Rs.750

Rs. 700

Rs.150

Rs.150

Rs.700

Rs.350

Rs.600

Rs.275

Rs.550

Rs.250

TallyPrime 6 Printing Book (Advanced Usage) Plus (+) FREE Download e-Book (PDF) ‘Practical Assignments’-[Covering 26 Chapters & 35+23 Assignments]

₹850.00 Original price was: ₹850.00.₹800.00Current price is: ₹800.00.Add to cart

TallyPrime 6 (Advanced Usage) e-Book (PDF)-[Covering 26 Chapters & 58 Assignments]-Download

₹800.00 Original price was: ₹800.00.₹750.00Current price is: ₹750.00.Add to cart

(Wholesaler, Distributor, Dealer, Retailer – Setup,Tutorial and Assignments)

₹750.00 Original price was: ₹750.00.₹700.00Current price is: ₹700.00.Add to cart

e-Book (PDF) - Download

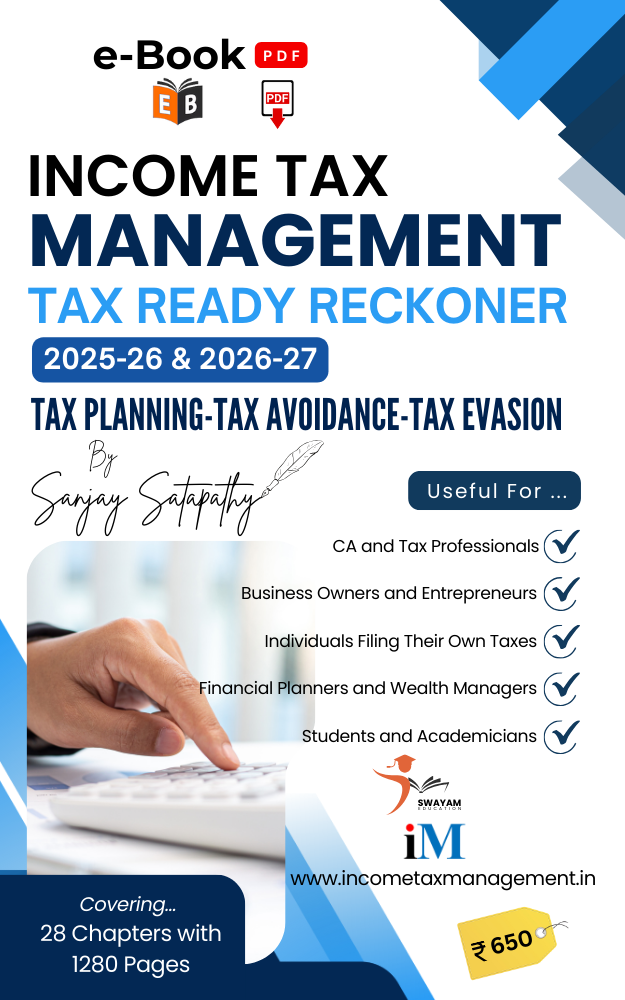

income Tax Management

[ Tax Ready Reckoner ]

e-Book (PDF)

AYs : 2025-26 & 2026-27

Most Useful by …

> CA and Tax Professionals,

> Business Owner and Entrepreneurs,

> Individuals Filing Their Own Taxes,

> Financial Planners and Wealth Managers &

> Students and Academicians.

> Coveting 28 Chapters with 1280 Pages

-

e-Book Download

TallyPrime 6 (Advanced Usage) e-Book (PDF)-[Covering 26 Chapters & 58 Assignments]-Download

₹800.00Original price was: ₹800.00.₹750.00Current price is: ₹750.00. Add to cart -

e-Book Download

TallyPrime-Rel. 2.1 Book (Advanced Usage) – e-Book (PDF) [Download]

₹600.00Original price was: ₹600.00.₹275.00Current price is: ₹275.00. Add to cart -

e-Book Download

TallyPrime 6- ‘Purchase Process’ of Goods and Services [e-Book (PDF)]-Download]

