Pass a Sales Invoice against sale of Items to Debtor Chitra & Co. :

1. Gateway of Tally> Vouchers > press F8 (Sale).

Alternatively, Alt+G (Go To) > Create Voucher > press F8 (Sale)

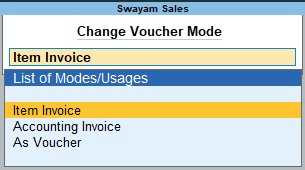

2. Press Ctrl+H(Change Mode) to select the required voucher mode (Item Invoice, in this case)

[83-Inventory Management using TallyPrime-4]

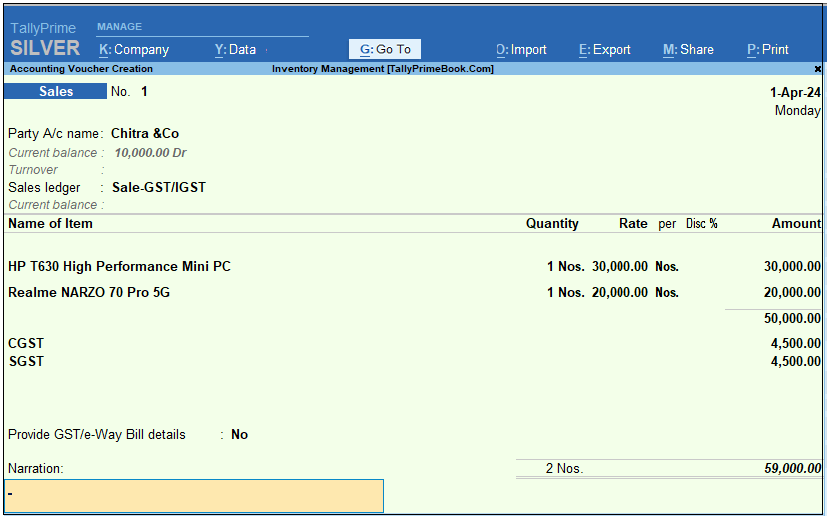

Transactions : Sold the following Goods to Chitra & Co. (within state customer) on Credit on 01/04/2024

| ITEMS | Qty. | Unit | Rate | Value |

| HP T630 High Performance Mini PC | 1 | Nos. | 30,000 | 30,000 |

| Realme NARZO 70 Pro 5G | 1 | Nos. | 20,000 | 20,000 |

[84-Inventory Management using TallyPrime-4]

1. Sale of Goods and Services in a Single Invoice with multiple GST Rate.

You can record the sales of both goods and services in the same invoice by selecting the required sales ledger and GST ledgers (state tax and central tax for local sales; integrated tax for interstate sales)

Example:

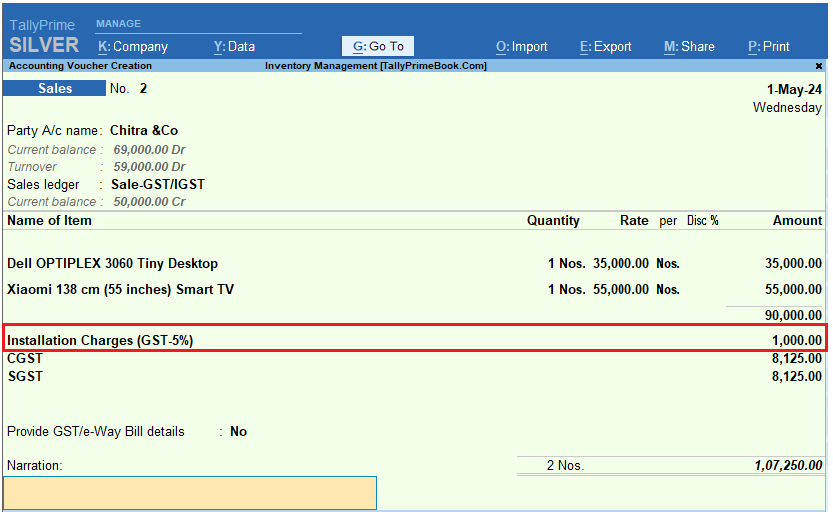

Transactions : Sold the following Goods to Chitra & Co. (within state customer) on Credit on 01/05/2024 with ‘Installation Charges’ Rs.1,000 extra which attracts GST 5% apart from Products GST.

