You can record a local purchase under GST for the purchase of services in TallyPrime, using a Purchase voucher in Accounting Invoice mode.

- Open the purchase voucher screen in Accounting Invoice Mode.

- Gateway of Tally > Vouchers > press F9 (Purchase).

Alternatively, press Alt+G (Go To) > Create Voucher > press F9 (Purchase). - Press Ctrl+H (Change Mode) to select the required voucher mode (Accounting Invoice, in this case).

Supplier invoice no.: Displays the sales invoice no. of the supplying party.

Date: Displays the date on which the sales invoice was passed by the supplier.

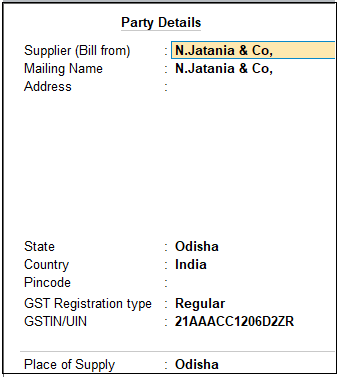

- In Party A/c name, select the supplier’s ledger or the cash ledger having Local State with GST No. Also, Enter Dispatch Details and Order Details, as needed.

- Place of Supply: Select the location where the goods are supplied.

This is prefilled with the State entered for your company. For local purchases, ensure that the Place of Supply is same as the state of the supplier, under Party Details.

You can also enter Receipt Details and Order Details if required. If you do not see these options, enable them from F12 (Configure).

[3-1-Local (within State) Purchase of Services in TallyPrime-3]

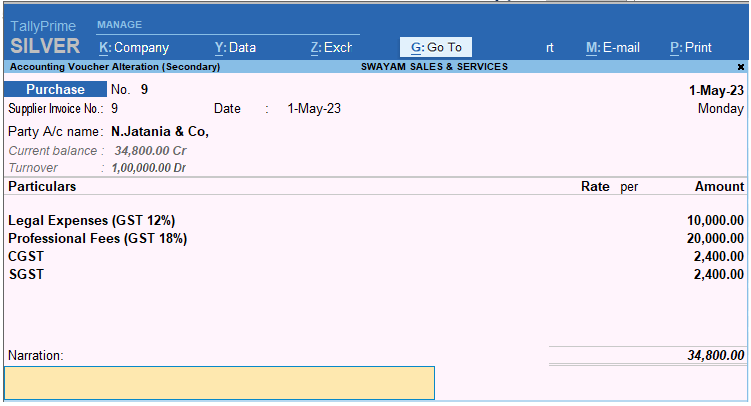

- Enter Particulars details.

- Select the service purchased ledger (Legal Expenses (GST 12%).

For GST to be calculated in the voucher, ensure that the service is configured with the correct GST Rate.

- Specify the Amount.

- Select the central (CGST) and state (SGST) tax ledgers for Local Purchase of Services which will be auto calculated on the basis of GST Rate given in Item-wise.

[3-2-Local (within State) Purchase of Services in TallyPrime-3]

- As always, press Ctrl+A to save the voucher.

You can see the transaction under Eligible for Input Tax Credit of GSTR-3B.

1. Creating Service Ledger with GST Compliance

In case of Service oriented Business like…Chartered Accountant, Lawyer, Advertising Agency, Consultant, Architectures etc.. they provide Service to the customer and provide Bill / Invoice with GST Compliance. So in this case, TallyPrime provides Accounting Invoice with auto GST Calculations, provided all Service Ledgers has to be created with GST Rate ( as applicable).

