In some business scenarios, you might need to change the taxable value of items or services in your voucher. For example, when you want to calculate GST less than the item value, or when you want to increase the assessable value more than the item cost you will have to change the assessable value. TallyPrime takes care of it by providing you with an option to Override Taxable Value while passing a GST purchase voucher.

Configure or Change the following Steps :

Step-1.

While recording a purchase voucher in Item Invoice mode,

Press F12 (Configure) > set Modify GST & HSN/SAC related details to Yes.

[15-1-Change in the Assessable (Taxable) Value of Purchase Under GST in TallyPrime-3]

Step-2.

Provide the stock item details and press Enter in the Amount field.

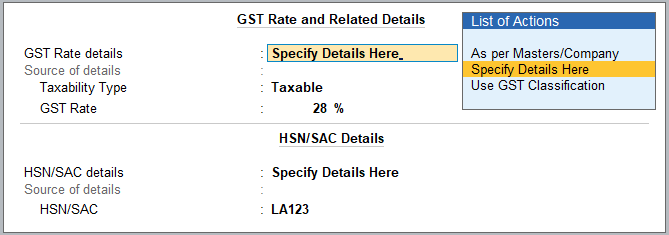

The GST Rate and Related Details screen appears.

[15-2-Change in the Assessable (Taxable) Value of Purchase Under GST in TallyPrime-3]

Step-3.

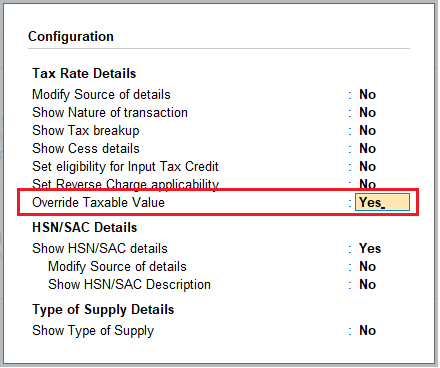

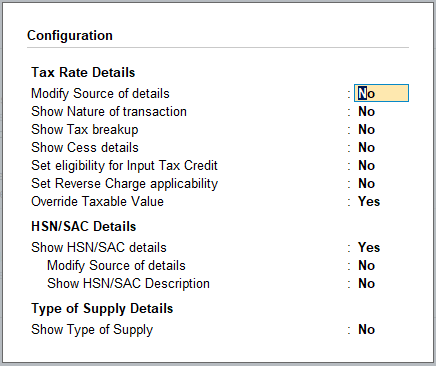

Provide the required details to override the taxable value.

- In the GST Rate and Related Details screen,

press F12 (Configure) > set Override Taxable Value to Yes.

[15-3-Change in the Assessable (Taxable) Value of Purchase Under GST in TallyPrime-3]

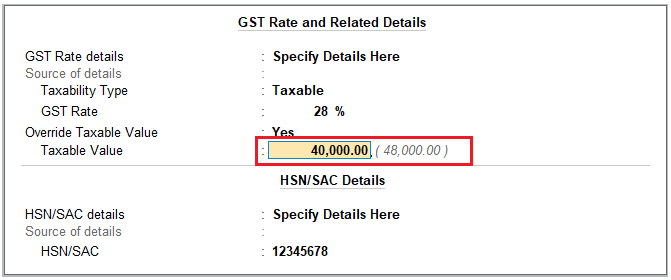

- Set Override Taxable Value to Yes.

- Enter the Taxable Value and press Ctrl+A to save.

[15-4-Change in the Assessable (Taxable) Value of Purchase Under GST in TallyPrime-3]

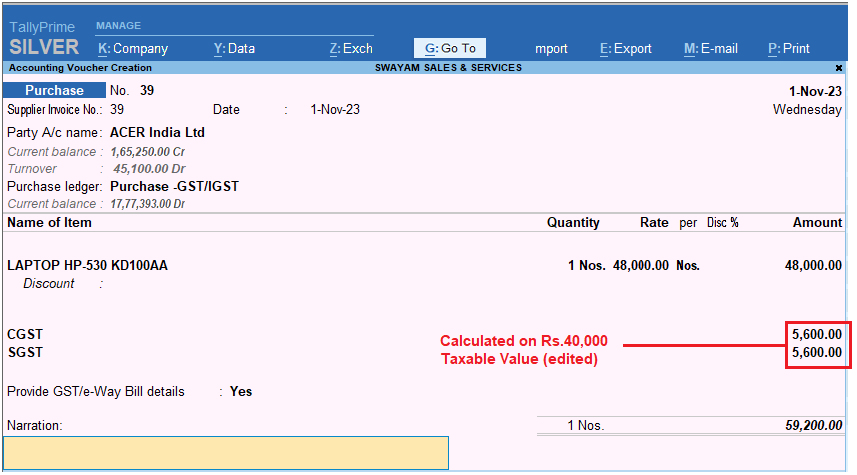

In the given above steps…One Laptop HP-530 KD100AA is purchased from ACER India Ltd. Of value of Rs.48,000 with GST @18%. But in this case we have changed the Assessable (Taxable) Value to Rs.40,000. So the GST will be calculated on Rs.40,000 as CGST @ Rs.5,600 and SGST @ Rs.5600 as per given Purchase voucher….

[15-5-Change in the Assessable (Taxable) Value of Purchase Under GST in TallyPrime-3]

Step-4

Select the required tax ledgers and provide other necessary details.

Step-5

As always, press Ctrl+A to save the voucher.

[15-6-Change in the Assessable (Taxable) Value of Purchase Under GST in TallyPrime-3]

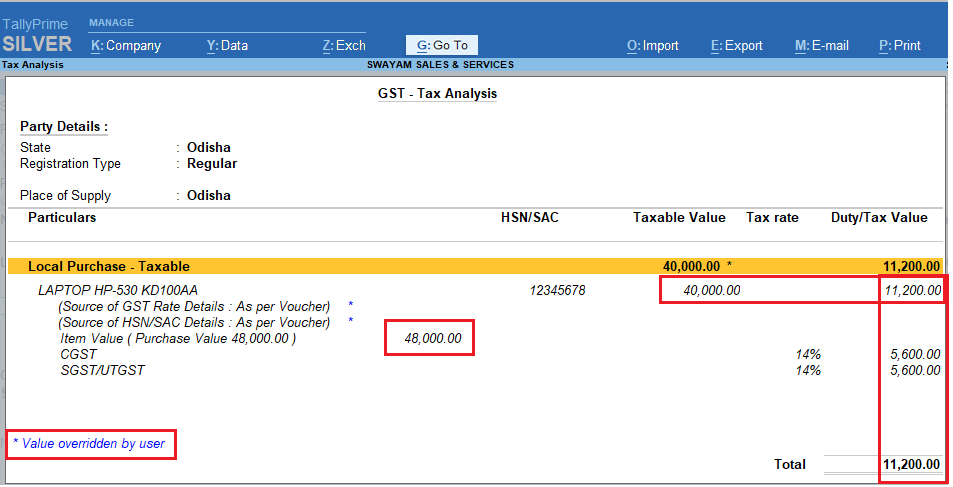

Press ALT+A and then Alt+F5 for Details to see the Tax Analysis Report as given below :

After changing the assessable value GST rate will be applied to that value to calculate the GST amount.

Similar to updating the accessable value, you can update other required details. On the GST Rate and Related Details screen press F12 (Configure) to see the list of Configuration that can be modified.

[15-7-Change in the Assessable (Taxable) Value of Purchase Under GST in TallyPrime-3]