This section will capture the total amount eligible for input tax credit, along with the breakup of the tax applicable (CGST, SGST/UTGST, IGST, and Cess). You can find finer detailing under the following sub-sections.

- Input Tax Credit Available (either in part or in full)

- Input Tax Credit Reversed

- Net Input Tax Credit Available (A) – (B)

- Other Details

- ITC reclaimed which was reversed under Table 4(B)(2) in earlier tax period

- Ineligible ITC under section 16(4) and ITC restricted due to PoS rules

[20-1-Eligible for Input Tax Credit in GSTR-3B in TallyPrime-3]

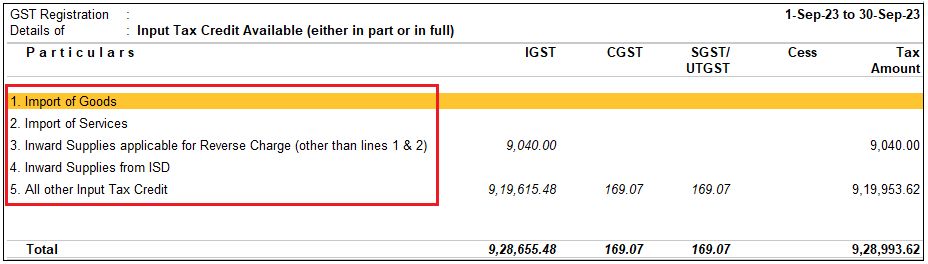

A. Input Tax Credit Available (either in part or in full)

This section will capture the details of inward supplies on which input tax credit was availed, and includes import of goods or services, supplies liable for reverse charge, supplies from ISD, and other inward supplies, as applicable.

You can drill down to view the following sub-sections:

- Import of Goods

- Import of Services

- Inward Supplies applicable for Reverse Charge (other than lines 1 & 2)

- Inward Supplies from ISD

- All other Input tax Credit

[20-2-Eligible for Input Tax Credit in GSTR-3B in TallyPrime-3]

You can drill down from any of the above sub-sections to view the full list of relevant transactions recorded during the period.

[20-3-Eligible for Input Tax Credit in GSTR-3B in TallyPrime-3]

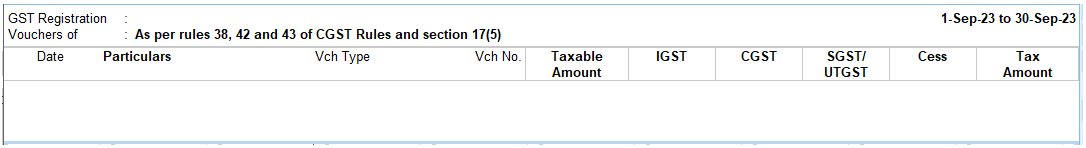

B. Input Tax Credit Reversed

This section will capture the reversal of input tax credit with respect to inputs/input services/capital goods used for a non-business purpose, or partly used for exempt supplies. Moreover, if depreciation is claimed on the tax components of capital goods, plant and machinery, then input tax credit will not be allowed. Such reversals will be captured in this section.

You can drill down to view the following sub-sections:

- As per Rules 38, 42 & 43 of CGST Rules and Section 17(5)

- Others

[20-4-Eligible for Input Tax Credit in GSTR-3B in TallyPrime-3]

You can drill down from any of the above sub-sections to view the full list of relevant transactions recorded during the period.

[20-5-Eligible for Input Tax Credit in GSTR-3B in TallyPrime-3]

C. Net Input Tax Credit Available (A) – (B)

This section captures the difference between the previous two sections (A & B). In other words, you can view the difference between the input tax credit available and the input tax credit reversed.

D. Other Details

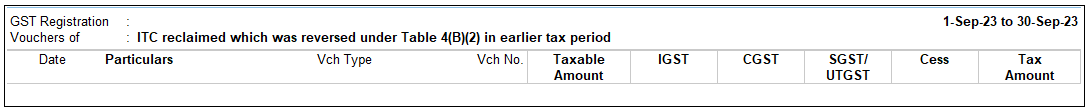

1. ITC reclaimed which was reversed under Table 4(B)(2) in earlier tax period

Table 4(B)(2) of the GST law specifies the conditions under which the ITC claimed needs to be reversed. It mainly applies to cases where the goods or services for which the ITC was claimed are not received or utilized by the business.

Reversing the ITC reclaimed under Table 4(B)(2) means that the credit claimed earlier will be added back to the output tax liability of the business. This essentially means that the business will have to pay back the credit that was previously claimed.

You can drill down this sections to view the full list of relevant transactions recorded during the period.

[20-6-Eligible for Input Tax Credit in GSTR-3B in TallyPrime-3]

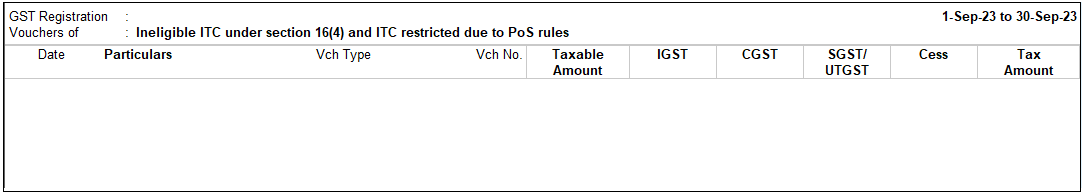

2. Ineligible ITC under section 16(4) and ITC restricted due to PoS Rules

Section 16(4) of the GST Act states that if a supplier does not pay the tax collected from the recipient to the government within a specified time period, the recipient will not be eligible to claim ITC. In other words, if the supplier defaults in paying the tax, the recipient will lose the right to claim ITC on that particular transaction.

On the other hand, the PoS rules restrict ITC on certain expenses like food and beverages, health services, and travel benefits. According to these rules, if a business incurs expenses on these restricted items, ITC cannot be claimed.

It is important for businesses to understand these provisions and ensure compliance to avoid any issues with claiming ITC.

You can drill down the above sub-sections to view the full list of relevant transactions recorded during the period.

[20-7-Eligible for Input Tax Credit in GSTR-3B in TallyPrime-3]