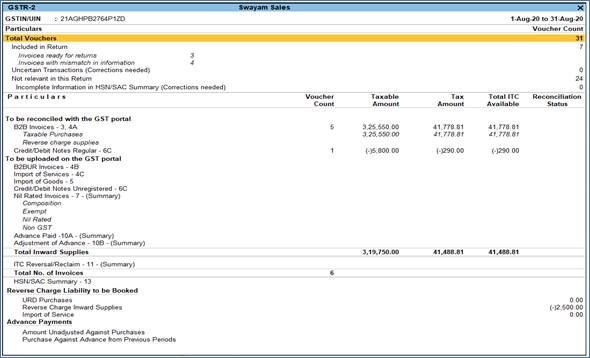

GSTR-2 report includes the details of all inward supplies (Purchase) made in the given period.

The inward supply (Purchase) details include B2B invoices to registered and unregistered dealers, import of goods and services, adjustments to purchases in debit/credit notes, nil rated invoices, advances paid and adjusted, and tax credit reversed or re-claimed.

| Note: GST council has deferred filing of GSTR-2 until further orders. Accordingly, the uploading, saving, and submitting of GSTR-2 are suspended on the GST portal. When GSTR-2 is reintroduced you can generate the returns from TallyPrime. |

Gateway of Tally > Display More Reports > Statutory Reports > GST Reports > GSTR-2.

Alternatively, press Alt+G (Go To) > type or select GSTR–2 > and press Enter.

211

Press F2 (Period) to change the report period.

Press Alt+F5 (Detailed) to view the breakup of:

- Taxable purchases and purchases under reverse charge for B2B invoices.

- Composition, exempt, nil rated and non GST supplies under Nil Rated Invoices.

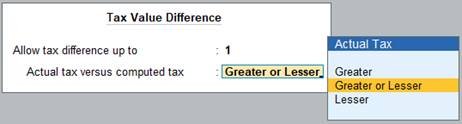

Ctrl+B (Basis of Values):

You can configure the values in your report for that instance, based on different business needs.

212

In GSTR-2 Report, you can allow tax difference. Press Ctrl+B (Basis of Values) > set Allow Tax Value Difference upto as Yes. Press Esc to view the default values.

Similarly, set Actual tax versus computed tax: Based on the tax difference value allowed, you can include the relevant vouchers.

- Greater: Vouchers with actual (transaction) value greater than the computed value are included in the returns.

- Greater or lesser: Vouchers with actual (transaction) value greater or lesser than the computed value are included in the returns.

- Lesser: Vouchers with actual (transaction) value lesser than the computed value are included in the returns.

213

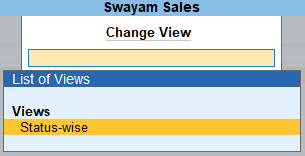

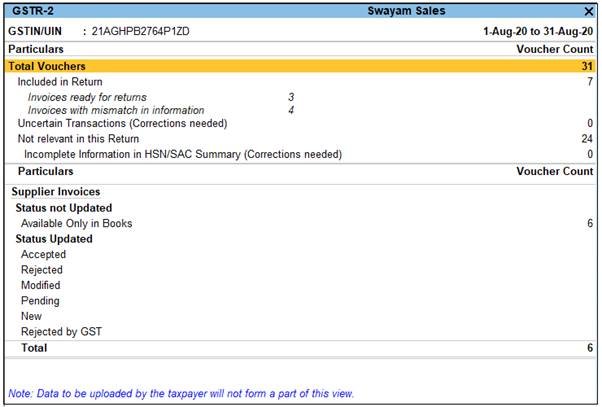

Ctrl+H (Change View):

You can display the details of a report in different views with additional details or for a specific period. You can also view other reports related to the current report.

To view the Status Wise report for GSTR-2,

Press Ctrl+H (Change View) > type or select Status-wise Report > press Enter.

214

215

Press Esc to view the default report.

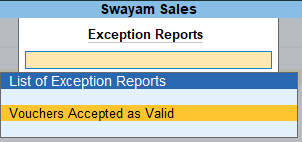

Ctrl+J (Exception Reports):

You can view the exceptions related to the data displayed in the current report by pressing Ctrl+J (Exception Reports), without closing the report.

216

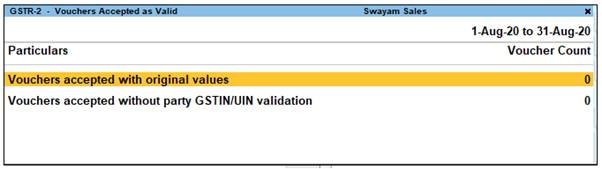

To view the Voucher Accepted as Valid for GSTR-2 report, press Ctrl+J (Exception Reports) > Voucher Accepted as Valid> and press Enter.

217

Press Esc to view the default report.

1. Transaction Summary in GSTR-2 Report

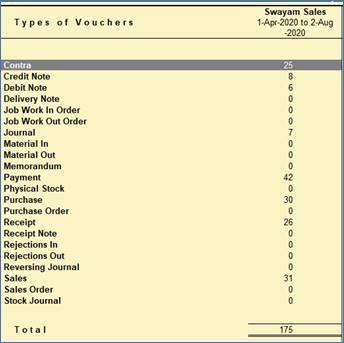

This section provides a summary of all transactions recorded in the reporting period. You can drill down on each row to view the details.

218

Total number of vouchers for the period

Drill down shows the Statistics report.

219

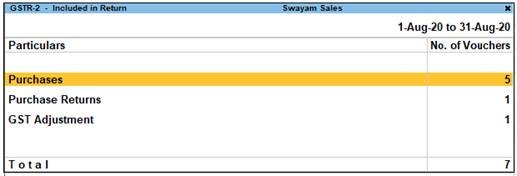

Included in Returns

Drill down from this row to view the Summary of Included Vouchers report, with the list of voucher-types with voucher count.