| ITEMS | Qty. | Unit | Rate | Value |

| Dell OPTIPLEX 3060 Tiny Desktop | 1 | Nos. | 35,000 | 35,000 |

| Xiaomi 138 cm (55 inches) Smart TV | 1 | Nos. | 55,000 | 55,000 |

Setup :

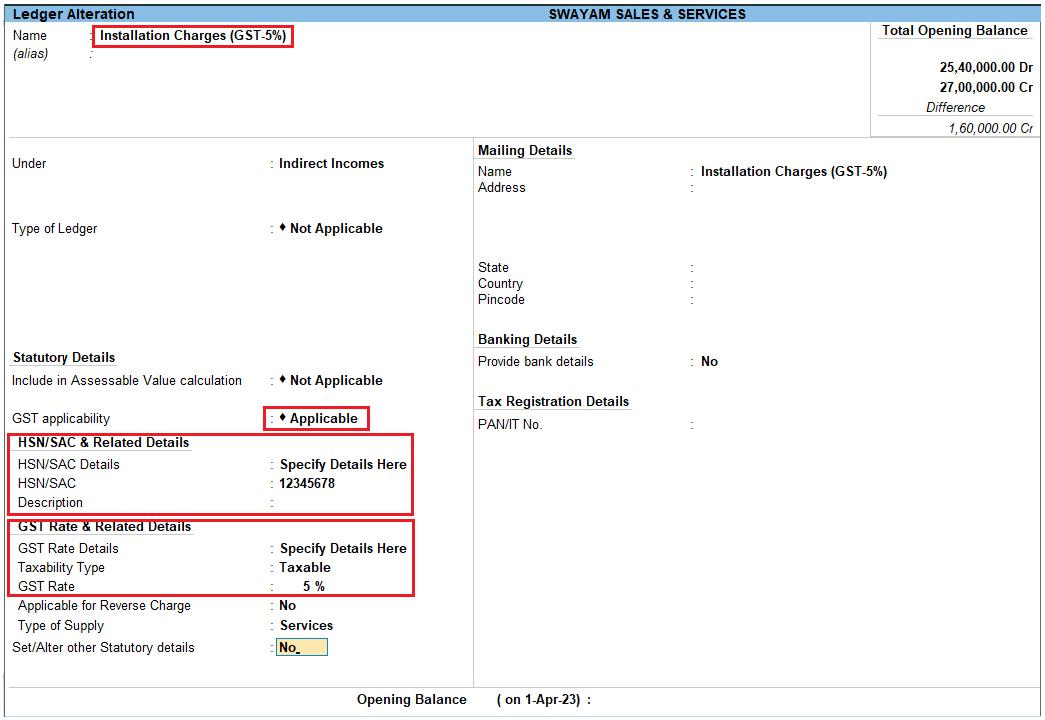

Create a Ledger “Installation Charges” under ‘Direct Income’ with GST Applicable @ 5% as details below :

[85-Inventory Management using TallyPrime-4]

The Sales Invoice will be as shown as below :

[86-Inventory Management using TallyPrime-4]

