In month of April 2023, Swayam Sales Purchase the following items and goods from different Suppliers both within State as well as Outside State with all GST Compliance.

Purchase Voucher (F9)

When a company buys goods on credit or cash, Purchase voucher is used to record all the Purchase transactions of the company.

Once you activate GST in your company, you can record the purchase of goods and services (inward supply) that attract GST using a purchase voucher.

- Go to Gateway of Tally > Vouchers > Press F9 (Purchase)

Alternatively, Press Alt+G (Go To) > Create Voucher > Press F9 (Purchase)

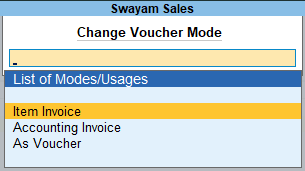

Change Voucher Mode :

Press Ctrl+H (Change Mode) to select the required voucher mode (Item Invoice / /Accounting Invoice/ As Voucher).

[56-Practical Assignment-TallyPrime]

Account Invoice/As Voucher: You will be directly selecting/debiting the Ledger account in case you are passing an Account Invoice. This is useful especially when a Service Bill is entered and does not include Inventory.

Item Invoice: You will be first selecting the Inventory and then allocating the same to the relevant Ledger account. This is useful to record all the Inventory movements in books of account.

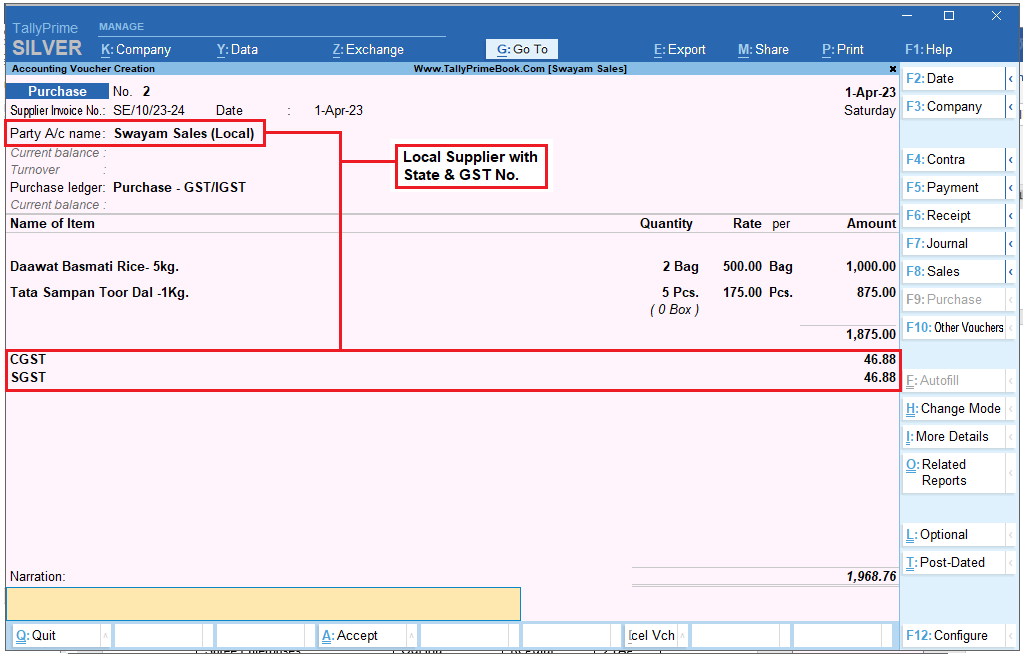

(A) Local Purchase (within State)

The purchase of goods or services from a supplier in the same state attracts central tax (CGST) and state tax (SGST).

To record a Local Purchase Transaction:

- Open the purchase voucher screen.

-

- Gateway of Tally > Vouchers > press F9 (Purchase).

Alternatively, press Alt+G (Go To) > Create Voucher > press F9 (Purchase). - Press Ctrl+H (Change Mode) to select the required voucher mode (Item Invoice, in this case).

