1. Inward Supply of Goods & Service under GST Reverse Charge (RCM)

GST on reverse charge is levied if there is intra State supply of goods or services or both by an unregistered supplier to a registered person and the value exceed Rs 5000 in a day.

In other words, If a vendor who is Not Registered under GST, supplies goods or Services to a person who is Registered under GST, then Reverse Charge would apply. This means that the GST will have to be paid directly by the receiver to the Government instead of the supplier.

The registered dealer who has to pay GST under reverse charge has to do self-invoicing for the purchases made.

For Inter-state purchases the buyer has to pay IGST. For Intra-state purchased CGST and SGST has to be paid under RCM by the purchaser.

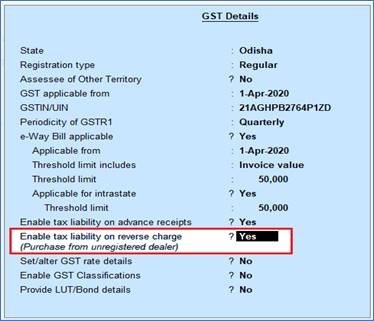

First enable Tax Liability on Reverse Charge ( Purchase from Unregistered Dealer) under F11 (Features) : → Enable Goods and Service Tax (GST) → Yes :

1. Open the company.

2. Press F11 (Feature) > set Enable Goods and Services Tax (GST) as Yes.

3. In the Company GST Details screen, Set Enable tax liability on reverse charge – Yes

294

Example-1

On 1st. April 2020, Swayam Sales hire Vehicle from Dust Transport Service ( Unregistered) for the dispatching goods to Bhubaneswar (Within State) and Pay Freight & Cartage Rs.20,000 (GST @5%). Pass the Entry and Calculate GST on RCM basis.

Example-2

On 2nd.April 2020, Swayam Sales hire Vehicle from Dirty Transport Service ( Unregistered) for the dispatching good to West Bengal ( Outside State ) and pay Freight & Cartage Rs. 30,000 (GST @5%) . Pass the entry and calculate GST on RCM basis.

2. Setup for Inward Supply under GST Reverse Charge

In TallyPrime, for implementation of GST Reverse Charge Mechanism (RCM), we have to create Supplier Ledger who is unregistered under Sundry Creditor with Expenses Ledger with Reverse Charge Applicable both for Inter-state and Intra-state. In case of Items and goods we can create with Reverse Charge applicable. Here we have discussed step by step with examples.

(A) Create Unregistered Supply Ledger under Sundry Creditor.

1. Create Supplier Ledger i.e. Dust Transport Service – (Local-URD) – Refer Para: 3.2.5. for Party Ledger Creation

295

2. Create Supplier Ledger i.e. Dirty Transport Service – (Outside-URD) – Refer Para: 3.2.5. for Party Ledger Creation

296

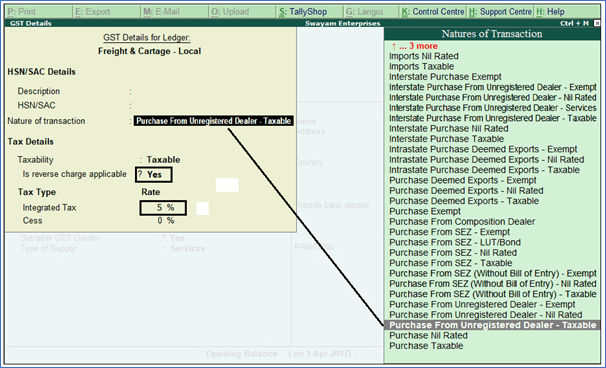

(B) Create Local Expenses Ledger i.e. Freight & Cartage – Local” with 5% GST under RCM

1. Gateway of Tally > Create > type or select Ledger and press Enter.

Alternatively, press Alt+G (Go To) > Create Master > type or select Ledger and press Enter.

2. Enter the Name of the Purchase ledger i.e. Freight & Cartage – Local

3. Select Indirect Expenses from the List of Groups in the Under field.

4. Set the option Inventory values are affected? to No,.

5. Is GST Applicable – Applicable.

6. Set/alter GST Details – Yes, specify the details in the GST Details screen as below , and Save.

297

7. Select Nature of Transaction – Purchase From Unregistered Dealer – Taxable

8. Set the option Is reverse charge applicable ? to Yes

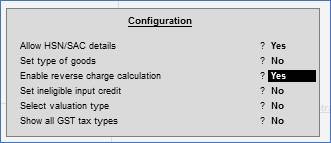

[ If this option is not visible, Press F12 : Configure and set the option ‘ Enable reverse charge calculation’ to Yes ]

