TallyPrime provides various GST Reports to File GST Returns very smoothly with 100% accuracy.

GST Return is a document that will contain all the details of your sales, purchases, tax collected on sales (output tax), and tax paid on purchases (input tax). Once you file GST returns, you will need to pay the resulting tax liability (money that you owe the government).

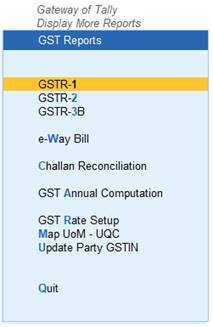

Here is a list of all the GST Reports required to file GST Returns as prescribed under the GST Law which TallyPrime provides.

Go to Gateway of Tally → Display More Reports (D)→ Statutory Report → GST RepOrts (O) ( Press DO in Gateway of Tally)

182

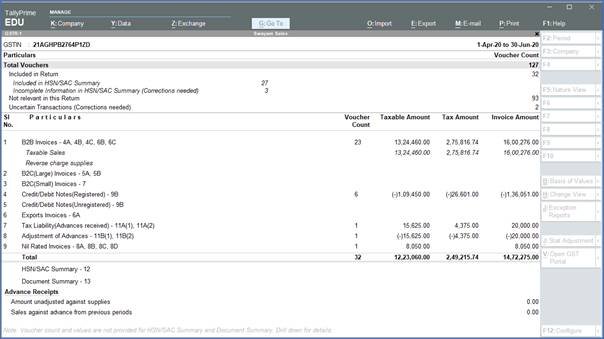

1. Gateway of Tally > Display More Reports > Statutory Reports > GST > GSTR–1.

Report displays the data for a month or quarter depending on the Periodicity of GSTR-1 set in the Company GST Details screen.

Alternatively, Alt+G (Go To) > type or search GSTR-1 or Returns or GST > select and press Enter.

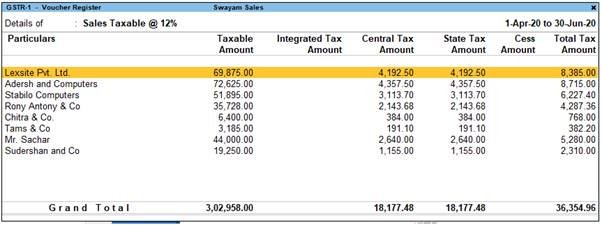

The report displays as below (Return View):

183

2. Press F5 to switch between Return View and Nature View.

Alternatively, press Ctrl+H (Change View) and select Nature View or Return View.

184

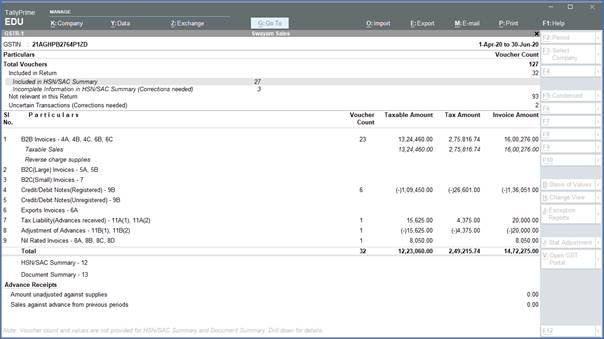

1. Return View of GSTR-1

1. Gateway of Tally > Display More Reports > Statutory Reports > GST > GSTR–1.

Alternatively, Alt+G (Go To) > type or search GSTR-1 or Returns or GST > select and press Enter.

The report displays as below (Return View):

185

In the Return View, there are two sections in the report:

- Returns summary – a snapshot of the business operations in the given period.

- Particulars – displays the taxable value and tax amount from outward supplies considered in the returns.