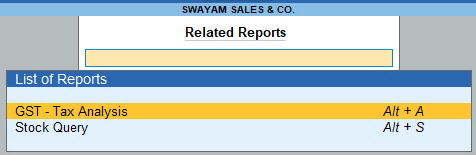

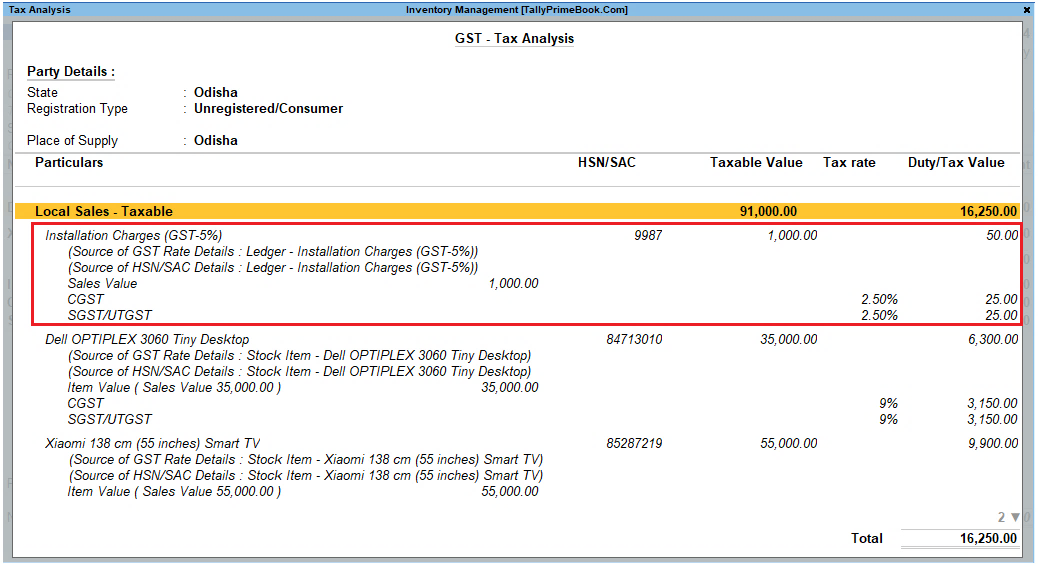

GST -Tax Analysis :

When you Press Press ALT+A to display GST-Tax Analysis Directly [ OR Press Ctrl + O (Related Reports) and select GST – Tax Analysis from Additional Details] and Press Alt + F1 or Alt+F5 for Details…you will see the GST Analysis as below by default.

[87-Inventory Management using TallyPrime-4]

[88-Inventory Management using TallyPrime-4]

2. GST Sale of a Composite Supply (Sale of Items & Goods with Expenses Apportioning)

This is called Recording Sales of Composite Supply under GST (Expenses Apportioning).

Composite supply means a supply is comprising two or more goods/services, which are naturally bundled and supplied in with each other in the ordinary course of business, one of which is a principal supply. The items cannot be supplied separately.

Illustration in Revised GST law : Where goods are packed, and transported with insurance, the supply of goods, packing materials, transport and insurance is a composite supply. Insurance, transport cannot be done separately if there are no goods to supply. Thus, the supply of goods is the principal supply

You can record the sales of a composite supply using a sales invoice. The rate of tax applicable on the principal supply will be considered as the rate of tax for the composite supply.

Example:

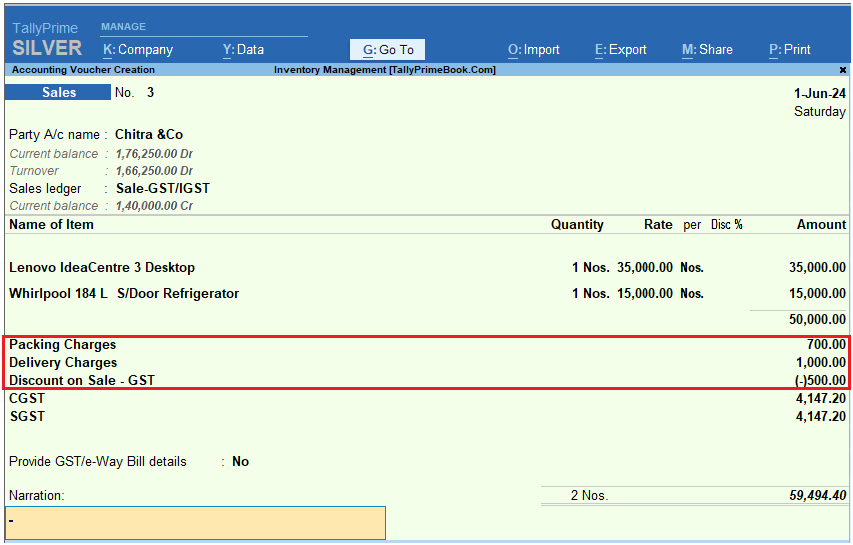

Transactions : Sold the following Goods to Chitra & Co. (within state customer) on Credit on 01/06/2024 with Packing Charges of Rs. 700, Delivery Charges with Rs. 1,000 and there is a Discount of Rs. 500 on total Sales value .

