Credit Note is a document issued to a party stating that you are crediting their Account in your Books of Accounts for the stated reason or vise versa. It is commonly used in case of Sales Returns, Escalation/De-escalation in price etc.

All features and functions of Sales Voucher and Credit Note Voucher are same. So just like Sale Voucher, you can record transaction in Credit Note either in Accounting Invoice or Item Invoice.

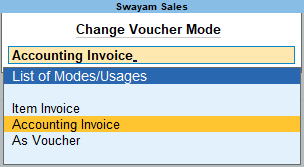

1. Mode of Transaction

A Credit Note can be entered in voucher or Invoice mode (either Accounting / Items).

To go to Credit Note Entry Screen :

1. Gateway of Tally> Vouchers > F10 (Other Vouchers) > type or select Credit Note > and press Enter.

Alternatively, press Alt+G (Go To) > Create Voucher > F10 (Other Vouchers) > type or select Credit Note.

2. Press Ctrl+H(Change Mode) and select Item invoice or Accounting Invoice mode as per your business needs.

[123-Inventory Management using TallyPrime-4]

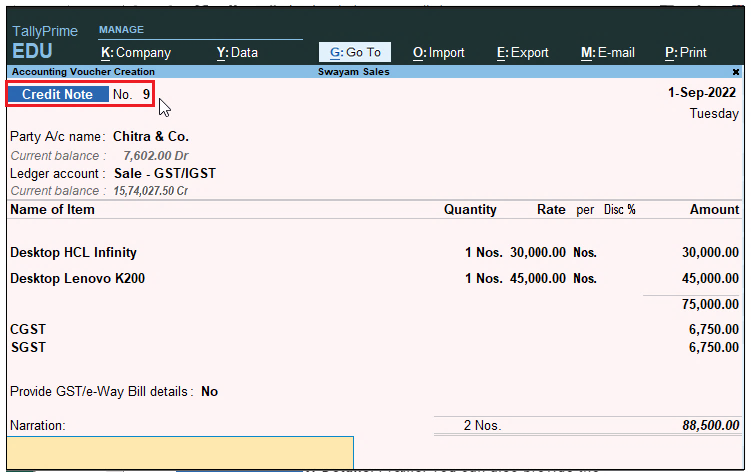

(A) Item Invoice Mode

Pass an entry for goods sold returned from Customer Chitra & Co. just like Sale Voucher :

This Credit Note will pass through Item Invoice ( by pressing ALT+F6).

1. Open the Credit Note in Item Invoice mode.

a. Gateway of Tally > Vouchers > press F10 (Other Vouchers) > type or select Credit Note > and press Enter.

b. Press Ctrl+H (Change Mode) > select Item Invoice.

2. Specify the buyer details.

3. Select the Sales ledger to allocate the stock items.

4. Enter the stock item details.

5. Select the GST Ledger.

[124-Inventory Management using TallyPrime-4]

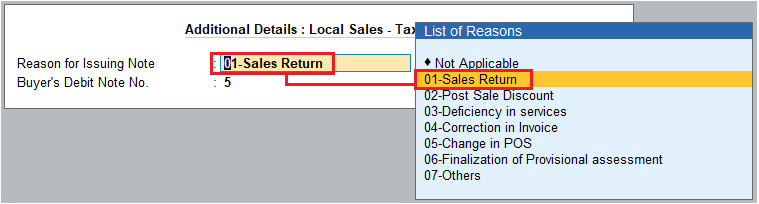

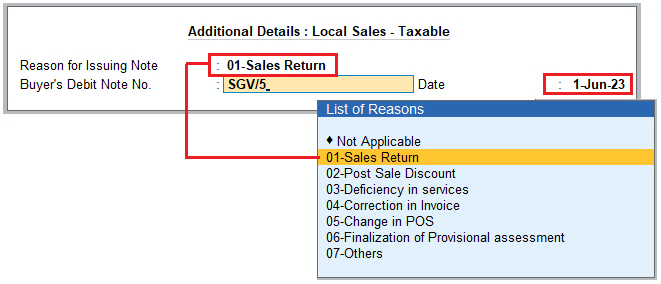

6. Set the option Provide GST details to Yes, and select the reason of the Sales Return from the List of Reasons.

[125-Inventory Management using TallyPrime-4]

The List of Reasons for receiving Note is the same in a debit note and a credit note.