- Gateway of Tally > Vouchers > press F9 (Purchase).

| Example:

Purchase from Swayam Sales (Local) the following items with GST Daawat Basmati Rice-5Kg. – 2 Bag @ Rs.500 per Bag. Tata Sampan Toor Dal -1Kg. – 5 Pcs. @ Rs.175 per Pcs. |

[57-Practical Assignment-TallyPrime]

Supplier invoice no.: Displays the sales invoice no. of the supplying party.

Date: Displays the date on which the sales invoice was passed by the supplier.

- In Party A/c name, select the supplier’s ledger or the cash ledger having Local State with GST No.

- Select the purchase ledger applicable for local taxable purchases.

- Select the required items, and specify the quantities and rates.

- Select the central and state tax ledgers which will be auto calculated on the basis of GST Rate given in Item-wise.

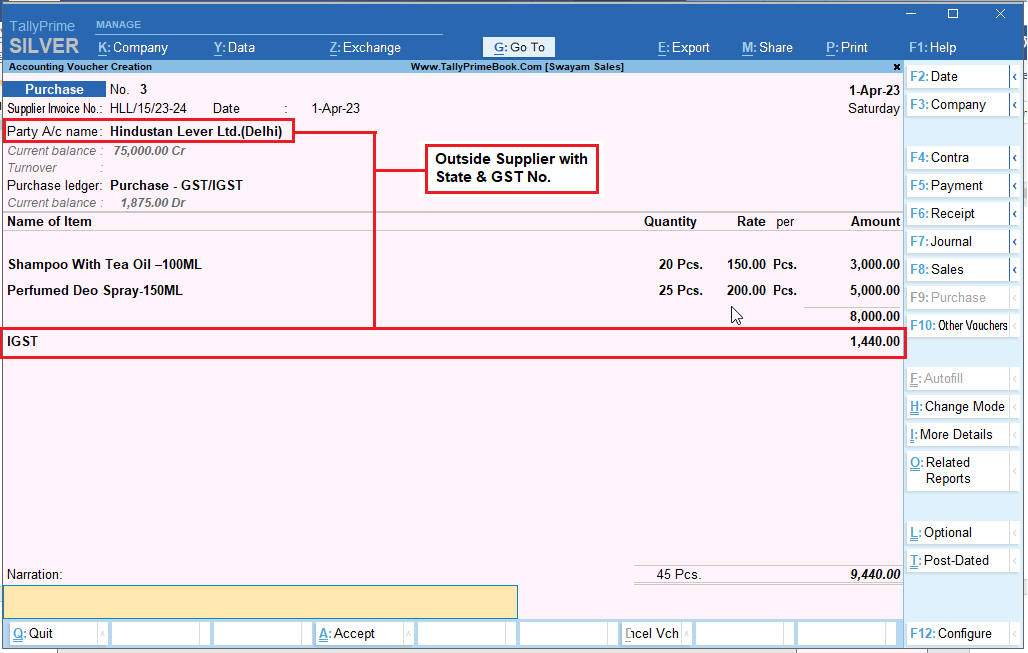

(B) Interstate Purchase (outside State)

The purchase of goods or services from a supplier from another state attracts integrated tax (i.e. IGST.

To record an interstate purchase:

- Follow the steps used for recording a local purchase transaction as above, with the following changes:

- Select the purchase ledger ( you can use one ledger for both local and Interstate Purchase or you create separate Ledger ).

- Select the integrated tax ledger i.e. IGST which will be auto calculated on the basis of GST Rate given Item-wise and also based on Outside State Party Ledger with GST No .

| Example:

Purchase from Hindustan Lever Ltd.(Delhi) the following items with IGST Shampoo With Tea Oil –100ML – 20 Pcs @ Rs.150 per Bag. Perfumed Deo Spray-150ML – 25 Pcs. @ Rs.200 per Pcs. |

[58-Practical Assignment-TallyPrime]

Depending on the location of the supplier i.e. State in address section, you can record a Local or Interstate Purchase transaction with the applicable GST rates.

(C) Purchase Voucher with some Additional Charges/ Discount etc.

Some Purchase Voucher includes some Additional Charges like…Delivery Charges, Insurance Charges, Installation Charges, Rounded Off, Discount on Purchase etc.. etc..

