Creation of Stock Items

Stock items are goods that you manufacture or trade (sell and purchase). It is the primary inventory entity. Stock Items in the Inventory transactions are similar to ledgers being used in accounting transactions.

- Gateway of Tally> Create > type or select Stock Item > and press Enter.

Alternatively, press Alt+G (Go To) > Create Master > type or select Stock Item > and press Enter.

[47-Practical Assignment-TallyPrime]

- Name & alias: As in other masters, you can specify multiple aliases for the stock item.

- Under: Select Primary or an existing Stock Group. If you have not created any Stock Group, you can create one in TallyPrime to assign to the stock item.

As always, press Alt+C, to create a master on the fly. Alternatively, press Alt+G (Go To) > Create Master > type or select Stock Items > press Enter.

- Units: Select the unit of measurement applicable for the stock item. If the unit is not listed, you can create the unit of measurement in TallyPrime to assign to the stock item.

As always, press Alt+C, to create a master on the fly. Alternatively, press Alt+G (Go To) > Create Master > type or select Units > press Enter.

- Statutory Details: Set the applicable Taxability option for the stock item under Statutory details, The option will depend on the option enabled in the F11 (Features) screen.

- Opening Balance: Specify the opening balance for the Stock Item as on the date of Beginning of Books.

Quantity: Specify the stock item Quantity.

Rate: Specify the stock item Rate.

Value: TallyPrime automatically calculates the value by multiplying the Quantity and Rate. You can also edit the value, TallyPrime automatically refreshes the Rate field accordingly.

- Accept the screen. As always, press Ctrl+Ato save.

Apply GST Rate and HSN/SAC Details in Stock Item

If your business deals with many unique stock items that have their own tax rates and HSN/SAC details, then you can directly update the details in the stock item master. After that, you only have to select the required stock items while recording transactions. The corresponding tax rates and HSN/SAC details will be picked up easily.

- Gateway of Tally> Create/Alter > Stock Item (under Inventory Master).

Alternatively, press Alt+G (Go To) > Create/Alter Master > Stock Item.

- Select the stock itemfrom the List of Stock Items, or create a new one, as needed.

- Fill in the relevant details for HSN/SAC and GST.

- HSN/SAC & Related Details: You have three options to choose from.

- Specify Details Here: Once you select this option, you will be able to enter the relevant details right here in Stock Item Creation/Alteration.

- Use GST Classification: This option allows you to select a previously created GST Classification, or create one on the spot. The details will be applied accordingly.

- Specify in Voucher: If you are not aware of the details at the moment, and if you want to add the details directly in the transaction, then you can select this option.

- GST Rate & Related Details: Like in the previous field (HSN/SAC Details), you have the same three options to choose from.

- HSN/SAC & Related Details: You have three options to choose from.

Select Specify Details Here and enter the relevant information.

[48-Practical Assignment-TallyPrime]

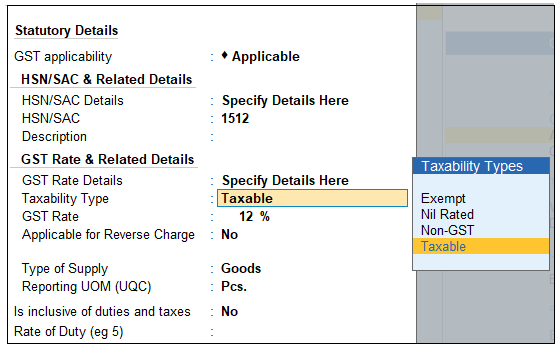

Select Taxable for goods and services that are classified as taxable type of supply under GST. Select Exempt , if the type of supply is exempted from tax under GST, or select Nil Rated , if the tax rate applicable to the type of supply is 0% under GST.

- Press Ctrl+A to save the details.

- Specify the details of Opening Balance , if any, for the Stock Item as on the date of Beginning of Books.

-

- In the Quantity Field, specify the stock item Quantity.

- In the Rate field, specify the stock item Rate.

- In the Value field, TallyPrime automatically calculates the value by multiplying the Quantity and Rate. You can also edit the value, TallyPrime automatically refreshes the Rate field accordingly.

