If many items you sell have the same tax rate, specify the tax rate and other GST details in your sales ledger.

If you sell items with multiple tax rates, you can still maintain a single Sales Ledger for both within and outside State Sales, and record all GST details at the stock item or stock group level.

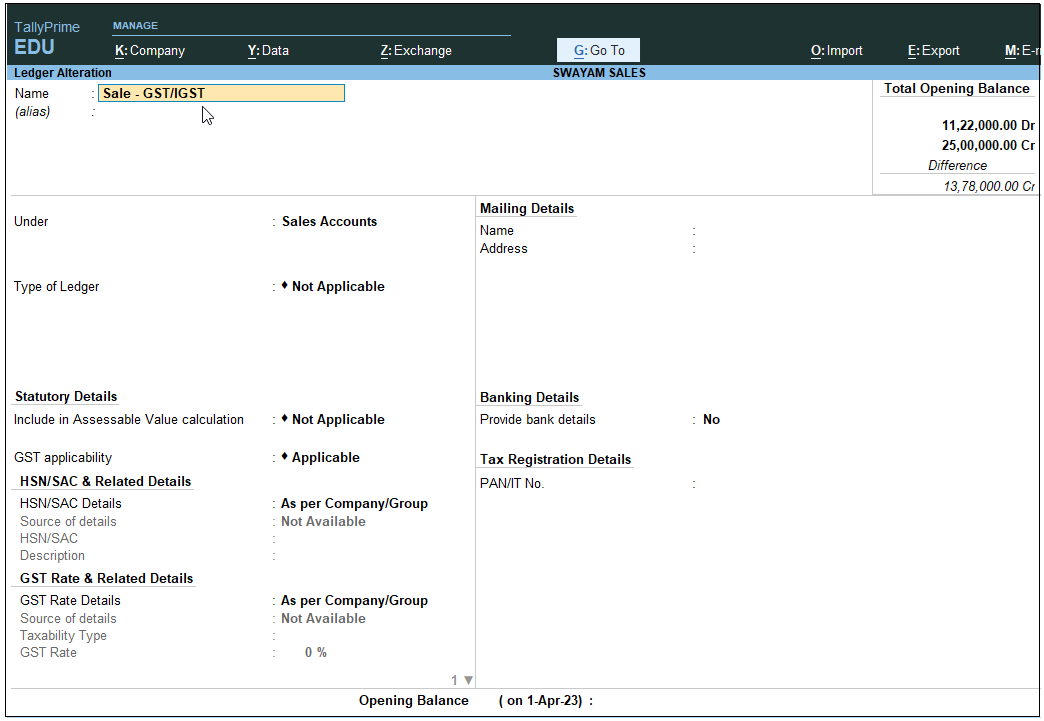

A. Creating a Sales Ledger: Sales-GST/IGST (both for Local & Outside State)

To Create a Sales Ledger i.e. GST-Sales

- Gateway of Tally > Create > type or select Ledger and press Enter.

Alternatively, press Alt+G (Go To) > Create Master > type or select Ledger and press Enter.

[10-Sales Process in TallyPrime-3 & Higher]

- Enter the Name of the Sales ledger i.e. Sale – GST/IGST (You can also Name – Sale A/c)

- Select Sales Account from the List of Groups in the Under field.

- Types of Ledger – Not Applicable.

- Include in Assessable Value calculation (under Statutory Details) – Not Applicable

- GST applicability – Applicable

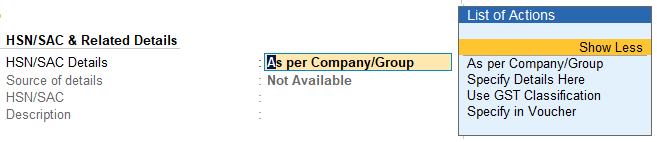

- HSN/SAC & Related Details: Select As per Company/Group

You have three options to choose from.

[11-Sales Process in TallyPrime-3 & Higher]

Specify Details Here: Once you select this option, you will be able to enter the details right here in Company GST Details.

Use GST Classification: This option allows you to select a previously created GST Classification, or create one on the spot. The details will be applied accordingly.

Specify in Voucher: If you are not aware of the details at the moment, and if you want to add the details directly in the transaction, then you can select this option.

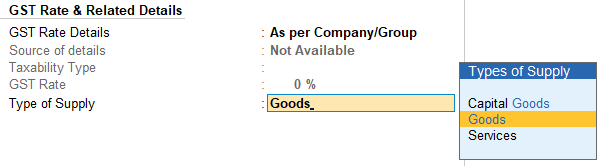

- GST Rate Details: Select As per Company/Group

Like in the previous field (HSN/SAC Details), you have the same three options to choose from.

Don’t specify the details in the GST Details because GST Rate specified in all Items will automatically Calculate the CGST and SGST as well as IGST,.

9. Select the Type of supply. By default the type of supply is set to Goods.

[12-Sales Process in TallyPrime-3 & Higher]

10. Press Ctrl + A to save.

[ Note : Only one Ledger i.e. Sale-GST/IGST will be created for all type of GST Sales ]