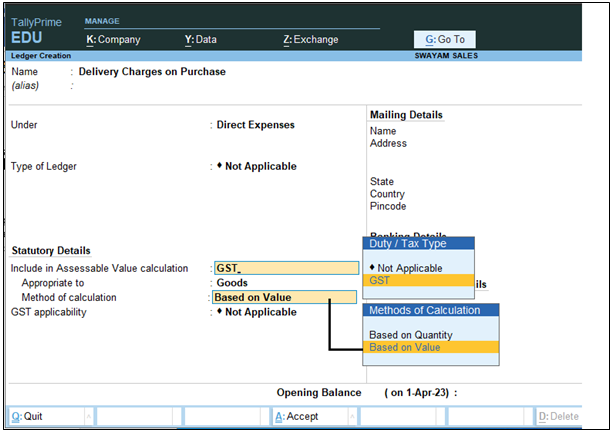

>> Creation of Additional Charges Ledger included before GST in Purchase Bill

The main situation is that whether all those additional charges are charged before GST or after GST. If those Expenses charged before GST, then all those Expenses should be created under Purchase Group without affecting Inventory value, GST Not Applicable, but it must be include in assessable value calculation for GST with Appropriation to Goods & Method of valuation should be Based on Value.. as given below screen :

[59-Practical Assignment-TallyPrime]

>> Creation of Additional Charges Ledger included after GST in Purchase Bill

Ledger creation will be as below ( with Not applicable in all cases and should be under Purchase Account Group)

Ledger Creation: ‘Insurance on Purchase’ & ‘Discount on Purchase’

[60-Practical Assignment-TallyPrime]

Ledger Creation : ‘Rounded Off (+/-)’

Already discussed earlier :

>> Purchase Bill Voucher with Additional Charges / Discount both before and after GST

Here we have one sample of Purchase Bill with Additional Charges or Discount on Purchase both Before and After GST :

| Example:

Purchase the following Items from Swayam Sales (Local) with Delivery Charges of Rs.500 charged before GST and Insurance Charges on Purchase of Rs.150 charged and with a Discount on Purchase @2% received after charging GST . 1. Daawat Basmati Rice-5Kg. – 20 Bag @ Rs.500 per Bag. 2. Tata Sampan Toor Dal -1Kg. – 50 Pcs. @ Rs.175 per Pcs. |

[61-Practical Assignment-TallyPrime]

GST Details :

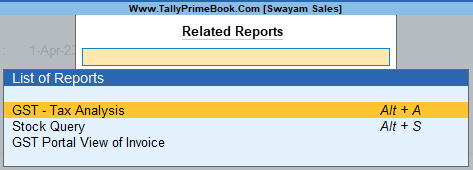

When you Press Alt + A or Ctrl+O (Related Report) and select GST – Tax Analysis from Additional Details and Press Alt+F1 or Alt+F5 for details …you will see the GST Analysis as below by default.

[62-Practical Assignment-TallyPrime]

[63-Practical Assignment-TallyPrime]

[Practical Assignment]

Please record all the following Purchase Transactions with CGST / SGST & IGST.