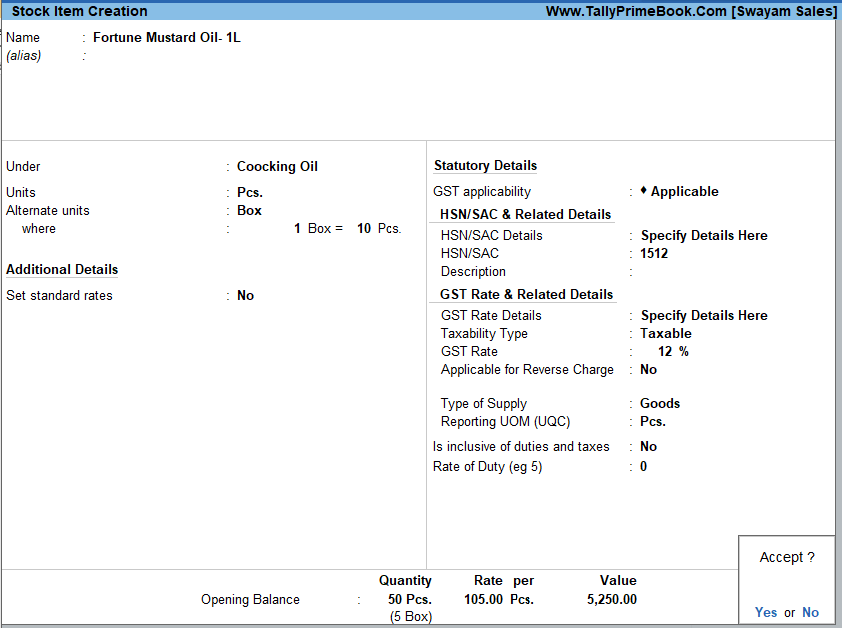

The Stock Item Creation screen appears as shown:

[49-Practical Assignment-TallyPrime]

[Practical Assignment]

Create the following Items and Goods with all Details given…like Stock Group, HSN Code, GST Rate, Opening Quantity with Rate:

| Name of Items | Unit | Alt Unit | Con. Factor | HSN | Taxability | GST Rate | Op. Qty. | Rate Per | Value |

| COOKING OIL | |||||||||

| Fortune Mustard Oil- 1L | Pcs | Box | 10 | 1512 | Taxable | 12% | 50 | 105 | 5250 |

| Saffola Gold Edible Oil Jar- 5L | Pcs | – | – | 1512 | Taxable | 12% | 3 | 500 | 1500 |

| Aadhar Refined Sunflower Oil -1L | Pcs | – | – | 1512 | Taxable | 12% | 20 | 120 | 2400 |

| Fortune Soyabean Oil -1L | Pcs | Doz | 12 | 1512 | Taxable | 12% | 24 | 110 | 2640 |

| Sundrop Rice Bran Oil -1L | Pcs | – | – | 1512 | Taxable | 12% | 15 | 125 | 1875 |

| ATTA AND RICE | |||||||||

| Fortune Besan -500g | Nos. | – | – | 1101 | Taxable | 12% | 10 | 46 | 460 |

| Fortune Chakki Atta-10kg. | Bag | – | – | 1101 | Taxable | 12% | 15 | 315 | 4725 |

| Daawat Basmati Rice- 5kg. | Bag | – | – | 1006 | Taxable | 5% | 5 | 400 | 2000 |

| India Gate Basmati Rice- 1Kg. | Pcs. | – | – | 1006 | Taxable | 5% | 20 | 75 | 1500 |

| Kohinoor Brown Basmati- 1Kg. | Pcs. | Box | 20 | 1006 | Taxable | 5% | 25 | 150 | 3750 |

| PULSES | |||||||||

| Tata Sampan Toor Dal -1Kg. | Pcs | Box | 20 | 0713 | Taxable | 5% | 50 | 130 | 6500 |

| Chana Dal -1Kg. | Pcs | – | – | 0713 | Exempt | – | 20 | 80 | 1600 |

| Moong Dal -500g.. | Pcs | – | – | 0713 | Exempt | – | 25 | 60 | 1500 |

| Black Chana- 1Kg. | Pcs | – | – | 0713 | Exempt | – | 30 | 90 | 2700 |

| Kabuli Chana- 1 Kg. | Pcs | – | – | 0713 | Exempt | – | 15 | 110 | 1650 |

| PERSONAL CARE | |||||||||

| Colgate Toothbrush – 4 Pcs Pack | Pcs | Doz | 12 | 3305 | Taxable | 12% | 60 | 95 | 5700 |

| Closeup Toothpaste- 150g. | Pcs | – | – | 3305 | Taxable | 12% | 50 | 70 | 3500 |

| Pepsodent 2 in 1 Toothpaste -100g. | Pcs | – | – | 3305 | Taxable | 12% | 30 | 60 | 1800 |

| Listerine Mouthwash -500ml | Pcs | – | – | 3305 | Taxable | 12% | 40 | 220 | 8800 |

| Whisper Clean and Fresh -20N | Pcs | – | – | 3305 | Taxable | 12% | 10 | 100 | 1000 |

| BODY CARE | |||||||||

| Shampoo With Tea Oil –100ML | Pcs | – | – | 3304 | Taxable | 18% | 20 | 110 | 2200 |

| Perfumed Deo Spray-150ML | Pcs | – | – | 3304 | Taxable | 18% | 15 | 160 | 2400 |

| Hair Oil With Conditioner -100 ML | Pcs | – | – | 3304 | Taxable | 18% | 25 | 90 | 2250 |

| Perfumed Body Talc- Dreams – 100 G | Pcs | – | – | 3304 | Taxable | 18% | 20 | 60 | 1200 |

| Face Wash Oil Clear For Men -50 g. | Pcs | – | – | 3304 | Taxable | 18% | 10 | 110 | 1100 |