1.1. Return View Information (GSTR-1 Report)

186

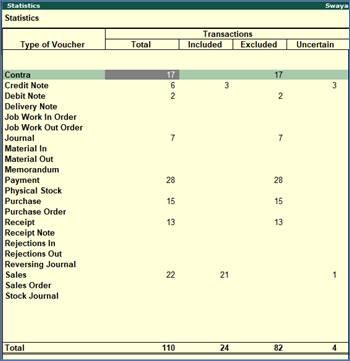

This section provides a summary of all transactions recorded in the reporting period. You can drill down on each row to view the details.

Total number of vouchers for the period

Drill-down shows the Statistics report, listing the vouchers participating in the GST return.

187

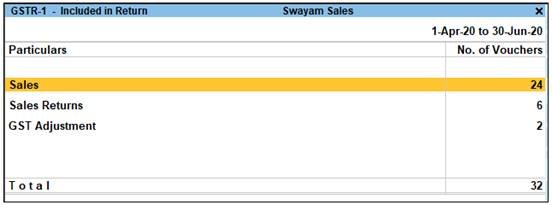

Included in returns

Drill down from this row to view the Summary of Included Vouchers report, with the list of voucher-types with voucher count.

188

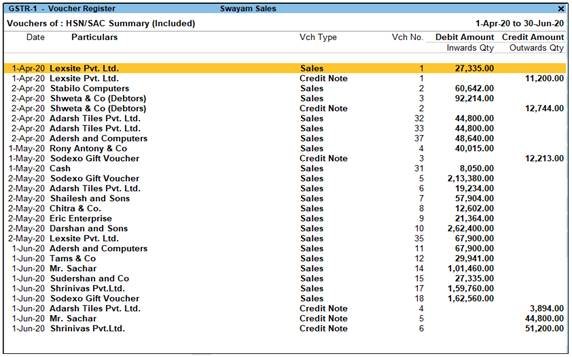

· Included in HSN/SAC Summary:

Drill down from this row to view the transactions included in HSN/SAC summary.

189

Drill down from this row to view the transactions that are included in returns but are not in HSN/SAC Summary.

190

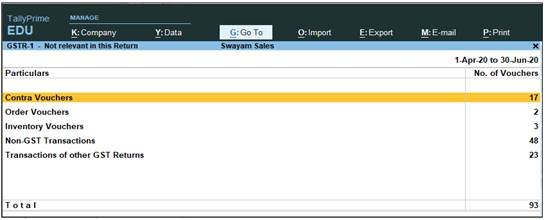

Not relevant for returns

Drill down from this row to view the Summary of Excluded Vouchers report, with the transaction type-wise voucher count.

191

Other transaction types that can appear under excluded vouchers:

- Excluded by User: Manually excluded by you from the list of included or uncertain transactions. Drill down and use H: Include Vouchers, if required. Based on the information in the voucher it will move to either included or uncertain.

- Contra Vouchers: The count of contra entries which involve only bank and cash ledgers.

- Order Vouchers: The count of sales order, purchase order, job work in order, and job work out order vouchers.

- Inventory Vouchers: The count of receipt note, stock journal, delivery note, material in, material out, rejections in, rejections out, and physical stock vouchers as they are purely inventory in nature and do not attract GST.

- Payroll Vouchers: The count of transactions recorded using payroll and attendance vouchers. GST does not apply to these transactions.

- No GST Implications: The count of receipts, payments, and journal vouchers that do not have any GST implication.

- Other voucher: The count of memorandum and reversing journal vouchers.

- Non GSTR-1 Transactions: The transactions which are part of other returns, for example: GSTR – 3B, and hence will not have any implication on GSTR–1.