Sl. No. Date Transactions

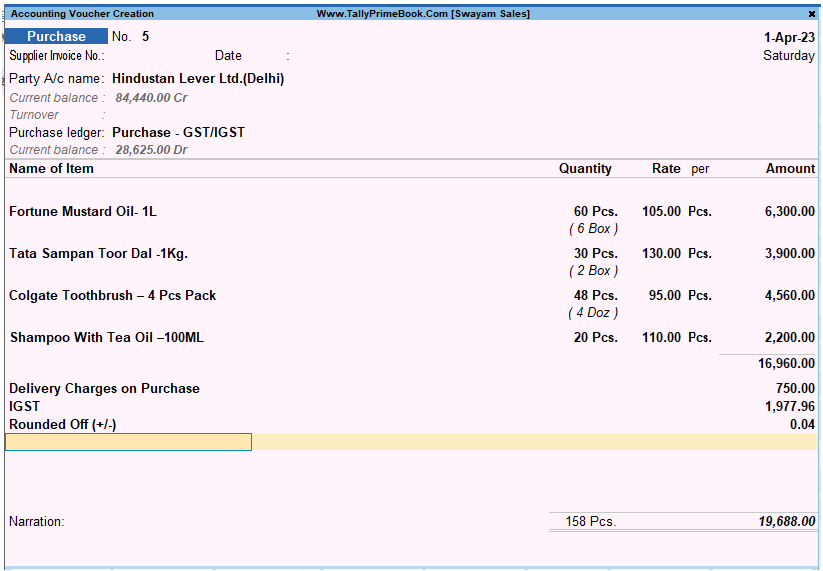

- 1/4/2023 Purchase the following Items from Hindustan Lever Ltd. (Delhi) with Delivery Charges on Purchase of Rs.750 before IGST .

| Fortune Mustard Oil- 1L | 60 | Pcs | 105 |

| Tata Sampan Toor Dal -1Kg. | 30 | Pcs | 130 |

| Colgate Toothbrush – 4 Pcs Pack | 48 | Pcs | 95 |

| Shampoo With Tea Oil –100ML | 20 | Pcs | 110 |

[Bill Value – Rs.19,688 with Rounded off: (+) Rs.0.04]

[64-Practical Assignment-TallyPrime]

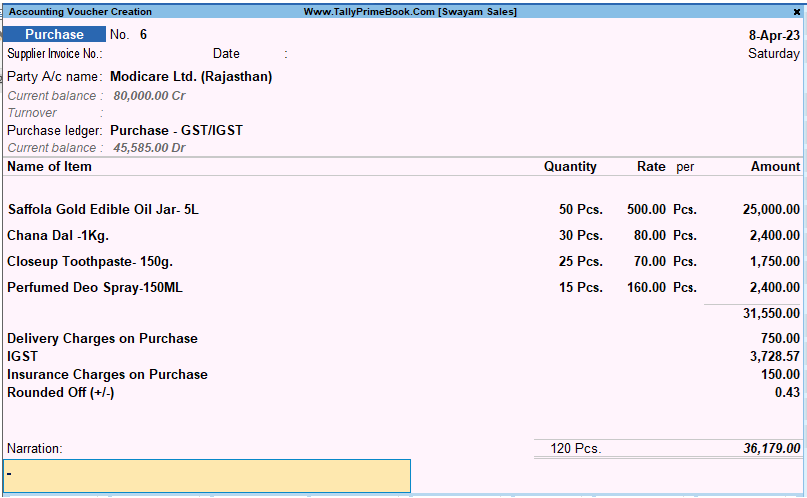

- 8/4/2023 Purchase the following Items from Modicare Ltd. (Rajasthan) with Delivery Charges on Purchase of Rs.750 before GST and Insurance Charges on Purchase of Rs.150 after GST.\

| Saffola Gold Edible Oil Jar- 5L | 50 | Pcs | 500 |

| Chana Dal -1Kg. | 30 | Pcs | 80 |

| Closeup Toothpaste- 150g. | 25 | Pcs | 70 |

| Perfumed Deo Spray-150ML | 15 | Pcs | 160 |

[Bill Value – Rs.36,179 with Rounded off: (+) Rs.0.43]

[65-Practical Assignment-TallyPrime]

- 15/4/2023 Purchase the following Items from ITC Ltd. ( Maharashtra) with Discount on Purchase Rs.200 after GST

| Aadhar Refined Sunflower Oil -1L | 30 | Pcs | 120 |

| Daawat Basmati Rice- 5kg. | 10 | Bag | 400 |

| Moong Dal -500g.. | 20 | Pcs | 60 |

| Pepsodent 2 in 1 Toothpaste -100g. | 35 | Pcs | 60 |

| Hair Oil With Conditioner -100 ML | 40 | Pcs | 90 |

[Bill Value – Rs.15,832 ]

[66-Practical Assignment-TallyPrime]