₹150.00 Add to cart -

e-Book Download

Microsoft Excel Expert e-Book (PDF) Tutorial for Beginners

₹150.00Original price was: ₹150.00.₹100.00Current price is: ₹100.00. Add to cart -

e-Book Download

TallyPrime 6-‘Sales Process’ of Goods and Services [e-Book (PDF)]-Download

₹150.00 Add to cart -

e-Book Download

Tally.ERP9 Book (Advanced Usage)-e-Book (PDF) – Download

₹550.00Original price was: ₹550.00.₹250.00Current price is: ₹250.00. Add to cart -

e-Book Download

TallyPrime Book-Rel. 3.0.1 (Advanced Usage) – [e-Book (PDF)-Downlod]

₹700.00Original price was: ₹700.00.₹350.00Current price is: ₹350.00. Add to cart -

e-Book Download

e-Invoice Process using TallyPrime 6 – [eBook (PDF)-Download]

₹150.00Original price was: ₹150.00.₹100.00Current price is: ₹100.00. Add to cart -

e-Book Download

Microsoft Word Expert e-Book (PDF) Tutorial for Beginners

₹150.00Original price was: ₹150.00.₹100.00Current price is: ₹100.00. Add to cart -

e-Book Download

TallyPrime 6 [e-Book (PDF)] (Wholesaler, Distributor, Dealer, Retailer – Setup,Tutorial and Assignments)-[Covering 24 Chapters & 39 Assignments]-DOWNLOAD

₹750.00Original price was: ₹750.00.₹700.00Current price is: ₹700.00. Add to cart -

e-Book Download

Microsoft PowerPoint Expert e-Book (PDF) Tutorial for Beginners

₹150.00Original price was: ₹150.00.₹100.00Current price is: ₹100.00. Add to cart -

e-Book Download

Microsoft Windows & internet Expert e-Book (PDF) Tutorial for Beginners

₹150.00Original price was: ₹150.00.₹100.00Current price is: ₹100.00. Add to cart -

e-Book Download

Income Tax Management- Direct & Indirect Taxes with “Tax Ready Reckoner”-(AYs 2025-26 & 2026-27]

₹650.00Original price was: ₹650.00.₹500.00Current price is: ₹500.00. Add to cart

![TallyPrime 6 Printing Book (Advanced Usage) Plus (+) FREE Download e-Book (PDF) 'Practical Assignments'-[Covering 26 Chapters & 35+23 Assignments]](http://tallyprimebook.com/wp-content/uploads/2025/01/TallyPrime-6-Printing-Book-Advanced-Usage-JPG.jpg)

![TallyPrime 6 (Advanced Usage) e-Book (PDF)-[Covering 26 Chapters & 58 Assignments]](http://tallyprimebook.com/wp-content/uploads/2025/11/TallyPrime-6-e-Book-PDF-Advanced-Usage-JPG.jpg)

![TallyPrime 6 [e-Book (PDF)] (Wholesaler, Distributor, Dealer, Retailer - Setup,Tutorial and Assignments)-[Covering 24 Chapters & 39 Assignments]-DOWNLOAD](http://tallyprimebook.com/wp-content/uploads/2025/04/TallyPrime-6-e-Book-PDF-Wholesaler-Distributor-Dealer-Retailer-JPG.jpg)

![TallyPrime 6-'Sales Process' of Goods and Services [e-Book (PDF)]-Download](http://tallyprimebook.com/wp-content/uploads/2023/12/Sales-Process-e-Book-PDF-using-TallyPrime-6.png)

![Inventory Management using TallyPrime 6 [e-Book (PDF)-Downlod]](http://tallyprimebook.com/wp-content/uploads/2024/05/Inventory-Management-e-Book-PDF-using-TallyPrime-6.png)

![Payroll Management using TallyPrime [e-Book (PDF)-Download]](http://tallyprimebook.com/wp-content/uploads/2024/06/Payroll-Management-e-Book-PDF-using-TallyPrime-6.png)

