Record Expenses with GST in Purchase Voucher (F9)

A business may incur day-to-day expenses such as rent, telephone bills, Internet Bill, stationery, petty-cash expenses, and so on, to carry out the operations. These expenses attract GST.

If you are a registered dealer and purchasing from another registered dealer, and paid GST at the time of payment or purchase, you are eligible to claim the Input Tax Credit. Ensure to enable the expense ledger with GST.

You can record an expense using a purchase voucher. This will auto-calculate the GST amounts.

Setup:

You have to create the Expenses Ledger with GST Applicable and with all GST Details like Nature of Transactions, Taxability, GST Rate etc. etc.

Say, for example, create a Expenses Ledger ‘Printing and Stationary’ which attracts GST 5% as below:

- Gateway of Tally > Create > type or select Ledger and press Enter.

Alternatively, press Alt+G (Go To) > Create Master > type or select Ledger and press Enter.

- Select direct or indirect expenses in the Underfield.

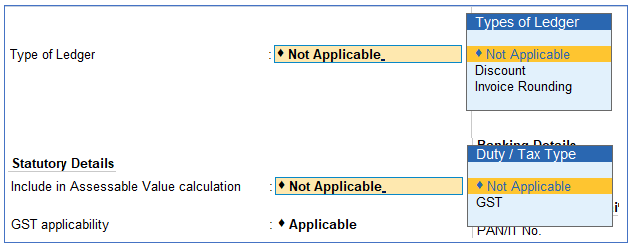

- Select the Type of Ledgeras Not Applicable and Include in Assessable Value Calculation as Not Applicable.

[72-Practical Assignment-TallyPrime]

- Set GST applicabilityas Applicable and enter the GST details.

[73-Practical Assignment-TallyPrime]

- Select the Type of supplyas:

Services, if the ledger is used to record sale of service. By default, the type of supply is set to Services.

Goods, if the ledger is used to record sale of goods.

[74-Practical Assignment-TallyPrime]

[75-Practical Assignment-TallyPrime]

- Accept the screen. As always, you can press Ctrl+Ato save the ledger.

[Practical Assignment]

(A). Create or Alter the following Expenses & Incomes with GST Compliance … as per above.

| Expenses with GST Compliance: (under Indirect Expenses) | GST Rate | HSN Code |

| Printing & Stationery (12%) | 12% | 4820 |

| Travelling Expense (18%) | 18% | 9985 |

| Telephone Charges (5%) | 5% | 8504 |

| Electricity Bills (5%) | 5% | 2716 |

| Legal Expenses (18%) | 18% | 9982 |

| Professional Fees (18%) | 18% | 9982 |

| Advertisement Expenses (12%) | 12% | 9983 |

| Purchase Account: | ||

| Claims / Refunds Received (18%) | 18% | 1988 |

| Scheme Incentive (18%) | 18% | 9997 |

(B). Record the following Expenses with GST in Purchase Voucher (F9) under Accounting Invoice:

Record the following Expenses with the help of Purchase Voucher in Accounting Invoice (CTRL+H) mode from the Registered Business either in Cash/Bank or Credit:

[76-Practical Assignment-TallyPrime]

- 5/4/2023 Purchase Printing & Stationary from Shree Enterprises of Rs.500 on Credit

[77-Practical Assignment-TallyPrime]

- 10/4/2023 Paid the following Expenses with GST in cash from Registered Business.

| Travelling Expense (18%) | Rs. 1500 |

| Advertisement Expenses (12%) | Rs. 1000 |

[78-Practical Assignment-TallyPrime]

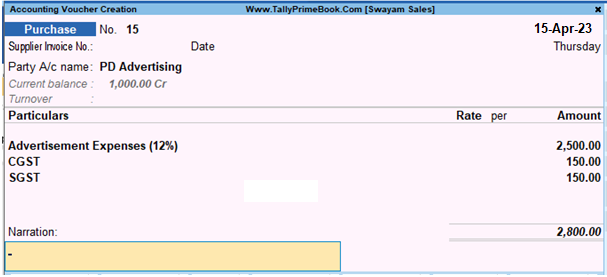

- 15/4/2023 Received a Bill of Advertisement Expenses (18%) of Rs.2500 from PD Advertising.

[79-Practical Assignment-TallyPrime]

- 20/4/2023 Received a Bill from N. Jatania towards following Expenses

| Legal Expenses (GST 12%) | Rs.10,000 |

| Professional Fees ( GST 5%) | Rs. 20,000 |

[80-Practical Assignment-TallyPrime]

- 28/4/2023 Paid Telephone Charges (5%) of Rs. 2200 to BSNL by cheque of ICICI Bank (Registered).

[81-Practical Assignment-TallyPrime]