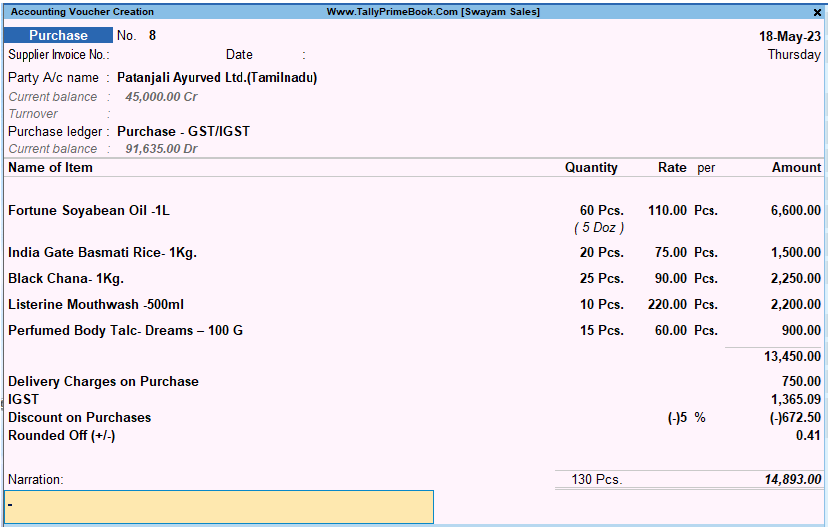

- 18/4/2023 Purchase the following Items from Patanjali Ayurved Ltd. ( Tamilnadu) with Delivery Charges on Purchase of Rs.750 before GST and Discount on Purchase @5% after GST

| Fortune Soyabean Oil -1L | 60 | Pcs | 110 |

| India Gate Basmati Rice- 1Kg. | 20 | Pcs | 75 |

| Black Chana- 1Kg. | 25 | Pcs | 90 |

| Listerine Mouthwash -500ml | 10 | Pcs | 220 |

| Perfumed Body Talc- Dreams – 100 G | 15 | Pcs | 60 |

[Bill Value – Rs.14,893 with Rounded off: (+) Rs.0.41]

[67-Practical Assignment-TallyPrime]

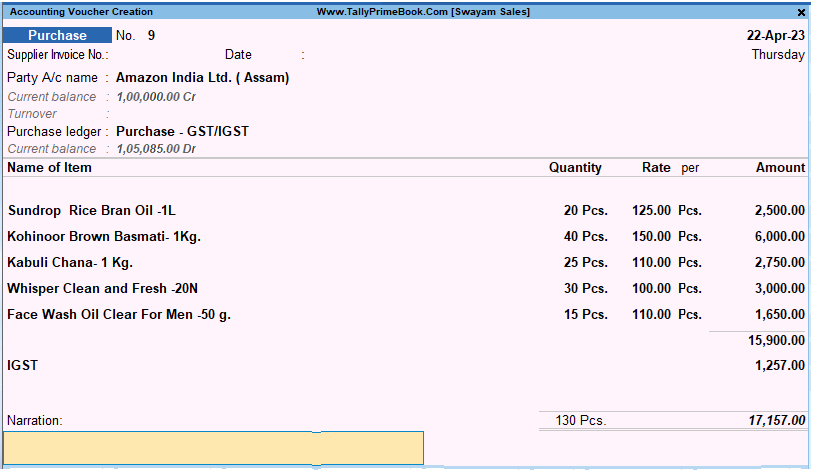

- 22/4/2023 Purchase the following Items from Amazon India Ltd. ( Assam)

| Sundrop Rice Bran Oil -1L | 20 | Pcs | 125 |

| Kohinoor Brown Basmati- 1Kg. | 40 | Pcs | 150 |

| Kabuli Chana- 1 Kg. | 25 | Pcs | 110 |

| Whisper Clean and Fresh -20N | 30 | Pcs | 100 |

| Face Wash Oil Clear For Men -50 g. | 15 | Pcs | 110 |

[Bill Value – Rs.17,157 ]

[68-Practical Assignment-TallyPrime]