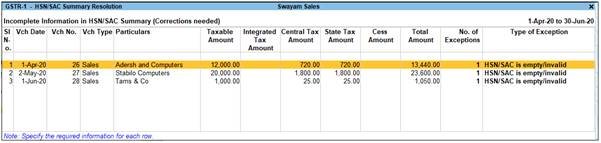

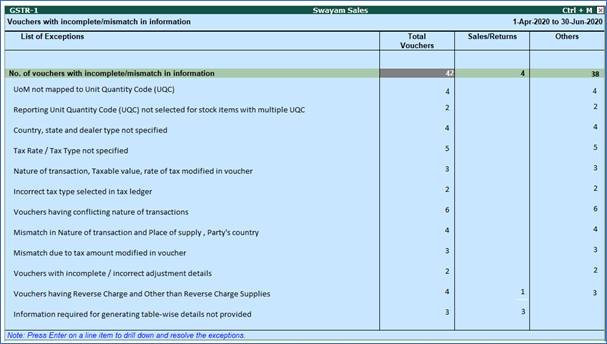

Incomplete/mismatch in information (to be resolved) – GSRT-1

Displays the count of all vouchers with insufficient GST-related information. You can correct exceptions in the vouchers before exporting GST returns. If the computed tax is not equal to the tax entered in the invoice, the transaction appears under Incomplete/Mismatch in information (to be resolved) . You need to update the missing information and resolve the mismatches to include these in the returns.

Drill down on No. of voucher with incomplete/mismatch in information as shown below:

192

Press Enter on No. of vouchers with incomplete/mismatch in information .

Note : Click X : Exclude from Summary in the Exception Resolution screen to exclude the voucher from GSTR-1 return.

>> UoM not mapped to Unit Quantity Code (UQC) :

Drill down from this line to view the units that are not mapped to UQC.

>> Reporting Unit Quantity Code (UQC) not selected for stock items with multiple UQC :

Drill down from this line to view the units for which alternate units are defined but reporting UQC has not been mapped.

>> Country, state and dealer type not specified :

Drill down from this line to view the vouchers of dealers with no information of country, state, dealer type or GSTIN.

>> Tax rate/tax type not specified :

Drill down from this line to view the vouchers where tax type or rate of tax is missing.

>> Nature of transaction, Taxable value, rate of tax modified in voucher :

Drill down from this line to view vouchers in which nature of transaction, assessable value or rate of tax defined in the ledger master was changed during recording of the transaction.

>> Incorrect tax type selected in tax ledger :

Drill down from this line to view the vouchers in which tax ledgers are not selected or are incorrectly selected.

>> Vouchers having conflicting nature of transactions :

Drill down from this line to view the vouchers that have two or more nature of transactions in which interstate and intrastate natures of transactions are selected in the same voucher.

>> Mismatch in Nature of transaction and Place of supply, Party’s country :

Drill down from this line to view the transactions having mismatch in the nature of transaction, place of supply and party’s country.

>> Mismatch due to tax amount modified in voucher :

Drill down from this line to view the transactions in which there is difference between the calculated and entered tax amount.

>> Vouchers with incomplete/incorrect adjustment details :

Drill down from this line to view the journal vouchers with incorrect or incomplete adjustment details.

>> Vouchers having Reverse Charge and Other than Reverse Charge Supplies :

Drill down from this line to view vouchers that contain both reverse charge and other than reverse charge supplies. It Displays the count of transactions that have stock items that attract regular tax rates and are taxed under reverse charge.

>> Information required for generating table-wise details not provided

Displays the count of transactions excluded from table-wise format of GSTR-1 due to incomplete information. The button Exception Types is provided to resolve all party ledger level or voucher level corrections from a single screen.

1.2. Particulars Information (GSTR-1 Report)

193

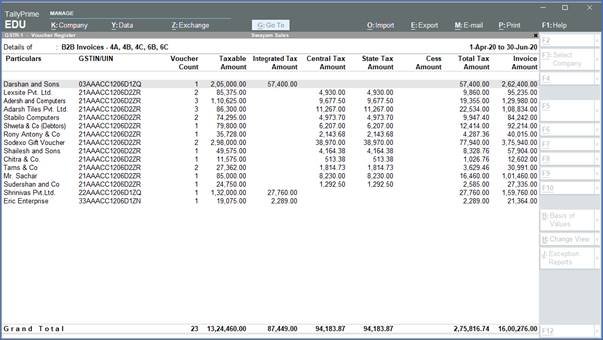

1. B2B Invoices – 4A, 4B, 4C, 6B, 6C

Taxable sales made to regular (registered) and composite dealers are captured here. If your tax invoice had exempt and nil rated items along with taxable items, then the total invoice value is captured here.

