Journal Vouchers (F7):

It is for adjustment between any two ledgers. No outside parties, like Debtors, Creditors, Branches / Divisions are involved. These are for rectification entries in which as any kind of adjustment for non-cash or bank transactions are recorded here.

Gateway of Tally à Voucher à Click on F7 : Journal

Alternatively, press Alt+G (Go To) > Create Voucher > F7 (Journal)

Transactions: Depreciation charge on Furniture of ₹. 5,000/- & Machinery of ₹. 20,000/- respectively.

[124-Practical Assignment-TallyPrime]

Under Journal Voucher (F7), Double Entry mode is applicable, means one Account will Debited and the corresponding Account will be Credited. So the basic knowledge of Debit & Credit is require. In other words, all Adjustment transactions (No Cash/ No Bank / No Sale / No Purchase) are entered with the help of Journal Voucher.

Note : (Rules of DEBIT & CREDIT ) :

DEBIT CREDIT

- What Comes In What Goes Out [Real A/c]

- The Receiver The Giver [Personal A/c]

- All Expenses / Losses All Incomes [Gains [ Nominal A/c]

[Practical Assignment]

Record the following Journal Voucher with date wise…

JOURNAL VOUCHER TRANSACTION [F7]

Sl. No. Date Transactions

- 2/4/2023 Following Expenses are Adjusted with their Deposit

| Dr. | Telephone / Telex / Fax Charges | 2,000 | |

| Dr. | Rent Paid | 5,000 | |

| Dr. | Electricity Bills | 3,000 | |

| Cr. | Deposit with Telephone Co. | 2,000 | |

| Cr. | Deposit for Rent | 5,000 | |

| Cr. | Deposit with Electric Supply Co. | 3,000 |

[125-Practical Assignment-TallyPrime]

- 10/4/2023 Depreciation is provided of the following Fixed Assets

| Dr. | Depreciation | 12,300 | |

| Cr. | Office Premises | 8,000 | |

| Cr. | Furniture and Fixtures | 1,000 | |

| Cr. | Office Equipment | 1,500 | |

| Cr. | Computers | 500 | |

| Cr. | Fax Machines | 200 | |

| Cr. | Vehicle | 800 | |

| Cr. | Air Conditioners | 300 |

[126-Practical Assignment-TallyPrime]

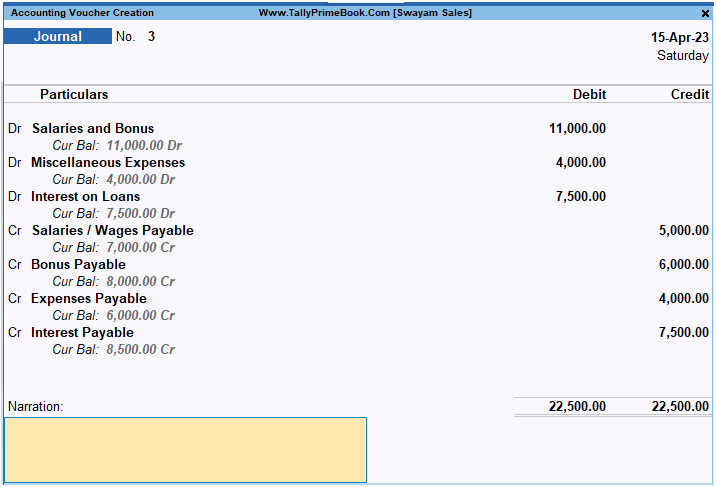

- 15/4/2023 Following Expenses are Due for the month of April 2023

| Dr. | Salaries and Bonus | 11,000 | |

| Dr. | Miscellaneous Expenses | 4,000 | |

| Dr. | Interest on Loans | 7,500 | |

| Cr. | Salaries / Wages Payable | 5,000 | |

| Cr. | Bonus Payable | 6,000 | |

| Cr. | Expenses Payable | 4,000 | |

| Cr. | Interest Payable | 7,500 |

[127-Practical Assignment-TallyPrime]

- 30/4/2023 GST for the Month of April 2023 is Adjusted

Dr. CGST 1680.03

Dr. SGST 1680.03

Cr. IGST 3360.06

[128-Practical Assignment-TallyPrime]

PROFIT & LOSS A/C REPORT OF SWAYAM SALES [www.TallyPrimeBook.Com] FOR THE MONTH OF APRIL 2023.

[129-Practical Assignment-TallyPrime]

‘BALANCE SHEET’ REPORT OF SWAYAM SALES [www.TallyPrimeBook.Com] FOR THE MONTH OF APRIL 2023.

[130-Practical Assignment-TallyPrime]

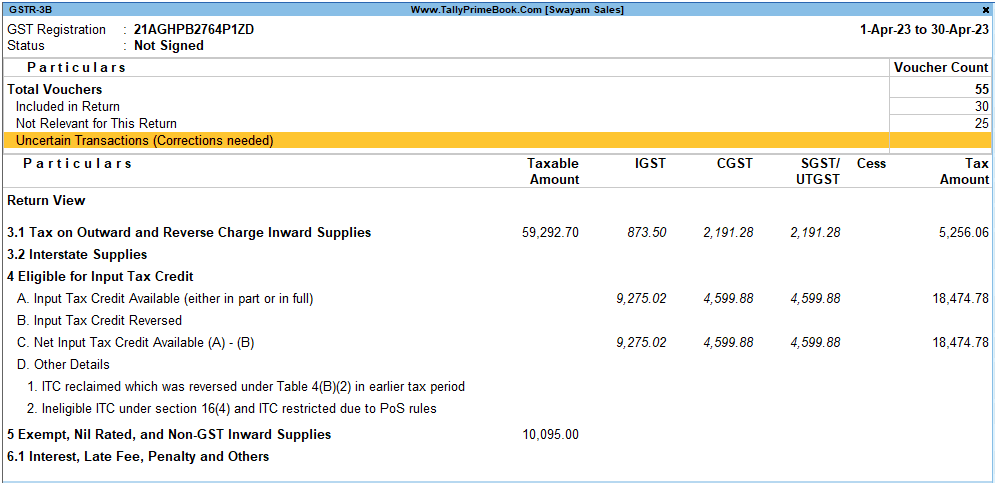

GSTR-3B REPORT OF SWAYAM SALES [www.TallyPrimeBook.Com] FOR THE MONTH OF APRIL 2023.

[131-Practical Assignment-TallyPrime]