- 25/4/2023 Purchase the following Items from Swayam Sales (Local) with Discount on Purchase @7% after GST

| Fortune Besan -500g | 100 | Pcs | 48 |

| Pepsodent 2 in 1 Toothpaste -100g. | 35 | Pcs | 60 |

| Listerine Mouthwash -500ml | 10 | Pcs | 220 |

| India Gate Basmati Rice- 1Kg. | 5 | Pcs | 75 |

[Bill Value – Rs.9,923 with Rounded off: (+) Rs.0.49]

[69-Practical Assignment-TallyPrime]

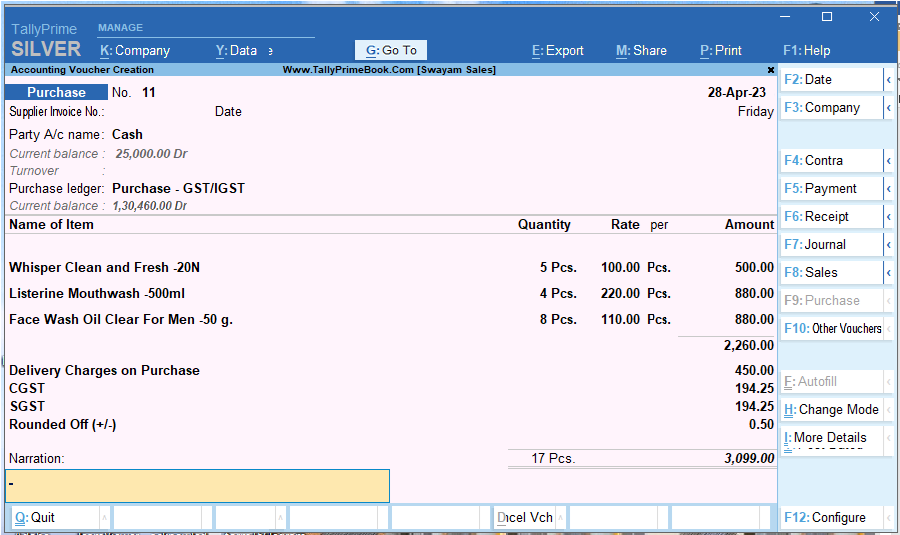

- 28/4/2023 Purchase the following Items with Cash from a Registered Firm within State with Delivery Charges on Purchase of Rs.450 before GST.

| Whisper Clean and Fresh -20N | 5 | Pcs | 100 |

| Listerine Mouthwash -500ml | 4 | Pcs | 220 |

| Face Wash Oil Clear For Men -50 g. | 8 | Pcs | 110 |

[Bill Value – Rs.3,099 with Rounded off: (+) Rs.0.50]

[70-Practical Assignment-TallyPrime]

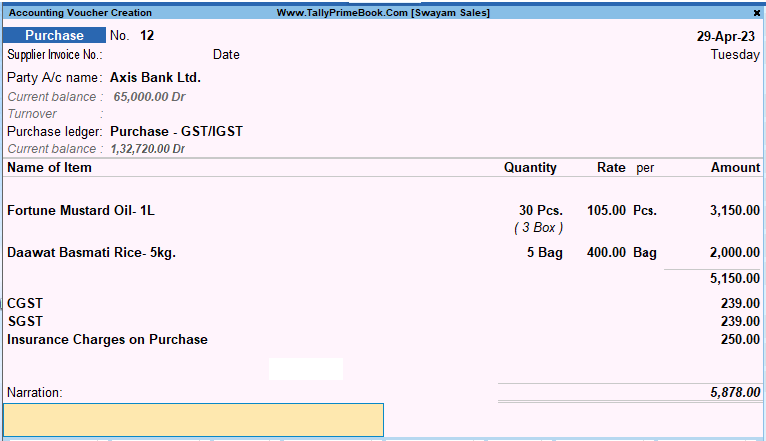

- 29/4/2023 Purchase the following Items with by Cheque of Axis Bank Ltd. (Registered) within State with Insurance Charges on Purchase of Rs.250 after GST.

| Fortune Mustard Oil- 1L | 30 | Pcs | 105 |

| Daawat Basmati Rice- 5kg. | 5 | Bag | 400 |

[Bill Value – Rs.5,878 ]

[71-Practical Assignment-TallyPrime]