The party-wise drill down report appears as shown below:

194

2. B2C(Large) Invoices – 5A, 5B

B2C Large Invoice means Business to Large Customer Invoice. This includes Unregistered Interstate sale more than Rs. 2.50 Lacs.

| Nature of transaction | Registration type |

| Interstate Sales Taxable Interstate Sales Exempt Interstate Sales Nil Rated | Unregistered Consumer |

3. B2C(Small) Invoices – 7

It means Business to Small Customer Invoice. Sales is Central Unregistered person and Amount is equal to or less than Rs. 2,50,000.

Sale is Local to Unregistered person (Even amount greater than Rs. 2,50,000 to be entered here if it is local)

The Voucher Register based on place of supply, appears as shown below:

195

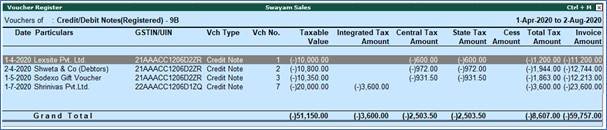

4. Credit/Debit Notes (Registered) – 9B

Displays the values of credit and debit notes (Registered), recorded in the reporting period.

196

5. Credit/Debit Notes (Unregistered) – 9B

Displays the values of credit and debit notes (Unregistered), recorded in the reporting period .

197

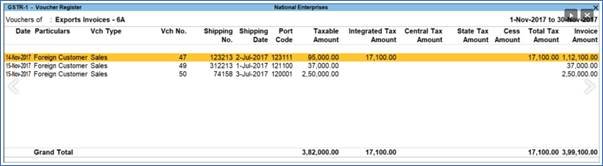

6. Exports Invoices – 6A

Displays the values of export sales recorded in the reporting period .

The Voucher Register of Export Invoices – 6A appears with details of shipping number, shipping date and port code.

198

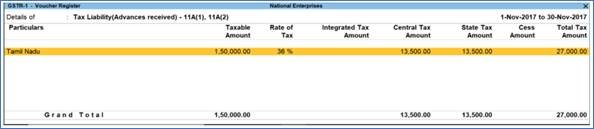

7. Tax Liability (Advances received) – 11A(1), 11A(2)

All the supplies for which Advances were received from the receiver of supplies but invoice was not raised will be entered here.

The value from transactions recorded for tax liability on advance receipt from customers will not be included in the GSTR-1 returns by default. Such transactions will be under Not relevant for returns in the GSTR-1 report. The businesses supplying services can enable the same by setting the option Enable tax liability on advance receipts to Yes in the Company GST Details screen.

The voucher register based on place of supply appears as shown:

199

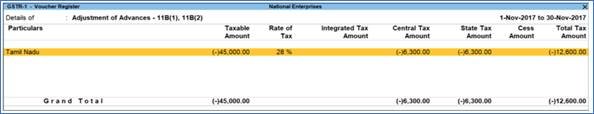

8. Adjustment of Advances – 11B(1), 11B(2)

The details of tax already paid on invoices issued in the current period against Advance Received and displays details for invoices issued in the current period on which tax has already been paid.

200

9. Nil Rated Invoices

Displays the net values of nil rated, exempt, and non-GST outward supplies made to registered and unregistered dealers, within and outside the state.

201

HSN/SAC Summary – 12

HSN/SAC Summary report contains the details of HSN/SAC-wise taxable value and tax amount.

202

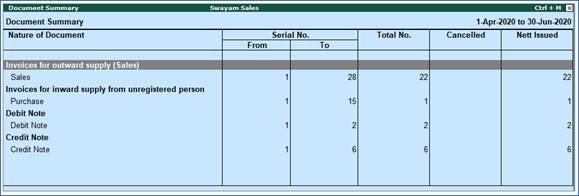

Document Summary – 13

Provides the details of transaction count based on the nature of document.

