When defining the price of the item you can include the tax rate. This inclusive Tax Rate can assign during sale under two ways..

- Permanently at the time of Creating a Stock Items

- In Sale Invoice, selecting the option – Allow inclusive of tax for stock items to YES in F12: Configuration.

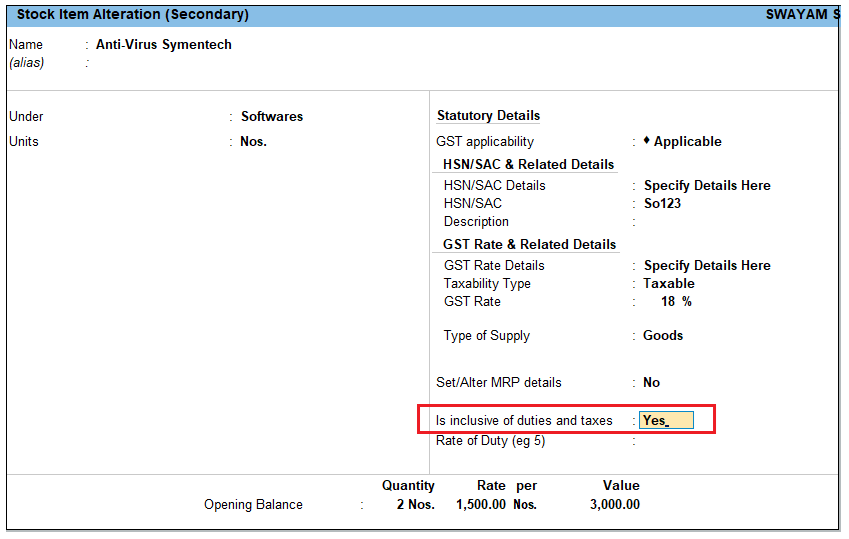

1. Enable Item Rate (Inclusive of Tax) at the time of Item Creation / Alternation mode :

- Gateway of Tally> Create > type or select Stock Item > and press Enter.

Alternatively, press Alt+G (Go To) > Create Master > type or select Stock Item > and press Enter.

[65-Sales Process in TallyPrime-3 & Higher]

- Set Is inclusive of duties and taxes? to Yes .

- To activate this option in Item creation screen, Press F12: Configure .

- Set Inclusive of Duties and Taxes option to Yes under Statutory Details.

[66-Sales Process in TallyPrime-3 & Higher]

- Press Ctrl+A to go to the Stock Item Alteration screen.

- Enter the Rate of Duty , as required.

- Press Ctrl+A to save the ledger.

2. Activation of Item Rate Inclusive of Tax in F12: Configuration during Sale Entry.

- Gateway of Tally> Vouchers > press F8 (Sale).

Alternatively, Alt+G (Go To) > Create Voucher > press F8 (Sale)

- Press F12: Configuration and Set Provide Rate Inclusive of Tax for Stock Items to Yes .

[67-Sales Process in TallyPrime-3 & Higher]

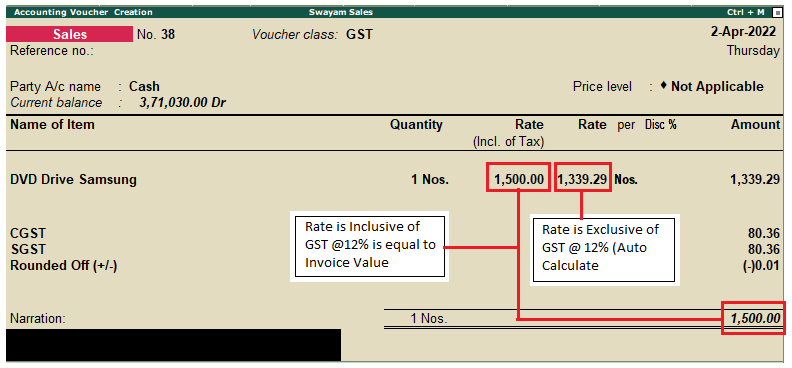

- An extra Inclusive of Tax Rate column will be added with normal Rate column in Sale Voucher screen.

- Assign Inclusive Tax Rate of the Item in Incl. of Tax Rate Column, TallyPrime will automatically calculate the Items Value after deducting GST as per given Sale Invoice with example.

Example :

Sole 1 Nos. DVD Drive Samsung of Rs. 1500 (Inclusive of GST @ 12%) in cash.

Sale Invoice will be as below :

[68-Sales Process in TallyPrime-3 & Higher]

[Practical Assignment]

(Sales Transactions)

SALE TRANSACTION [F8]

Swayam Sales Sold the following Items and Goods to various Customer both within State as well as Outside State with GST .

Record the following Sales Transactions after referring Para – 5.3.