298

9. Integrated Tax Rate is 5 % for this type of Service from URD –Local Ledger

10. Select the Type of supply i.e. Service.[ By default the type of supply is set to Goods.]

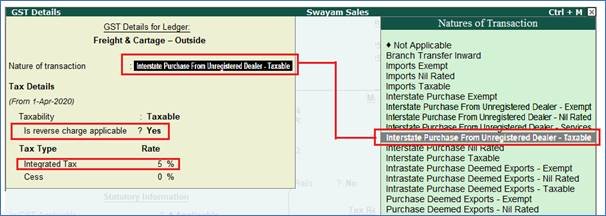

(C) Create Expenses Ledger (IGST) with Reverse Charge Applicable

Just like same as in case of Local Expenses Ledger as above….create outside Expenses Service Ledger i.e. Freight & Cartage – Outside with GST 5% & Nature of Transaction – ‘ Interstate Purchase From Unregistered Dealer – Taxable” and with Reverse Charge Applicable as image given below :

299

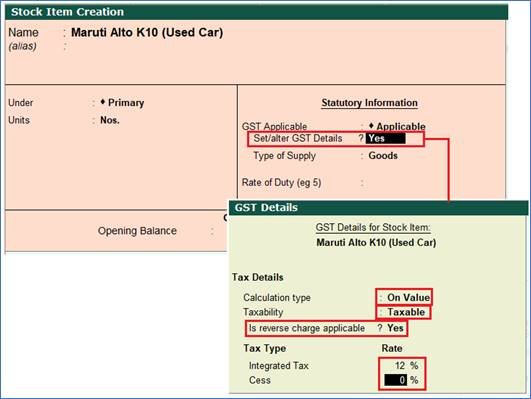

(D) Create Items and goods as Reverse Charge Applicable

Like Service / Expenses Ledger creation, you can also create Items & Goods with Reverse Charge Applicable

Example-3

Purchased one Maruti Alto K10 (Used Car) of Value Rs. 1,20,000 ( GST @ 12%) from Yours Motors (Unregistered shop) and pass the entry and calculate GST on RCM basis.

Create a Item ‘ Maruti Alto K10 (Used Car)’ @ GST 12% with Reverse Charge Applicable as below :

300

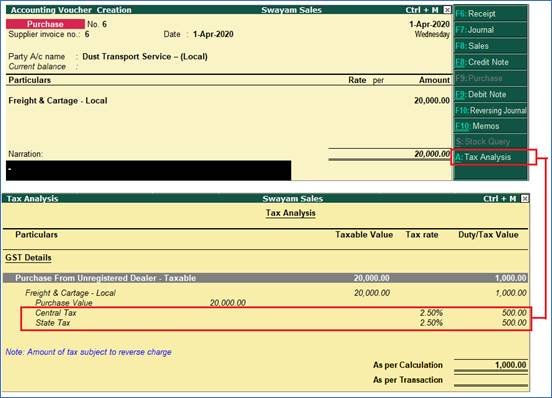

Example-1

Recording an RCM Invoice for Service Hired from M/s Dust Transport Service ( Local URD) for the payment of Freight Charges of Rs.20,000

[ Note : We can create a separate Voucher Type for making all RCM Transactions i.e. RCM Invoice ]

To record an invoice for purchase from unregistered dealer

1. Go to Gateway of Tally > Vouchers > F9: Purchase > Select RCM Invoice.

[ Press Ctrl + H (Change Mode) for converting to Accounting Invoice from Item Invoice]

2. Enter the Supplier invoice no. and Date ( Should be on / after 01-07-2017).

3. Select the party ledger in the field Party’s A/c Name : Dust Transport Service.

4. Select the Purchase Ledger : Freight & Cartage – Local. Put Rs. 20,000 in Amount

5. The RCM Invoice towards Freight & Cartage payment of Rs.20,000 will look like below…

301

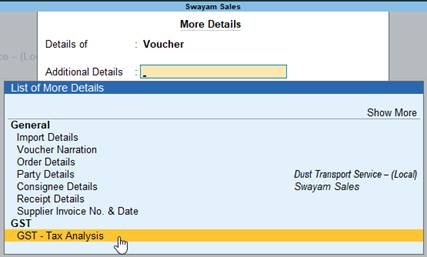

6. When you Press Ctrl + I (More Details) and select GST – Tax Analysis and Press Alt + F1 for Details…you will see the GST Analysis as below by default.

302

7. Press Enter to save.

Note : Don’t charge any GST in this Purchase Voucher due to Purchase from URD who has not charges any GST in their Bill.

8. As per the GST Law Reverse Charge is applicable in this Purchase Bill, that means we have pay the Tax ₹.1000 i.e. CGST-₹. 500 & SGST-₹. 500 ( 5% on ₹.20,000) on this RCM Invoice Value due to hiring Service from Unregistered Dealer.