203

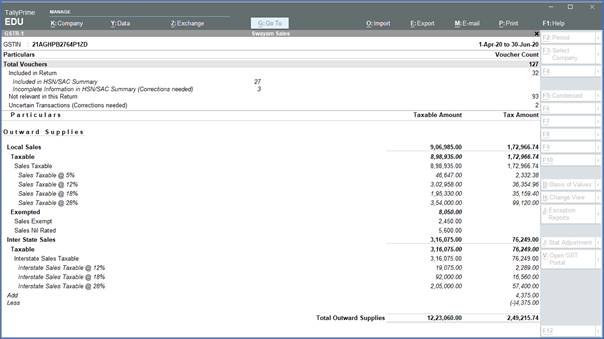

2. Nature View of GSTR-1 Report

The Summary Format displays the local and interstate transactions based on GST and non-GST outward supplies.

- Press F5 to change view from Return View to Nature View and vice versa.

- Press Alt+F5: Detailed to view the breakup of sales based on tax rates.

204

The total local and interstate sales are divided into Taxable and Exempted . To view all the sales transactions, Press Enter to display the Voucher Registered Screen.

205

You can view this report ledger wise or commodity wise by clicking F8 between Stock Item wise or Part-wise.

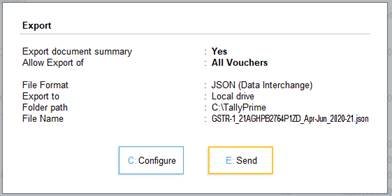

3. Export GSTR-1 Report from TallyPrime in the JSON Format.

Once you are satisfied with the details of your transactions, you can generate a return file in the JSON or MS Excel format.

1. Go to Gateway of Tally > Display > Statutory Reports > GST > GSTR-1.

Alternatively, Alt+G (Go To) > type or search GSTR-1 or Returns or GST > select and press Enter.

2. F2: Period: Select the period for which returns need to be filed.

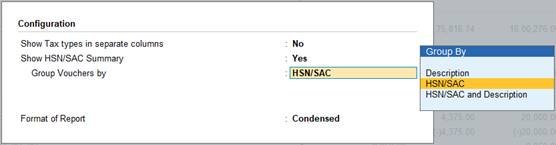

3. F12: Configure: To view the export options for HSN/SAC details, enable Show HSN/SAC Summary?

206

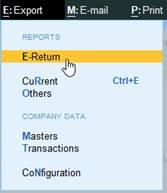

4. Press Alt+E and select E-Return.

207

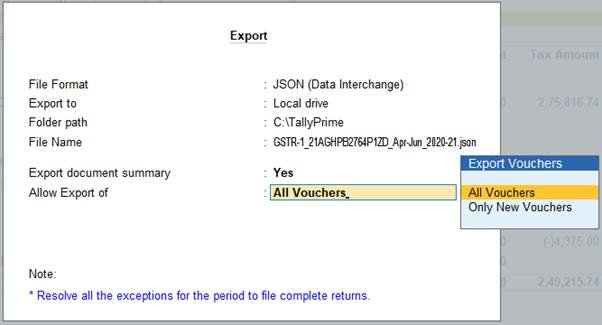

5. Select JSON (Data Interchange) as the File Format to directly upload the generated file in GST portal.

208

- Select Excel (Spreadsheet) or CSV (Comma delimited) as the Format to use the offline tool to generate JSON file.

6. Specify the Folder path.

209

7. Allow Export of:

- All Vouchers: Select this option to export all the transactions that have been already filed on the GST portal.

- Only New Vouchers: Select this option to export the transactions that are not filed on GSTN portal.

210

8. Press Enter to export.

Upload the JSON file generated from TallyPrime to the portal for filing returns.

If you have selected the CSV format, TallyPrime will create separate CSV files for each table in GSTR-1. These files need to be imported into the GST Offline Tool.