Debit Note is a document issued to a party stating that you are debiting their Account in your Books of Accounts for the stated reason or vice versa. It is commonly used in case of Purchase Returns, Escalation/De-escalation in price, any other expenses incurred by you on behalf of the party etc.

All features and functions of Purchase Voucher and Debit Note Voucher are same. So just like Purchase Voucher, you can record transaction in Debit Note either in Accounting Invoice or Item Invoice.

A Debit Note can be entered in voucher or Invoice mode (either Accounting / Items).

Debit Note can be entered in voucher or Invoice mode.

Record Purchase Returns:

- Press Alt+G (Go To) > Create Voucher > press F10 (Other Vouchers) > type or select Debit Note and press Enter.

Alternatively, Gateway of Tally > Vouchers > press F10 (Other Vouchers) > type or select Debit Note and press Enter OR Press Alt+F5 inside Voucher

- In Party A/c name, select the party from whom the original purchase was made and press Enter.

The Dispatch Details screen will appear.

- Under Original Invoice Details, enter the Original Invoice No. and Date of the original purchase transaction against which you are recording a purchase return.

As per the Purchase voucher, you can enter the Original Invoice Details in the Debit Note as shown in the image below:

[14-1-Purchase Return or Debit Note Voucher (Alt+F5) under GST in TallyPrime-3]

- Enter stock item details for debit note and select the tax ledgers.

- Name of Stock Item – Select the stock item that you are returning to the supplier.

- Specify Quantity and Rate.

- Select the required tax ledgers.

For example, shown below is a Debit Note for 1 Laptop ACER 4720Z with a taxable value of Rs. 40,000/- and with GST of Rs. 11,200/- recorded on 2-Aug-23. The values of GST ledgers here, that is, Rs. 11,200/- will be the Input Tax Credit (ITC) reversed from the original purchase ITC.

[14-2-Purchase Return or Debit Note Voucher (Alt+F5) under GST in TallyPrime-3]

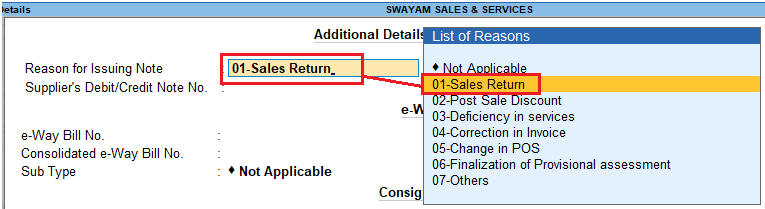

- Set the option Provide GST details to Yes, and select the reason of the purchase return from the List of Reasons.

[14-3-Purchase Return or Debit Note Voucher (Alt+F5) under GST in TallyPrime-3]

When the seller has not uploaded the credit note, the buyer has to upload the debit note from the viewpoint of outward supply. Hence, the List of Reasons for Issuing Note is the same in a debit note and a credit note.

- 01-Sales Return: When there is a return of goods or services after the purchase.

- 02-Post Sale Discount: When a discount is allowed on goods or services after the purchase.

- 03-Deficiency in services: When there is a deficiency in services (like a quality issue) after purchase.

- 04-Correction in Invoice: When there is a change in the invoice raised that leads to a change in the tax amount.

- 05-Change in POS: When there is a change in place of supply that leads to a change in the tax amount.

- 06-Finalization of Provisional assessment: When there is a change in price or rate after the department issues a notification about the finalized price of the goods or services.

- 07-Others: Any other nature of the return.

- As always, press Ctrl+A to save the Debit Note.

[Practical Assignment]

( Debit Note / Purchase Return)

Record the following Purchase Return Transactions under Debit Note ( CTRL+F9) with GST Adjustment.

DEBIT NOTE / PURCHASE RETURN [Ctrl + F9]

Sl. No. Date Transactions

- 22/4/2023 Following item purchased found defective and Return back to ACER India ltd.

with GST (SGST 4550 and CGST 4550)

Laptop ACER 4720Z 1 Nos. 32,500

- 12/6/2023 Following Items are Returned to Intel Solutions due to used products with GST (SGST 855 and CGST 855)

Motherboard-Intel 1 Nos. 5000

Processor Intel 1 Nos. 4500

- 29/7/2023 Following item Returned back to Radiant Techno Ltd. because of high price with GST (SGST 450 and CGST 450)

Processor Intel Celeron Dual Core E1200 2 Nos. 2500

- 30/7/2023 Purchase the following Items and now Returned to Thakral Infotech Ltd. due to Sample product with IGST Rs.636

RAM 1 GB 1 Nos. 2100

RAM 8 GB 1 Nos. 3200

- 5/8/2023 Following Items Purchased from Shree Enterprises and now Returned back with GST (SGST 145 and CGST 145)

Speaker 1 Nos. 800

Windows Xp 1 Nos. 5000

- 10/8/2023 A Scheme Incentive of Rs. 10,000 was received from Intel Solution with GST Adjustment @18% [ Record this in Accounting Invoice – ALT+i]