Payroll in TallyPrime is easy to use and can handle all the functional, accounting and statutory requirements of the payroll department.

1. Enabling Payroll in TallyPrime

In TallyPrime activation of Payroll requires a one-time simple setup. Create a new company in TallyPrime and follow the steps given below to enable Payroll.

EXAMPLE >>

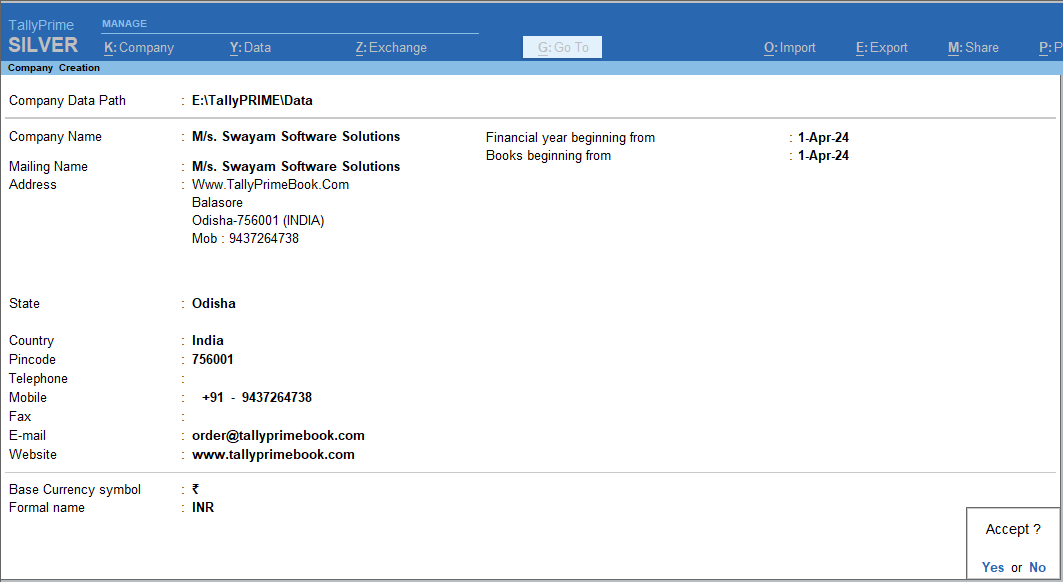

Case Study Company

M/s. Swayam Software Solutions (www.tallyprimebook.com) is engaged in the Software services Business. It is a Odisha-based company with the following three major departments:

- Sales & Marketing

- Administration

- R & D

Step – 1 : Company Setup

You can create a Company profile by using the following procedure :

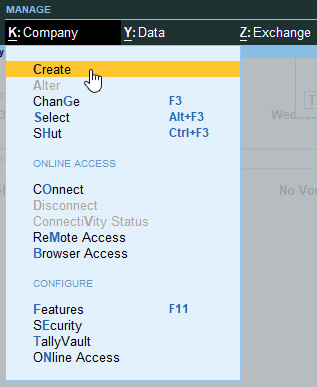

- Press Alt+K > Create.

[1-Payroll Management using TallyPrime-4]

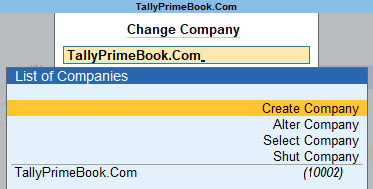

Alternatively, at the Gateway of Tally, press F3 > Company > Create Company

[2-Payroll Management using TallyPrime-4]

The Company Creation screen appears.

[3-Payroll Management using TallyPrime-4]

Step-2 : Enable Payroll with Statutory Details

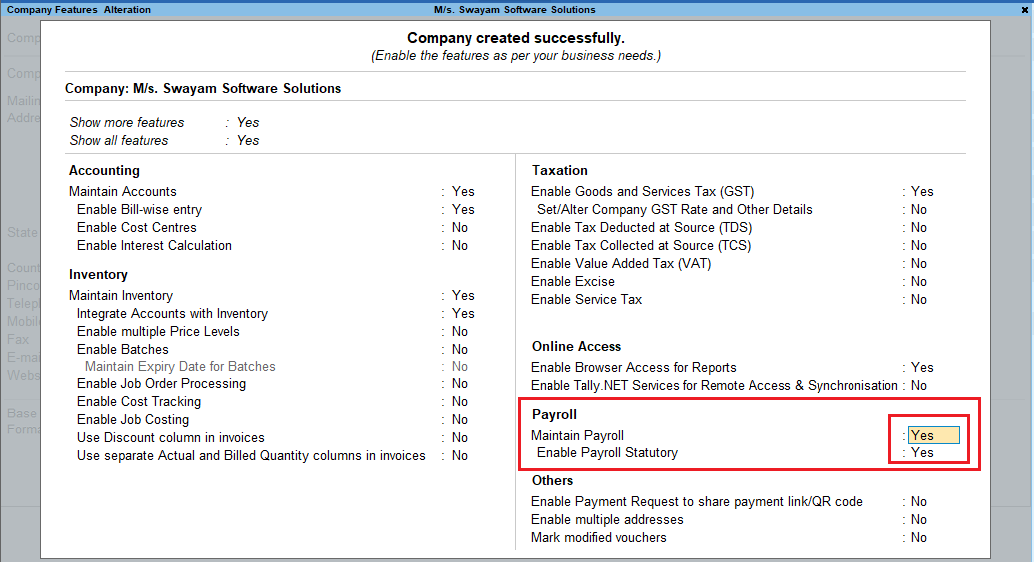

After Creating a New Company as above, you will get Company Features Screen with Company created successfully as below :

[4-Payroll Management using TallyPrime-4]

- set Maintain Payroll to Yes

- To use the Provident Fund, Employee State Insurance (ESI), National Pension Scheme (NPS), Income Tax and Professional Tax features for Indian Payroll, you must enable Statutory Features for Payroll.

| Note: The Payroll Statutory Features are available only for India. For other countries, this option is not available. |

- set Enable Payroll Statutory to Yes.

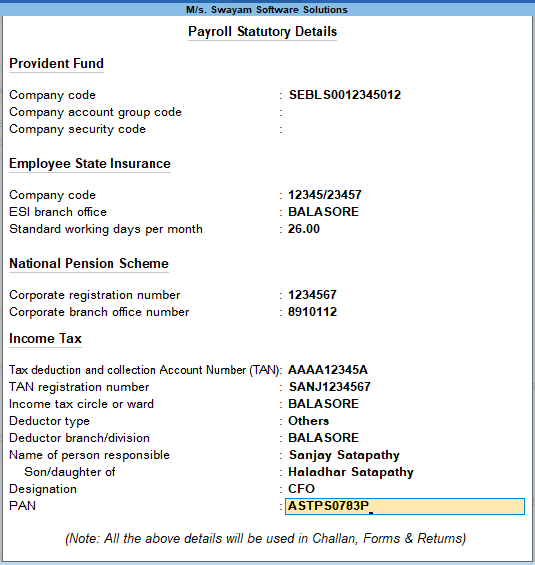

In the Payroll Statutory Details screen:

- Enter the Provident Fund & Employee State Insurance , National Pension Scheme, Income Tax details of the company as shown:

[5-Payroll Management using TallyPrime-4]

- Press Enter to Accept the screen and go back to F11: Statutory & Taxation Features screen

- Press Ctrl+A to Accept the screen.