- 01-Sales Return: When there is a return of goods or services after the purchase.

- 02-Post Sale Discount: When a discount is allowed on goods or services after the purchase.

- 03-Deficiency in services: When there is a deficiency in services (like a quality issue) after purchase.

- 04-Correction in Invoice: When there is a change in the invoice raised that leads to a change in the tax amount.

- 05-Change in POS: When there is a change in place of supply that leads to a change in the tax amount.

- 06-Finalization of Provisional assessment: When there is a change in price or rate after the department issues a notification about the finalized price of the goods or services.

- 07-Others: Any other nature of the return.

7. As always, press Ctrl+A to save the Debit Note.

[Practical Assignment]

[Sales Return Transactions under Credit Note (ALT+F6) with GST Adjustment]

Record the following Sales Return Transactions under Credit Note ( ALT+F6) with GST Adjustment. Also Provide GST Details of each transaction with Buyer Debit Note No. with Date..

[126-Inventory Management using TallyPrime-4]

CREDIT NOTE / SALE RETURN [Alt + F6]

Sl. No. Date Transactions

[A] Item Invoice (Alt+F6 > Ctrl+H > Select Item Invoice)

1. 30/4/2024 Following goods has been returned by Lexsite Pvt. Ltd. [against Buyer Debit Note No- LPL/6 Dated 13/4/2023)] With CGST & SGST

| ITEMS | Qty. | Unit | Rate |

| Panasonic 1.5 Ton Split AC | 1 | Nos. | 50,000 |

[ Invoice value Rs. 59,000]

2. 30/5/2024 Shwetha &Co has returned the goods given with CGST & SGST [against Buyer Debit Note No- SC/7 Dated 28/5/2024)]

| ITEMS | Qty. | Unit | Rate |

| Lenovo Idea Centre 3 Desktop | 1 | Nos. | 36,000 |

[ Invoice value Rs. 42,480]

3. 18/6/2024 Goods Sold to Adarsh Technology Pvt. Ltd. has returned back [against Buyer Debit Note No- ATPL/5 Dated 1/5/2024)].

| ITEMS | Qty. | Unit | Rate |

| ASUS VivoBook 15 Laptop | 1 | Nos. | 23,000 |

[ Invoice value Rs. 27,140]

4. 2/7/2024 Chitra & Co. has Returned the following goods [against Buyer Debit Note No- CC/10 Dated 9/6/2024)]

| ITEMS | Qty. | Unit | Rate |

| Tropicana Litchi 1000 ml | 2 | Pcs. | 110 |

| Fortune Sunflower Oil 1L | 2 | Pcs. | 130 |

[ Invoice value Rs. 519 with Rounded Off (+/-) Rs. 0.40]

5. 9/9/2024 Goods returned by Eric Enterprises (IGST) [against Buyer Debit Note No- EE/11 Dated 26/8/2023)]

| ITEMS | Qty. | Unit | Rate |

| Suffola Active Pro Rice Bran Oil 1L | 1 | Pcs. | 150 |

| Patanjali Kachi Ghani Mustard Oil 1L | 1 | Pcs. | 160 |

| Tata Sampan Gota Urad Dal 1Kg. | 1 | Pcs. | 240 |

[ Invoice value Rs. 578 with Rounded Off (+/-) Rs. 0.50]

6. 30/11/2024 The given goods returned by Swayam Sales (IGST) (Outside – IGST) [against Buyer Debit Note No- SS/10 Dated 30/10/2024)]

| ITEMS | Qty. | Unit | Rate |

| Haier 273 L D/Door Refrigerator | 1 | Nos. | 27,000 |

[ Invoice value Rs. 27,140]

7. 11/12/2024 Sold the following Items to Karnataka Stores (IGST) which was returned back [against Buyer Debit Note No- KS/12 Dated 24/11/2024)]

| ITEMS | Qty. | Unit | Rate |

| Suffola Active Pro Rice Bran Oil 1L | 1 | Pcs. | 150 |

| Patanjali Kachi Ghani Mustard Oil 1L | 2 | Pcs. | 180 |

| Tata Sampan Gota Urad Dal 1Kg. | 1 | Pcs. | 260 |

| Good Life Chana Dal 500 gm. | 2 | Pcs. | 75 |

[ Invoice value Rs. 966]