1. Activate GST for Your Company in TallyPrime

To use TallyPrime for GST compliance, you need to activate the GST feature. Once activated, GST-related features are available in ledgers, stock items, and transactions, and GST returns can be generated.

GST Registrations are of two types…

- GST Regular Scheme ( for Regular Dealer)

The GST regular scheme is for the general taxpayers whose turnover is above the threshold limit.

Under the GST regular scheme, all individuals with turnover above 40 lacs are required to take GST Registration. They are required to pay GST on goods & services as per the applicable rates and do regular GST return filing

- GST Composition Scheme ( for Composite Dealer)

The composition scheme is meant for small businesses whose turnover of taxable goods not more than₹1.5 crores, where GST has to be borne by the seller @1% of such turnover by traders, @2% bymanufacturers, 5% for Restaurants & 6% for Service Providers.

A Composition Dealer has to issue Bill of Supply. They cannot issue a Tax Invoice. This is because the tax has to be paid by the dealer out of pocket. A Composition Dealer is not allowed to recover the GST from the customers.

2. Activate GST for Regular or Registered Dealers in TallyPrime

To use TallyPrime for GST compliance, you need to activate the GST feature. Once activated, GST-related features are available in ledgers, stock items, and transactions, and GST returns can be generated.

1. Open the company for which you need to activate GST.

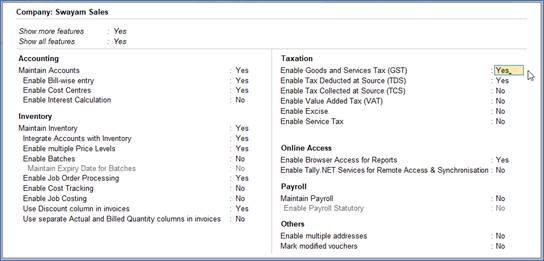

2. Press F11 (Features) > set Enable Goods and Services Tax (GST) to Yes.

3. If you do not see this option:

Set Show more features to Yes.

Set Show all features to Yes.

29

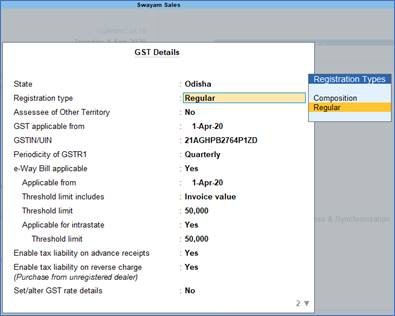

5. State – shows the State name as selected in the Company Creation screen. This helps in identifying local and interstate transactions according to the party’s state.

6. Set the Registration type as Regular .

7. You can keep the rest default fields as same and don’t change ( but you can change as per your requirements)

30

3. Activate GST for Composition Dealers in TallyPrime

If you are using the GST feature provided for regular dealers to maintain your books under the composition scheme, you can now start using the GST composition features.

To maintain books under GST composition, you need to:

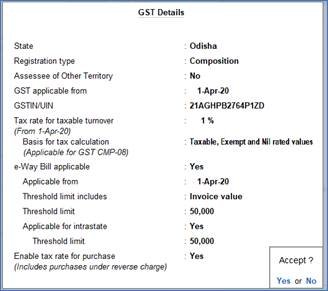

- Change Registration Type to Composition

1. Press F11 (Features) > Enable Goods and Services Tax (GST) – Yes.

2. Set/alter GST details? – Yes.

3. Registration type – select as Composition.

4. Tax rate for taxable turnover appears as 1%. This rate is applied on your transactions to arrive at the taxable value.

5. Based on your business type, select the Basis for tax calculation. For outward supplies, the total of taxable, exempt and nil rated will be considered as the Taxable Value. For inward supplies, the total value of purchases made under reverse charge will be considered as the Taxable Value.

- Taxable, Exempt and Nil rated values – the tax will be calculated on the:

- Total of taxable, exempt and nil rated sales.

- Total of purchases attracting reverse charge.

31

6. Enable tax rate for purchase – Yes. This allows you to enter the tax rate in the purchase ledger, for calculating tax on purchases from regular dealers and reverse charge transactions.

You can record transactions using the ledgers with GST details, and print invoices with GSTIN.