In your business, you deal with the movement of your inventories from one place to another. In some cases, you must be receiving inventories from your supplier or any other party. TallyPrime release 3.0 brings this exclusive feature that enables you to record the movement of inventory using the Material In voucher with GST taxation.

For example, if you are a Principal Manufacturer, then you can use this voucher to record the receipt of finished goods from the Job Worker.

Similarly, If you are a Job Worker, then you can use this voucher to account for the receipt of raw material from the Principal Manufacturer.

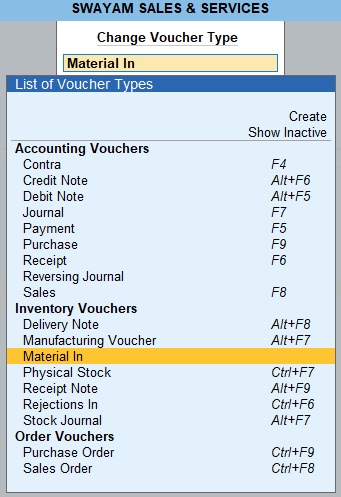

- Open the Material In voucher.

- Press Alt+G (Go To) > Create Voucher > press F10 (Other Vouchers) > type or select Material In and press Enter.

Alternatively, Gateway of Tally > Vouchers > press F10 (Other Vouchers) > type or select Material In and press Enter.

[16-1-GST Invoice Support for Material in Voucher in TallyPrime-3]

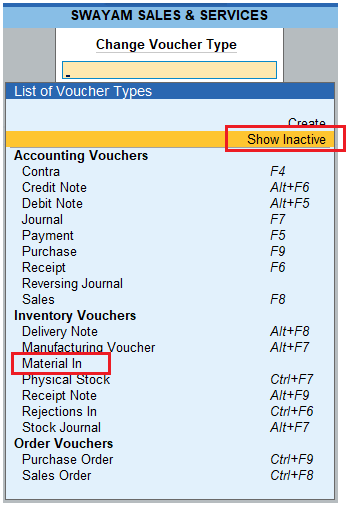

If the Material In voucher type is not visible on the List of Voucher Types screen, Show Inactive > type or select Material In and press Enter.

[16-2-GST Invoice Support for Material in Voucher in TallyPrime-3]

An activation prompt appears, press Enter or click on Yes to activate the voucher.

[16-3-GST Invoice Support for Material in Voucher in TallyPrime-3]

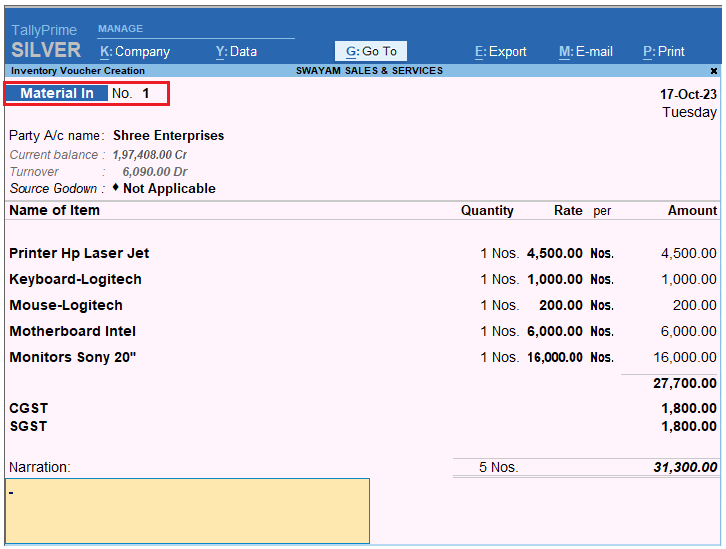

- Enter the Supplier Invoice No. and Date.

- In Party A/c name, select the party ledger from whom you are getting the material.

- In Source Godown, select the godown from where you are getting the material.

- Enter stock item details.

- Name of Stock Item – Select the stock item

- Specify Quantity and Rate.

- Select the tax ledgers.

[16-4-GST Invoice Support for Material in Voucher in TallyPrime-3]