EXAMPLE – 2

Recording an RCM Invoice for Service Hired from M/s Dirty Transport Service ( Outside-URD) for the payment of Freight Charges of Rs. 30,000 for dispatching Goods in West Bengal (Outside State)

Pass the entry in Purchase Voucher as an Accounting Invoice and calculate GST on RCM basis.

303

Note : Don’t charge any GST in this Purchase Voucher due to Purchase from URD who has not charges any GST in their Bill.

8. As per the GST Law Reverse Charge is applicable in this Purchase Bill, that means we have pay the Tax ₹.1,500 i.e. IGST- ₹. 1,500 ( 5% on ₹. 30,000) on this RCM Invoice Value due to hiring Service from Outside State Unregistered Dealer.

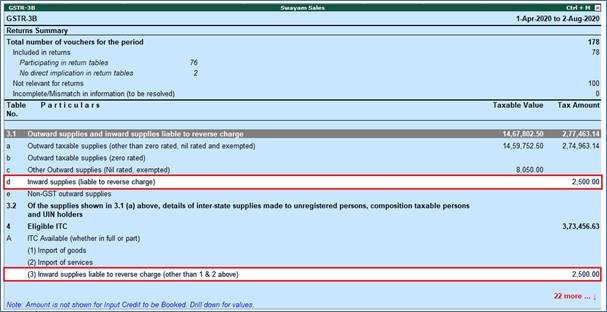

3. View Total Tax Liability under GST Reverse Charge (RCM) in GSTR-3B & GSTR-2 Report

All the Tax liability created and Due under GST Reverse Charges (RCM) towards purchase from URD, will be payable by the Recipient of the Purchases by the Registered Dealer who received Services or Stocks.

All the Tax Liability under Reverse Charge are shown in GSTR-3B & GSTR-2 Report.

1. Go to Gateway of Tally > Display More Reports > GST Reports > GSTR-3B

2. Click V : Default View (if any) > Press F1 : Details

304

So the Total Tax Liability of ₹. 2,500 under Reverse Charge Supplies are :

i. IGST – ₹. 1500 ( i.e. 5% on ₹. 30000 purchase value)

ii. CGST – ₹. 500 ( i.e. 2.5% on ₹. 20,000 purchase value)

iii. SGST – ₹. 500 ( i.e. 2.5% on ₹. 20,000 purchase value)

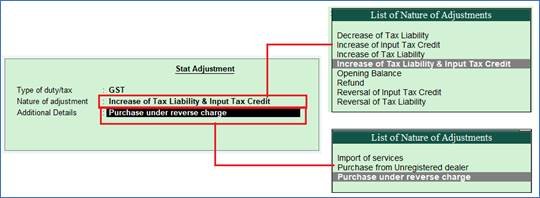

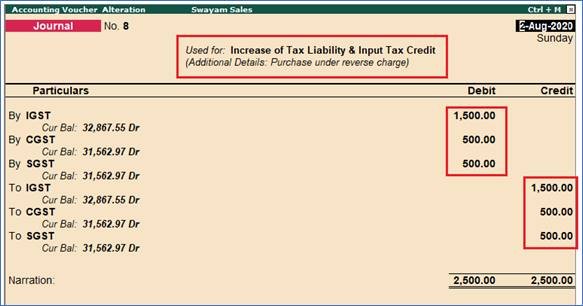

4. Journal Voucher for Increase of Tax Liability & Input Tax Credit on Purchase under Reverse Charge.

When we purchase from Unregistered Dealer, first we have to raise the Tax Liability in our Book, then pay to the Tax Department. For this purpose we have to make entry in Journal Voucher to raise this Tax Liability under Reverse Charge.

To account for Tax Liability on Purchase from Unregistered Dealers

1. Go to Gateway of Tally > Vouchers > F7: Journal.

Alternatively…. Gateway of Tally > Display More Reports > GST Reports > GSTR2 > ( under Default Report)

2. Click J: Stat Adjustment. In the Stat Adjustment Details screen,

o Select the option GST in the Type of duty/tax field.

o Select the option ‘Increase of Tax Liability & Input Tax Credit’ in the Nature of adjustment field.

o Select the option Purchase under Reverse Charge in the Additional Details field.

o Press Enter to save and return to the voucher screen.

305

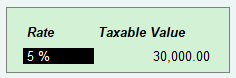

3. The journal voucher appears as shown below:

306

Note :

Don’t forget to put % and Taxable value at the time of Debiting or Crediting CGS Ledger as ..

307

4. Press Enter to save.

How it will affect in GSTR-3B Report :

Gateway of Tally > Display More Reports > GST Reports > GSTR-3B

308