220

Not included in returns due to incomplete information

Displays the count of all vouchers for which tax type/tax rate not specified, vouchers have incomplete/incorrect adjustment details, and UQC is not selected. You can correct exceptions in the vouchers before exporting GST returns. If the computed tax is not equal to the tax entered in the invoice, the transaction appears under Incomplete/Mismatch in information (to be resolved) .

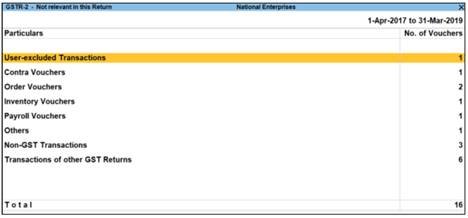

Not relevant for returns

Drill down from this row to view the Summary of Excluded Vouchers report, with the transaction type-wise voucher count.

221

Other transaction types that can appear under excluded vouchers:

- User-excluded Transactions: Manually excluded by you from the list of included or uncertain transactions. Drill down and use Alt+H (Include Vouchers), if required. Based on the information in the voucher it will move to either included or uncertain.

- Contra Vouchers: The count of contra entries which involve only bank and cash ledgers.

- Order Vouchers: The count of sales order, purchase order, job work in order, and job work out order vouchers.

- Inventory Vouchers: The count of receipt note, stock journal, delivery note, material in, material out, rejections in, rejections out, and physical stock vouchers as they are purely inventory in nature and do not attract GST.

- Payroll Vouchers: The count of transactions recorded using payroll and attendance vouchers. GST does not apply to these transactions.

- Other voucher: The count of memorandum and reversing journal vouchers.

- No GST Transactions: The count of receipts, payments, and journal vouchers that do not have any GST implication.

- Transactions of other GST Returns: The transactions which are part of other returns, for example: GSTR – 1, and hence will not have any implication on GSTR–2.

All the transaction types are not displayed by default. Based on the voucher type used and the exclusions done by you, the relevant categories appear with the voucher count.

Invoices with mismatch in information

Displays the count of all vouchers for which information required for filing returns is missing in the invoice. You can correct exceptions in the vouchers before exporting GST returns.

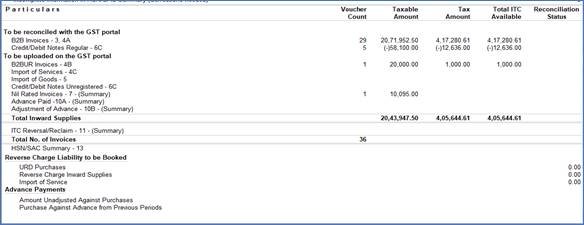

2. Particulars Information (GSTR-2 Report)

222

1. B2B Invoices – 3, 4A

The taxable, exempt and nil rated purchases made from regular dealers are captured here. If your tax invoice had exempt and nil rated items along with taxable items, then the total invoice value is captured here.

The party-wise drill down report appears as shown below:

223

2. B2BUR Invoices – 4B

Displays the details of journal vouchers recorded by debiting and crediting tax ledgers with:

- Nature of Adjustment – Increase of Tax Liability & Input Tax Credit

- Additional Details – Purchase From Unregistered dealer .

Note:

You can set this as additional details only if you have set Enable tax liability on reverse charge (Purchase from unregistered dealer)? to Yes in the Company GST Details screen.

3. Import of Services – 4C

Inward supply of services as imports and purchase from SEZs.

4. Import of Goods – 5

Inward supply of goods as imports and purchase from SEZs.

5. Credit/Debit Notes Regular – 6C

Credit and debit notes, recorded by selecting dealers having GSTIN in the reporting period.

Journal voucher recorded by debiting GST ledgers with:

- Nature of Adjustment- Decrease of Tax Liability

- Additional Details – Cancellation of Advance Payments under Reverse Charge

6. Credit/Debit Notes Unregistered – 6C

Credit and debit notes of imports, and journal vouchers recorded for cancellation of advance payments under reverse charge in the reporting period.

Journal voucher recorded by debiting tax ledgers and crediting expenses/current assets ledger, with:

- Nature of Adjustment – Decrease of Tax Liability

- Additional Details – Cancellation of Advance Payments under Reverse Charge

7. Nil Rated Invoices – 7

Displays the exempt, nil rated and non-GST supplies from composition dealers.

The purchases made from unregistered dealers will appear in this table, if the option Enable tax liability on reverse charge (Purchase from unregistered dealer)? is set to No in the Company GST Details screen.

8. Advance Paid – 10A

Journal voucher recorded by crediting tax ledgers and debiting expenses/current assets ledger, with:

Nature of Adjustment – Increase of Tax Liability

Additional Details – Advances Paid under Reverse Charge

9. Adjustment of advance – 10B

Journal voucher recorded by debiting tax ledgers and crediting expenses/current assets ledger, with:

Nature of Adjustment – Decrease of Tax Liability

Additional Details – Purchase against Advance Payment

10. ITC Reversal/Reclaim – 11

Journal vouchers recorded to reverse input tax credit are considered.

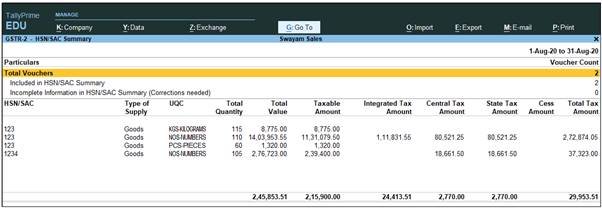

HSN Summary of inward supplies – 13

Provides the details of HSN/SAC-wise taxable value and tax amount of all inward supplies.

224