Debit Note is a document issued to a party stating that you are debiting their Account in your Books of Accounts for the stated reason or vice versa. It is commonly used in case of Purchase Returns, Escalation/De-escalation in price, any other expenses incurred by you on behalf of the party etc.

All features and functions of Purchase Voucher and Debit Note Voucher are same. So just like Purchase Voucher, you can record transaction in Debit Note either in Accounting Invoice or Item Invoice.

A Debit Note can be entered in voucher or Invoice mode (either Accounting / Items).

Debit Note can be entered in voucher or Invoice mode.

To go to Debit Note Entry Screen,

- Gateway of Tally > Vouchers > press F10 (Other Vouchers) > type or select Debit Note > and press Enter.

- Alternatively, press Alt+G (Go To) > Create Voucher > press F10 (Other Vouchers) > type or select Debit Note > and press Enter.

Pass an entry for the goods Purchased Returned to Supplier ACER India Ltd.:

(A) Item Invoice Mode :

This Debit Note will pass through Item Invoice :

1. Press Ctrl+H (Change Mode) to select the required voucher mode (Item Invoice, in this case)

99

2. Party A/c Name: Select the party name.

3. Party Details: Provide the Supplier details.

You can also provide the Receipt or Order details as per your invoice requirements. You can also enter the Original Invoice No. and Date, against which this purchase return is being recorded.

If you do not see the Party Details screen, press F12 (Configure), and set Provide Dispatch, Order, and Export/Import details to Yes.

As always, you can press Ctrl+A to save and proceed.

4. Select the Purchase ledger to allocate the stock items.

5. Provide the stock item details with Quantity and Rate.

(B) Accounting Invoice Mode :

The Supplier ‘Intel Solutions’ (local supplier) given Scheme Incentive for the given month for Rs. 50,000 with GST adjustment @ 18% .

This Debit Note will pass through Accounting Invoice :

1. Press Ctrl+H (Change Mode) to select the required voucher mode (Accounting Invoice, in this case)

100

Note: See Para : 5.1.1. for Ledger creation of ‘Scheme Incentive’ under Other Income as given in above image.

[Practical Assignment-14]

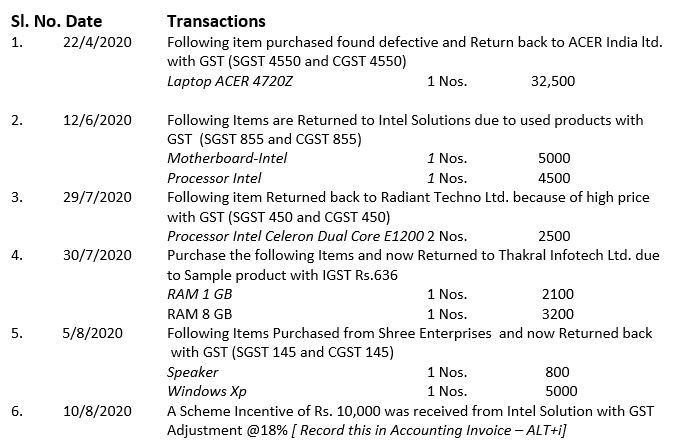

Record the following Purchase Return Transactions under Debit Note ( CTRL+F9) with GST Adjustment.

DEBIT NOTE / PURCHASE RETURN [Ctrl + F9]