![TallyPrime 6 e-Invoice Process of Goods and Services [e-Book (PDF)]](http://tallyprimebook.com/wp-content/uploads/2024/04/e-Invoice-Process-e-Book-PDF-using-TallyPrime-6.png)

![TallyPrime 6 Printing Book (Advanced Usage) Plus (+) FREE Download e-Book (PDF) 'Practical Assignments'-[Covering 26 Chapters & 35+23 Assignments]](https://tallyprimebook.com/wp-content/uploads/2025/01/TallyPrime-6-Printing-Book-Advanced-Usage.png)

![TallyPrime 6 (Advanced Usage) e-Book (PDF)-[Covering 26 Chapters & 58 Assignments]](https://tallyprimebook.com/wp-content/uploads/2025/01/TallyPrime-6-e-Book-PDF-Advanced-Usage.png)

![TallyPrime 6 [e-Book (PDF)] (Wholesaler, Distributor, Dealer, Retailer - Setup,Tutorial and Assignments)-[Covering 24 Chapters & 39 Assignments]-DOWNLOAD](https://tallyprimebook.com/wp-content/uploads/2025/04/TallyPrime-6-e-Book-PDF-Wholesaler-Distributor-Dealer-Retailer-1.png)

![Practical Assignment on TallyPrime 6-[e-Book (PDF) - Download]](https://tallyprimebook.com/wp-content/uploads/2024/01/Practical-Assignment-on-TallyPrime-6-e-Book-PDF-Front-Cover-300x400.png)

![TallyPrime 6 (Advanced Usage) e-Book (PDF)-[Covering 26 Chapters & 58 Assignments]](https://tallyprimebook.com/wp-content/uploads/2025/01/TallyPrime-6-e-Book-PDF-Advanced-Usage-1-300x400.png)

![Payroll Management using TallyPrime [e-Book (PDF)-Download]](https://tallyprimebook.com/wp-content/uploads/2024/06/Payroll-Management-e-Book-PDF-using-TallyPrime-6-300x400.png)

![Purchase Process using TallyPrime 6-[e-Book (PDF)-Download]](https://tallyprimebook.com/wp-content/uploads/2023/12/Purchase-Process-e-Book-PDF-using-TallyPrime-6-300x400.png)

![Inventory Management using TallyPrime 6 [e-Book (PDF)-Downlod]](https://tallyprimebook.com/wp-content/uploads/2024/05/Inventory-Management-e-Book-PDF-using-TallyPrime-6-300x400.png)

![TallyPrime 6-'Sales Process' of Goods and Services [e-Book (PDF)]-Download](https://tallyprimebook.com/wp-content/uploads/2023/12/Sales-Process-e-Book-PDF-using-TallyPrime-6-300x400.png)

![TallyPrime Book-Rel. 3.0.1 (Advanced Usage) - [e-Book (PDF)-Downlod]](https://tallyprimebook.com/wp-content/uploads/2023/12/TallyPrime-Book-3-Advanced-Usage-eBook-PDF-F-Cover-300x400.png)

![TallyPrime 6 e-Invoice Process of Goods and Services [e-Book (PDF)]](https://tallyprimebook.com/wp-content/uploads/2024/04/e-Invoice-Process-e-Book-PDF-using-TallyPrime-6-300x400.png)

![TallyPrime 6 [e-Book (PDF)] (Wholesaler, Distributor, Dealer, Retailer - Setup,Tutorial and Assignments)-[Covering 24 Chapters & 39 Assignments]-DOWNLOAD](https://tallyprimebook.com/wp-content/uploads/2025/04/TallyPrime-6-e-Book-PDF-Wholesaler-Distributor-Dealer-Retailer-JPG-300x400.jpg)

![Income Tax Management-Tax Ready Reckoner [e-Book (PDF)] (AYs 2025-26 & 2026-27]](https://tallyprimebook.com/wp-content/uploads/2025/08/income-tax-Management-Tax-Ready-Reckoner-2025-26-Book-COVER-300x400.png)