You can select the income or expenses account group to create ledgers.

To create an Expense Ledger:

1. Gateway of Tally > Create > type or select Ledger and press Enter.

Alternatively, press Alt+G (Go To) > Create Master > type or select Ledger and press Enter.

2. Enter the name of the ledger in the Name field.

3. Select Indirect Expenses from the List of Groups in the Under field.

Note: Select Indirect Income from the List of Groups if you want to create an income ledger.

4. Set the option Inventory values are affected? to No . (Default is No)

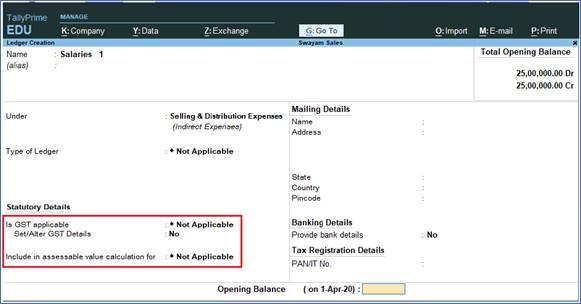

The expense Ledger Creation screen appears as shown below:

63

5. Regarding Statutory Information, GST should be Not Applicable , as well as the Option ‘Include in assessable value calculation for’ should be Not Applicable as white marked above.

6. Press Ctrl+A to accept.

You can also enable cost centre options in expenses or income ledger.

To enable Cost Centres in the Ledger Creation screen

1. Go to Gateway of Tally > F11: Features

2. Set the option Cost/Profit Centres Management to Yes.

3. Set the option Cost centres are applicable? to Yes in the Ledger Creation screen, if any of the transactions have to be allocated to a particular cost centre.

[Practical Assignment-6]

Create the following Incomes and Expenses Ledgers as per given Groups… (without Opening Bal. & Cost Center)

[Assignment-6]