With the introduction of GST, the goods and services have been classified into Nil Rated, Exempted, Zero Rated and Non-GST supplies. The Purchase or Sales of these goods to a local or interstate customer does not attract GST, and can be recorded using a Purchase / Sales voucher. Let us take a look at what distinguishes each of them with some examples:

| Supply | GST Applicable | Type of Supply | Eligibility for ITC | Examples |

| NIL Rated | 0% | Everyday items | No | Grains, Salt, Jaggery, etc. |

| Exempted | – | Basis essentials | No | Bread, Fresh Fruits, Fresh Milk, Curd etc. |

| Non- GST | – | Supplies for which GST is not applicable but can attract other taxes | No | Petrol, Alcohol etc. |

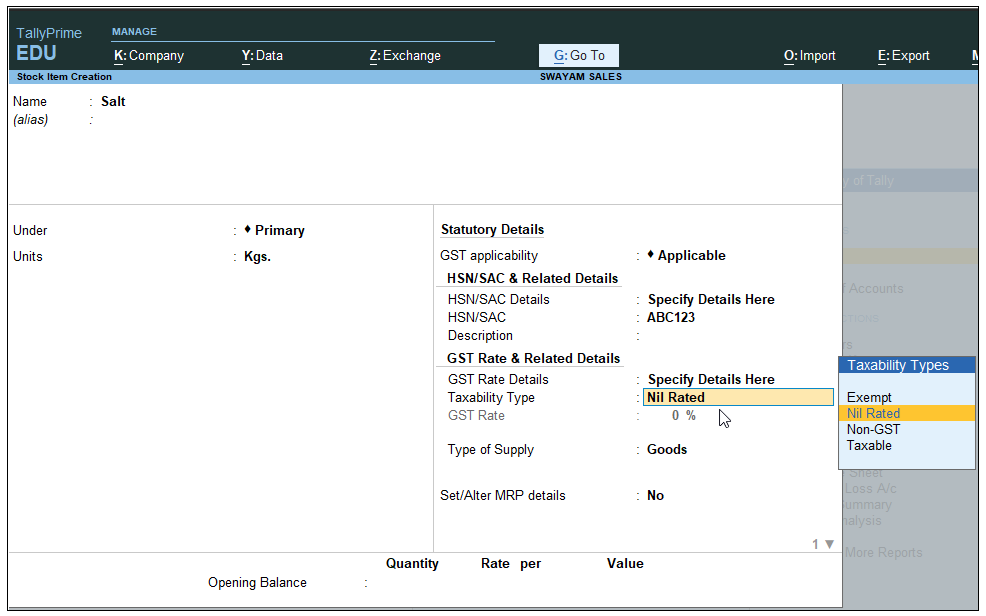

In case of above Items and Goods , the option Nil Rated / Exempt has to be selected as the Taxability in the GST Details screen of the item or item group master.

Setting Nil-Rated & Exempted items and Goods :

[24-Sales Process in TallyPrime-3 & Higher]

[Practical Assignment]

(Creation Nil or Exempted Items & Goods)

Swayam Sales deals the following Nil-Rated / Exempted Items and goods which purchased and sold in his business. Create the following Items as details given.

| Name of Items | Unit of Measurement | Taxability of GST |

| Moong Dal | (Unit is Kg. with Decimal 3) | with Nil Rated GST |

| Salt | (Unit is Kg. with Decimal 3) | with Nil Rated GST |

| Bread | ( Unit is Pcs.) | with Exempt GST |

| Fruits | ( Unit is Kg. with Decimal 3) | with Exempt GST |

Transactions:

Sold the following items in Cash which are Nil Rated and Exempted

| Name of items | Quantity | Rate | Value | |

| Moong Dal | 50 Kg. | 100 | 5000 | (Nil Rated) |

| Salt | 20 kg. | 30 | 600 | (Nil Rated) |

| Bread | 48 Pcs. | 25 | 1200 | (Exempted) |

| Fruits | 10 Kg. | 125 | 1250 | (Exempted) |

Total: 8050

Sale Invoice of above goods are given below :

[24-A-Sales Process in TallyPrime-3 & Higher]

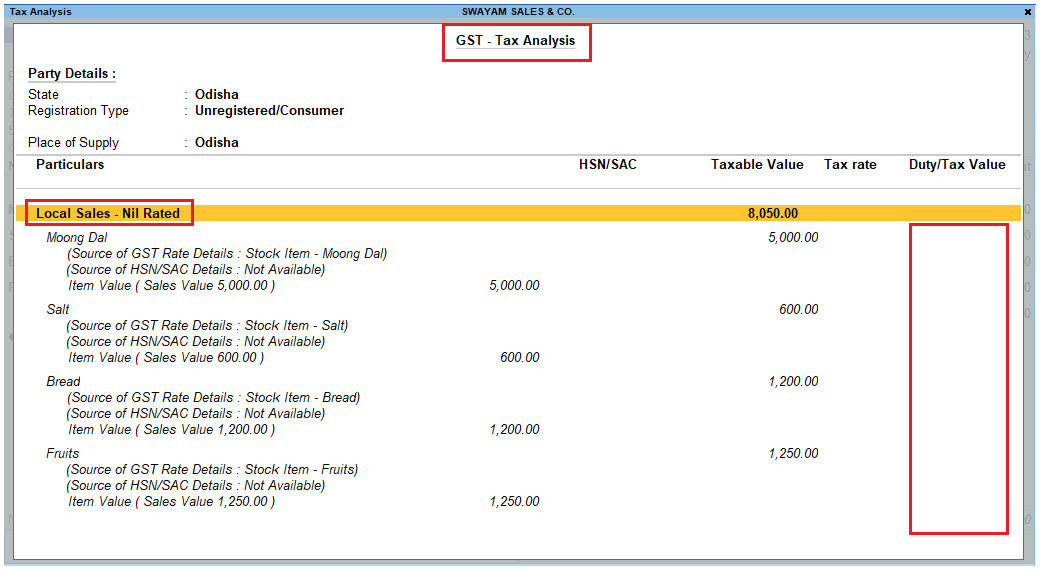

GST Details of the above invoice :

When you Press Press ALT+A to display GST-Tax Analysis Directly [ OR Press Ctrl + O (Related Reports) and select GST – Tax Analysis from Additional Details] and Press Alt + F1 or Alt+F5 for Details…you will see the GST Analysis as below by default.

[24-B-Sales Process in TallyPrime-3 & Higher]