In case of Service oriented business, they also product invoice with their Service Charges plus GST. In this case TallyPrime maintain Accounting Invoice where list of Accounts displays instead of Items and Goods.

1. Go to Gateway of Tally > Vouchers > Press F8 (Sales)

Alternatively, Press Alt+G (Go To) > Create Voucher > Press F8 (Sales)

Change Voucher Mode :

Press Ctrl+H (Change Mode) to select the required voucher mode (Item Invoice / /Accounting Invoice/ As Voucher) i.e. Accounting Invoice in this case.

152

Accordingly, Invoice body will converted into – Name of Item, Rate, Amount ( in case of Item Invoice). In this case, list of items will display.

Item Invoice:

153

Similarly, Invoice body will converted into – Particular , Value ( in case of Accounting Invoice). In this case, list of Ledgers / Accounts will display.

Accounting Invoice:

154

(A) Sale Invoice with Service Charges within State (CGST / SGST)

Example:

Transactions : An invoice issued for Audit Fee of Rs. 20,000 with GST 28% (within State) to Chitra & Co. on 01/04/2020

Setup:

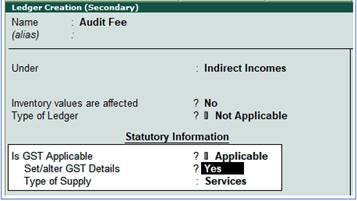

Create a Ledger, ‘Audit Fee’ under Direct Income with GST Applicable and Set/Alter GST Details – YES , with Type of Supply – Service as per screen below:

155

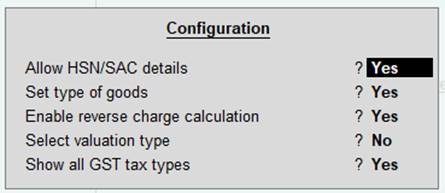

1. Set/alter GST Details – Yes , specify the details in the GST Details screen below, and save.

156

Nature of transaction : Select Sales Taxable from the Natures of Transactions List as above.

[Select Sales Exempt , if the type of supply is exempted from tax under GST, or select Sales Nil Rated , if the tax rate applicable to the type of supply is 0% under GST.]

To specify further GST-related details , click F12: Configure .

157

2. Type of supply – Services .

3. Press Ctrl + A to save.

4. Go to Gateway of TallyPrime → Accounting Voucher → Sales (F8) → Alt+I (Accounting Invoice -if any)

5. Go to Gateway of Tally > Vouchers > Press F8 (Sales)

Alternatively, Press Alt+G (Go To) > Create Voucher > Press F8 (Sales)

Press Ctrl+H (Change Mode) to select Accounting Invoice in this case.

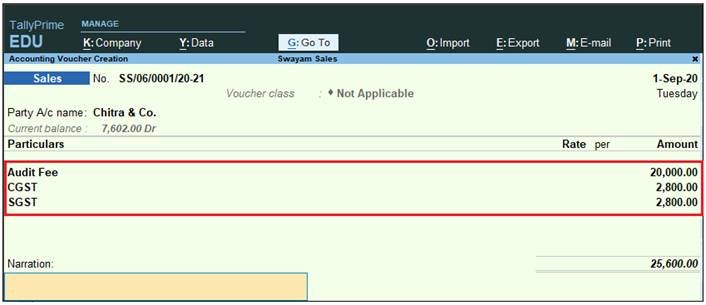

Issue a Bill/Invoice to Chitra & Co. with a Service of Audit Fee Rs. 20,000 with CGST & SGST as given below:

158

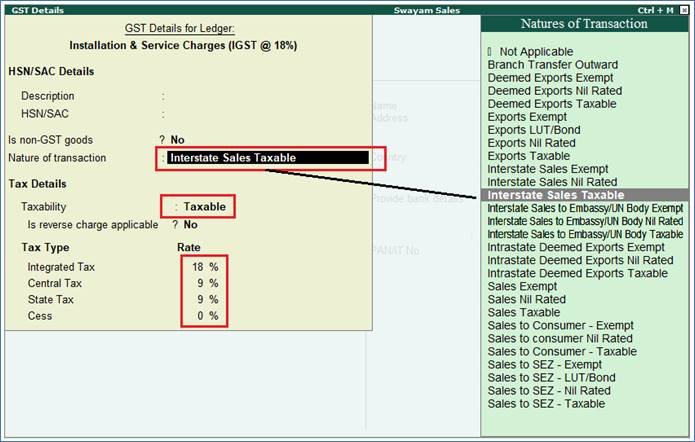

(B) Sale Invoice with Service Charges Outside State (IGST)

If you are providing any Service to outside State and want to issue an Invoice outside State with IGST, in this situation, you have create a Ledger as usual under Direct / Indirect Income with GST Applicable. But while providing GST Details for Ledger under Set / Alter GST Details, you should select ‘Interstate Sales Taxable’ under Nature of Transaction as given below:

Create a Ledger : Installation & Service Charges (IGST @ 18%)

160