

You can record an expense using a purchase voucher. This will auto-calculate the GST amounts.

Setup:

You have to create the Asset Ledger with GST Applicable and with all GST Details like Nature of Transactions, Taxability, GST Rate etc. etc.

Say, for example, Creating a Fixed Assets ( Capital Goods) with GST Details :

[ Example : Furniture (GST 18%) ] which attracts GST 18% as below:

- Gateway of Tally > Create > type or select Ledger and press Enter.

Alternatively, press Alt+G (Go To) > Create Master > type or select Ledger and press Enter.

- Select Fixed Asset in the Underfield.

- Select.. Include in Assessable Value Calculationas Not Applicable.

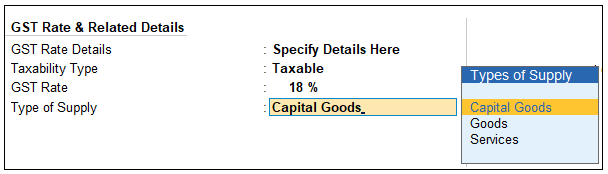

- Set GST applicabilityas Applicable and enter the GST details.

[11-1- Purchase of Fixed Assets (Capital Goods) in TallyPrime-3]

- Select the Type of supplyas:

Services, if the ledger is used to record sale of service. By default, the type of supply is set to Services.

Capital Goods, if the ledger is used to record sale of Capital Goods.

[11-2- Purchase of Fixed Assets (Capital Goods) in TallyPrime-3]

[11-3- Purchase of Fixed Assets (Capital Goods) in TallyPrime-3]

- Accept the screen. As always, you can press Ctrl+Ato save the ledger.

[Practical Assignment]

(Ledger Creation of Fixed Assets)

Alter or Create the following Fixed Assets Ledger with Opening Balance & GST Compliance … as per above.

| Fixed Assets: | GST Rate | Opening Balance |

| Furniture (18%) | 18% | 50,000 |

| Machinery (5%) | 5% | 1,10,000 |

| Land & Building | NA | 1,25,000 |

| Office Equipment (12%) | 12% | 60,000 |

| Computers (18%) | 18% | 35,000 |

| Vehicle (18%) | 18% | 40,000 |

Record Purchase of Fixed Assets (Capital Goods)

Example :

5/4/2023 Purchase Furniture for Rs. 40,000 from Supreme Furniture on Credit (within state) with GST (SGST 3600 and CGST 3600)

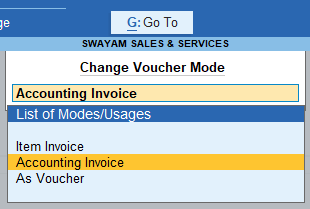

This Purchase will pass through Accounting Invoice :

- Open the Purchase voucher in Accounting Invoice mode.

- Press Alt+G (Go To) > Create Voucher > press F9 (Purchase).

Alternatively, Gateway of Tally > Vouchers > F9 (Purchase).

- Press Ctrl+H (Change Mode) and select Accounting Invoice.

[11-4- Purchase of Fixed Assets (Capital Goods) in TallyPrime-3]

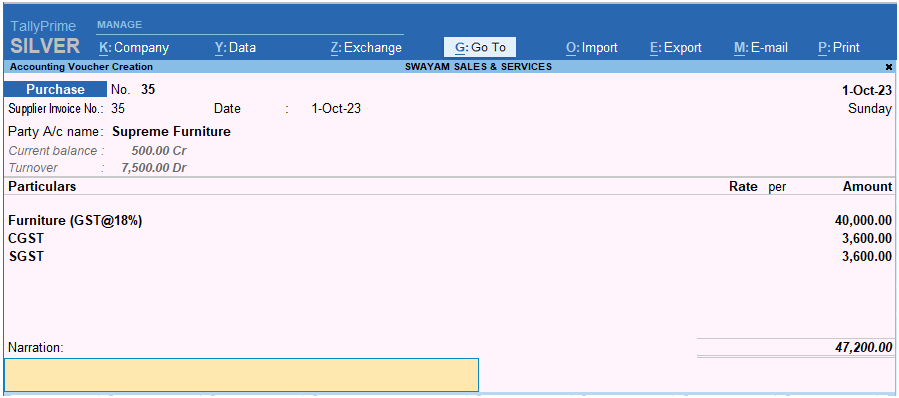

- Enter the Supplier Invoice No. and Date.

- In Party A/c name, select the supplier’s ledger

- Under Particulars, enter the Fixed Asset ledger (i.e. Furniture), and specify the Amount.

- Select the required tax ledgers.

[11-5- Purchase of Fixed Assets (Capital Goods) in TallyPrime-3]

- Enter the Narration if required. As always, press Ctrl+A to save the Purchase voucher.

Now that you have recorded an expense with GST in Purchase voucher, you can see the transaction under Eligible for Input Tax Credit of GSTR-3B.

[11-6- Purchase of Fixed Assets (Capital Goods) in TallyPrime-3]

[Practical Assignment]

(CAPITAL GOODS PURCHASE VOUCHER [F9] – Accounting Invoice ( Alt+H))

Sl. No. Date Transactions

- 5/4/2023 Purchase Furniture for Rs. 40,000 from Supreme Furniture on Credit (within state) with GST (SGST 3600 and CGST 3600)

- 10/5/2023 Purchase Office Equipment for Rs. 50,000 by cheque of Axis Bank Ltd. (within state) from a Registered Showroom with GST (SGST 3000 and CGST 3000)

- 12/6/2023 Purchase one Computer from Excel IT Care for Rs. 35,000 on Credit with GST (SGST 3150 and CGST 3150)

- 20/7/2023 One Vehicle is Purchased for Office purpose from Honda Motors Ltd. for Rs. 60,000 with GST (SGST 5400 and CGST 5400)