A business may incur day-to-day expenses such as rent, telephone bills, Internet Bill, stationery, petty-cash expenses, and so on, to carry out the operations. These expenses attract GST.

If you are a registered dealer and purchasing from another registered dealer, and paid GST at the time of payment or purchase, you are eligible to claim the Input Tax Credit. Ensure to enable the expense ledger with GST.

| Note : If it is a URD purchase of more than Rs. 5,000, you need to pay GST and then claim ITC. |

You can record an expense using a purchase voucher. This will auto-calculate the GST amounts.

Setup:

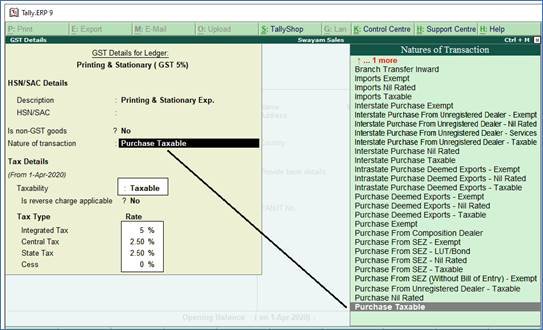

You have to create the Expenses Ledger with GST Applicable and with all GST Details like Nature of Transactions, Taxability, GST Rate etc. etc.

Say, for example, create a Expenses Ledger ‘Printing and Stationary’ which attracts GST 5% as below:

1. Gateway of Tally > Create > type or select Ledger and press Enter.

Alternatively, press Alt+G (Go To) > Create Master > type or select Ledger and press Enter.

94

2. Under Statutory Information, Set/alter GST Details should be YES with GST Applicable. Then you will get GST Details for Ledger Screen as below:

95

3. Select ‘Purchase Taxable’ under Nature of transaction lists as displayed above.

4. Mention GST Rate under Tax Type

5. Select Goods or Service accordingly, then Press CTRL + A ( to Save)

[Practical Assignment-12]

(A). Create or Alter the following Expenses with GST Compliance … as per above.

| GST Rate | |

| Administrative Expenses: | |

| Printing & Stationary (GST 5%) | 5% |

| Telephone/Telex/Fax Charges (GST 18%) | 18% |

| Electricity Bill (GST 18%) | 18% |

| Insurance Premiums (GST 18%) | 18% |

| Legal Expenses (GST 12%) | 12% |

| Professional Fees (GST 18%) | 18% |

| Selling & Distribution Expenses: | |

| Advertisement Expenses (GST 12%) | 12% |

| Sales Promotion Expenses (GST 18%) | 18% |

| Bank Charges (GST 5%) | 5% |

(B). Record the following Expenses with GST in Purchase Voucher (F9) under Accounting Invoice :

EXPENSES in PURCHASE VOUCHER [F9] – Accounting Invoice ( Ctrl+H)