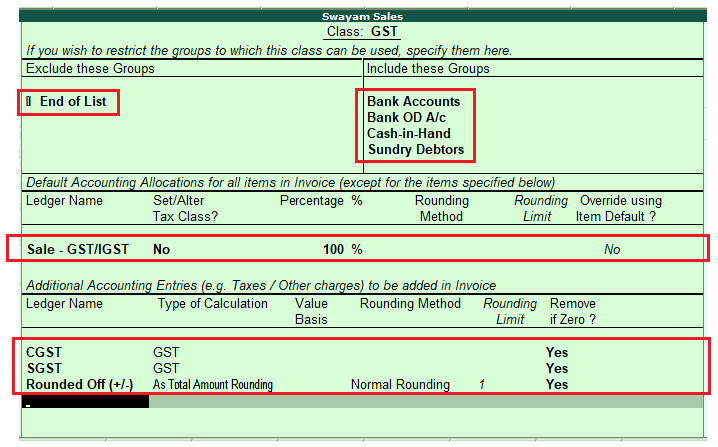

Suggestion:

Before start your Sale Voucher, you may Alter your Sale Voucher Class into (i) GST & (ii) IGST with predefined Sale Ledger , GST Ledger, Rounded Off Ledger, so that your Sale Voucher entry will be Speedy with 100% accuracy.

[69-Sales Process in TallyPrime-3 & Higher]

GST Class Details :

[70-Sales Process in TallyPrime-3 & Higher]

IGST Class Details :

[71-Sales Process in TallyPrime-3 & Higher]

Go to F11 (Features) → Enable ‘Yes” to ‘Use Discount Column in Invoices’ under Inventory Features : to provide Trade Discount product-wise.

- 13/4/2023 Sold the following Items to Lexsite Pvt. Ltd

| Cabinet | 2 Nos. | 5000 |

| CD Drive | 5 Nos. | 600 |

| Dvd Drive Samsung | 5 Nos. | 1250 |

| Keyboard-Logitech | 2 Nos. | 1750 |

| Keyboard-I Ball | 2 Nos. | 1000 |

[ Invoice value Rs. 27,335]

- 24/4/2023 Sold the following Items with Discount 2% for each Items to Stabilo

| Printer Epson Lq1024 | 1 Nos. | 18725 |

| Printer HP Laser Jet | 1 Nos. | 17120 |

| Printer Samsung Laser Jet | 1 Nos. | 16050 |

| Microsoft Office 2003 | 2 Nos. | 1200 |

| Printer Epson Lq1024 | 1 Nos. | 18725 |

[ Invoice value Rs. 60,642 with Rounded off (-) 0.40]

- 28/4/2023 Sold the following Items Shwetha &Co

| Anti Virus Norton | 5 Nos. | 2160 |

| Anti-Virus Symentech | 5 Nos. | 1800 |

| TallyPrime Gold | 1 Nos. | 45000 |

| TallyPrime Silver | 1 Nos. | 15000 |

[ Invoice value Rs. 92,214]

- 4/5/2023 Sold the following Items in cash with discount to Rony Antony & Co

| Monitor LG14” | 1 Nos. | 8800 | 2% (Discount) |

| Monitor Samsung G17” | 1 Nos. | 10450 | 4% (Discount) |

| Monitor Sony20” | 1 Nos. | 17600 | 3% (Discount) |

[ Invoice value Rs. 40,015 with Rounded off (-) 0.36]

- 9/5/2023 Sold the following Items to Sodexo Gift Voucher.

| Laptop ACER 4720Z | 1 Nos. | 37,000 |

| Laptop Compaq A901TU | 1 Nos. | 40,000 |

| Laptop HCL MiLeap | 1 Nos. | 39,000 |

| Desktop Lenovo K200 | 1 Nos. | 55,000 |

[ Invoice value Rs. 2,13,380]

- 9/5/2023 Sold the following Items to Adarsh Tiles Pvt. Ltd.

| Processor Intel | 1 Nos. | 5500 |

| Processor AMD Athlon™X2 Dual-Core | 1 Nos. | 7500 |

| Processor Intel Celeron Dual Core E1200 | 1 Nos. | 3300 |

[ Invoice value Rs. 19,234]

- 11/5/2023 Sold the following Items to Shaliesh and Sons

| Webcam ADCOM | 2Nos. | 600 |

| Webcam Logitech | 1Nos. | 2100 |

| Carry Case (Laptop) | 1Nos. | 1275 |

| TallyPrime Gold | 45000 |

[ Invoice value Rs. 57,904 with Rounded off (+) 0.24]

- 11/5/2023 Sold the following Items to Chitra &Co.

| Windows Xp | 1 Nos. | 1275 |

| UPS Apc | 1 Nos. | 2000 |

| Speakers | 2 Nos. | 1200 |

| TV Tuner | 1 Nos. | 1500 |

| UPS Microtech | 2 Nos. | 2200 |

[ Invoice value Rs. 12,602 with Rounded off (+) 0.24]

- 26/5/2023 Sold the following Items to Eric Enterprises (IGST)

| Ram 1 GB | 1 Nos. | 3000 |

| Ram 2 GB | 1 Nos. | 3500 |

| Ram 4 GB | 1 Nos. | 4375 |

| Ram 512 GB | 1 Nos. | 2600 |

| Ram 8 GB | 1 Nos. | 5600 |

[ Invoice value Rs. 21,182]

- 30/5/2023 Sold the following Items to Darshan & Sons (IGST)

| Laptop ACER 4720Z | 1 Nos. | 40000 |

| Laptop Compaq A901TU | 1 Nos. | 42000 |

| Laptop HCL MiLeap | 1 Nos. | 39000 |

| Laptop HP-530 KD100AA | 1 Nos. | 52000 |

| Laptop IBM Thinkpad R50e | 1 Nos. | 32000 |

[ Invoice value Rs. 2,62,400]