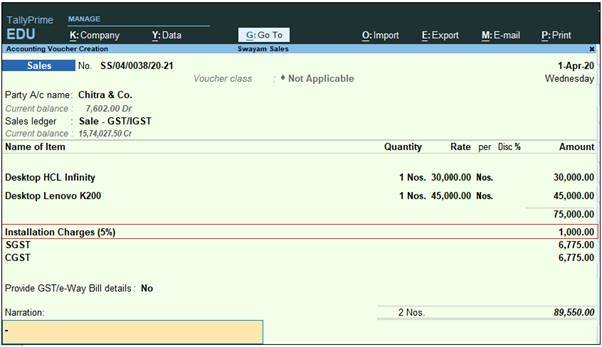

You can record the sales of both goods and services in the same invoice by selecting the required sales ledger and GST ledgers (state tax and central tax for local sales; integrated tax for interstate sales)

Example:

Transactions : Sold the following Goods to Chitra & Co. (within state customer) on Credit on 01/04/2020 with ‘Installation Charges’ Rs.1,000 extra which attracts GST 5% apart from Products GST.

| Name of Product | Qty. | Rate | Value | GST |

| Desktop HCL Infinity | 1 Nos. | 30,000 | 30,000 | (GST-18%) |

| Desktop Lenovo K200 (GST-18%) | 1 Nos. | 45,000 | 45,000 | (GST-18%) |

Setup :

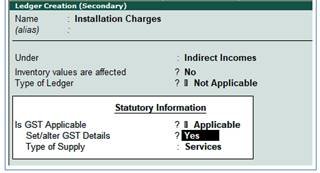

Create a Ledger “Installation Charges” under ‘Direct Income’ with GST Applicable @ 5% as details below :

122

Under Statutory Information, write YES in Set/Alter GST Details. Immediately you will be move to GST Details for Ledger screen as below :

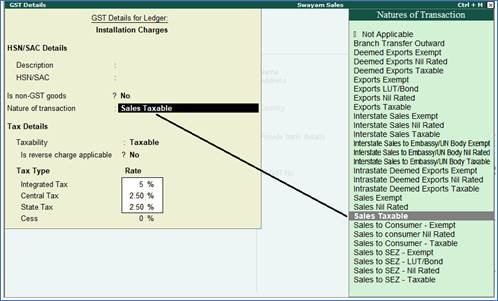

Select ‘Sales Taxable’ under Nature of Transaction list with GST % i.e. 5% as per screen below:

123

124

GST Details :

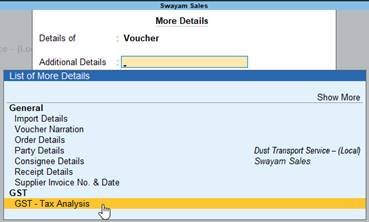

When you Press Ctrl + I (More Details) and select GST – Tax Analysis from Additional Details and Press Alt + F1 for Details…you will see the GST Analysis as below by default.

125

126