For Example:

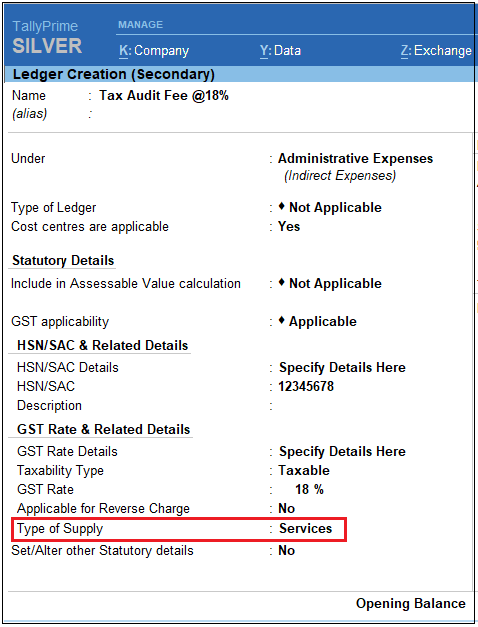

Create a Ledger – Audit Fee with GST 18%

Setup:

Create a Ledger, ‘Audit Fee’ under Direct Income with GST Applicable and the GST details will be applied seamlessly, with Type of Supply – Service as per screen below:

[3-3-Local (within State) Purchase of Services in TallyPrime-3]

- Press Alt+G(Go To) > Create/Alter Master > Ledger (under Accounting Master).

Alternatively, go to Gateway of Tally > Create/Alter > Ledger. - Select the required service ledgerfrom the List of Ledgers, or create a new one, as needed.

- Fill in the relevant details for HSN/SAC and GST.

- HSN/SAC Details: You have three options to choose from.

- Specify Details Here: Once you select this option, you will be able to enter the details right here in the service ledger.

[3-4-Local (within State) Purchase of Services in TallyPrime-3]

- Use GST Classification: This option allows you to select a previously created GST Classification, or create one on the spot. The details will be applied accordingly.

- Specify in Voucher: If you are not aware of the details at the moment, and if you want to add the details directly in the transaction, then you can select this option.

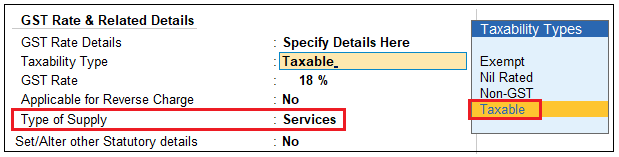

- GST Rate Details: Like in the previous field (HSN/SAC Details), you have the same three options to choose from.

[Select Sales Exempt , if the type of supply is exempted from tax under GST, or select Sales Nil Rated , if the tax rate applicable to the type of supply is 0% under GST.]

- Type of supply – Services .

[3-5-Local (within State) Purchase of Services in TallyPrime-3]

- Press Ctrl + A to save.

[Practical Assignment]

(Local Purchase of Services -Within State)

Create or Alter the following Expenses with GST Compliance …

| Taxable Expenses: | GST Rate |

| Printing & Stationery (12%) | 12% |

| Travelling Expense (18%) | 18% |

| Telephone Charges (5%) | 5% |

| Electricity Bills (5%) | 5% |

| Legal Expenses (18%) | 18% |

| Professional Fees (18%) | 18% |

| Advertisement Expenses (12%) | 12% |

Record the following Expenses with the help of Purchase Voucher in Accounting Invoice (ALT+I) mode from the Registered Business either in Cash/Bank or Credit:

- 5/4/2022 Purchase Printing & Stationary from Shree Enterprises of Rs.500 on Credit

- 10/4/2022 Paid the following Expenses with GST in cash from Registered Business.

Telephone/Telex/Fax Charges (GST 5%) Rs. 1500

Electricity Bill ( GST 5%) Rs. 1000

- 15/4/2022 Received a Bill of Advertisement Expenses (18%) of Rs.2500 from

PD Advertising.

- 20/4/2022 Received a Bill from N. Jatania towards following Expenses

Legal Expenses (GST 12%) Rs.10,000

Professional Fees ( GST 5%) Rs. 20,000

- 28/4/2022 Paid Telephone Charges (5%) of Rs. 2200 to BSNL by cheque of ICICI Bank.