| ITEMS | Qty. | Unit | Rate | Value |

| Lenovo Idea Centre 3 Desktop | 1 | Nos. | 35,000 | 35,000 |

| Whirlpool 184 L S/Door Refrigerator | 1 | Nos. | 15,000 | 15,000 |

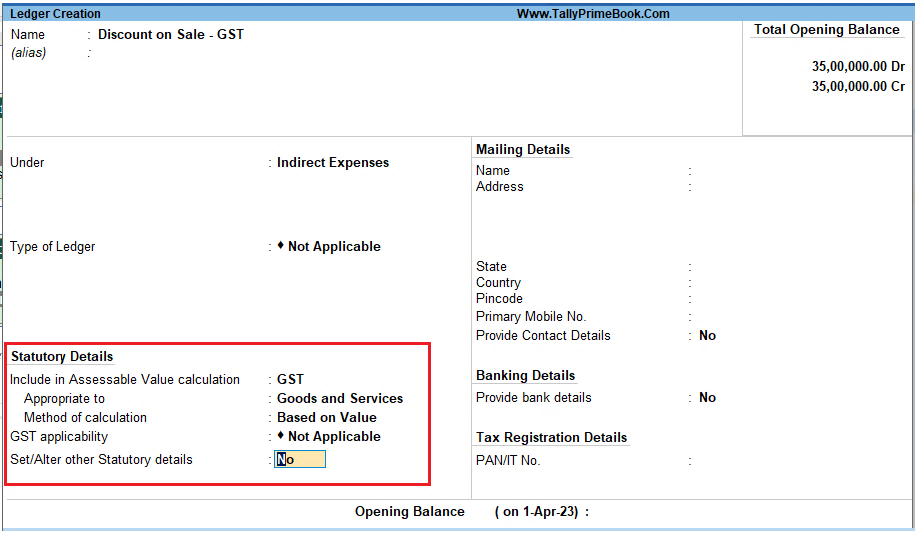

To create a ‘Discount on Sale’ / ‘Packing Charges’ & ‘Delivery Charges’ Ledger:

1. Gateway of Tally> Create > type or select Ledger and press Enter.

Alternatively, press Alt+G (Go To) > Create Master > type or select Ledger and press Enter.

2. Enter the Nameof the ledger ‘Discount on Sale’

3. Select Indirect Expensesas the group name in the Under field.

4. Set the option Inventory Values are affectedto No.

5. Select GSTin the Include in assessable value calculation for: field.

[89-Inventory Management using TallyPrime-4]

[ Automatically, the option GST Applicable will become Not Applicable by default]

6. Select Goods in the Appropriated to field.

[90-Inventory Management using TallyPrime-4]

7. Select Based on Valuein the Method of Calculation field.

[91-Inventory Management using TallyPrime-4]

[92-Inventory Management using TallyPrime-4]

8. Press Enterto accept and save the ledger.

| Note : Like ‘Discount on Sale’ ledger as created above, you can create ‘‘Packing Charges’ & ‘Delivery Charges’ Ledger |

9. Example of GST Sales Invoice having Packaging Charges, Delivery Charges and Discount on Sale as below…

[93-Inventory Management using TallyPrime-4]

| Note :

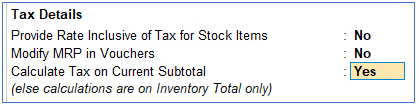

1. Remember, put the Discount on Sale Value with minus (-) symbol to deduct the amount form the invoice value. 2. All these Indirect Expenses can be given either in % or in Value. 3. Under Configure F12, Don’t forget to enable or set Yes to Calculate Tax on Current Subtotal-Yes

[94-Inventory Management using TallyPrime-4] |

GST-breakup details are :

When you Press Press ALT+A to display GST-Tax Analysis Directly [ OR Press Ctrl + O (Related Reports) and select GST – Tax Analysis from Additional Details] and Press Alt + F1 or Alt+F5 for Details…you will see the GST Analysis as below by default.

[95-Inventory Management using TallyPrime-4]

[96-Inventory Management using TallyPrime-4] Note : Packing Charges, Delivery Charges and Discount on Sale is calculated Proportionately on the basis of Value of Goods. |