Tax Ledgers should be created under Duties and Taxes group which contains all tax accounts like GST, and other trade taxes and total liability.

To account for the different taxes to be paid under GST (central tax, state tax, union territory tax, integrated tax, and cess), you have to create a tax ledger for each tax type.

The following GST Ledgers will be created :

i. SGST [ State Tax for both Purchase and Sale within State ]

ii. CGST [ Central Tax for both Purchase and Sale within State ]

iii. IGST [ Integrated Tax for both Purchase and Sale Outside State]

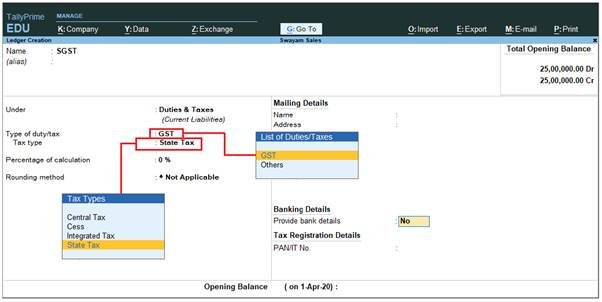

i. To create ‘SGST’ ledger

1. Gateway of Tally > Create > type or select Ledger and press Enter.

Alternatively, press Alt+G (Go To) > Create Master > type or select Ledger and press Enter.

53

2. In Under, select Duties & Taxes.

3. Select GST as the Type of duty/tax.

54

4. Select State Tax as the Tax type.

Note : Percentage of Calculation should be 0% ( Don’t Change ) due to multiple Tax Rate

Similarly, you can create ledgers CGST & IGST by selecting the relevant Tax type under GST.

For CGST Ledger :

55

For IGST Ledger :

56

[Practical Assignment-4]

Create the following GST Ledgers :

| Duties & Taxes: CGST SGST IGST |