Purchase of capital goods are recorded as fixed assets and is taxable. Input tax credit can be availed.

You can record taxable purchases of fixed assets (capital goods).

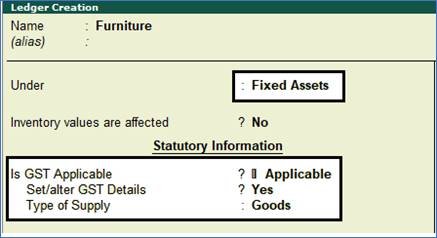

Creating a Fixed Assets ( Capital Goods) with GST Details : [ Example : Furniture ( GST 18%) ]

1. Gateway of Tally > Create > type or select Ledger and press Enter.

Alternatively, press Alt+G (Go To) > Create Master > type or select Ledger and press Enter.

96

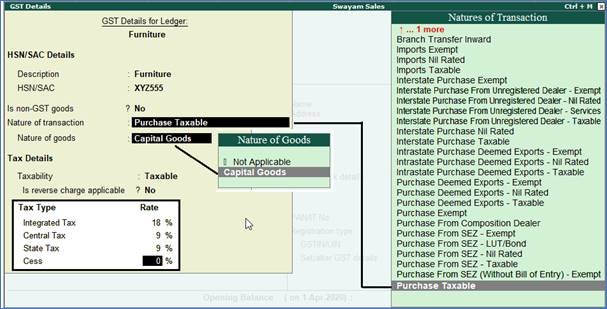

2. Under Statutory Information, Set/alter GST Details should be YES with GST Applicable. Then you will get GST Details for Ledger Screen as below:

97

3. Select ‘Purchase Taxable’ under Nature of transaction lists as displayed above.

4. Select ‘Capital Goods’ in case of Nature of goods

4. Mention GST Rate under Tax Type

5. Select Goods or Service accordingly, then Press CTRL + A ( to Save)

[Practical Assignment-13]

1. Alter or Create the following Fixed Assets Ledger with Opening Balance & GST Compliance … as per above.

| Fixed Assets: | GST Rate | Opening Balance |

| Furniture (18%) | 18% | 50,000 |

| Machinery (5%) | 5% | 1,10,000 |

| Land & Building | NA | 1,25,000 |

| Office Equipment (12%) | 12% | 60,000 |

| Computers (18%) | 18% | 35,000 |

| Vehicle (18%) | 18% | 40,000 |

2. Record the Purchase of following Fixed Assets ( Capital Goods) with GST Compliance under Purchase Voucher in Accounting Invoice

CAPITAL GOODS PURCHASE VOUCHER [F9] – Accounting Invoice ( Alt+H)

| SL | Date | Transactions |

| 1. | 5/4/2020 | Purchase Furniture for Rs. 40,000 from Supreme Furniture on Credit (within state) with GST (SGST 3600 and CGST 3600) |

| 2. | 10/5/2020 | Purchase Office Equipment for Rs. 50,000 by cheque of Axis Bank Ltd. (within state) from a Registered Showroom with GST (SGST 3000 and CGST 3000) |

| 3. | 12/6/2020 | Purchase one Computer from Excel IT Care for Rs. 35,000 on Credit with GST (SGST 3150 and CGST 3150) |

| 4. | 20/7/2020 | One Vehicle is Purchased for Office purpose from Honda Motors Ltd. for Rs. 60,000 with GST (SGST 5400 and CGST 5400) |