In case of Service oriented business, they also product invoice with their Service Charges plus GST. In this case TallyPrime maintain Accounting Invoice where list of Accounts displays instead of Items and Goods.

- Go to Gateway of Tally > Vouchers > Press F8 (Sales)

Alternatively, Press Alt+G (Go To) > Create Voucher > Press F8 (Sales)

Change Voucher Mode :

Press Ctrl+H (Change Mode) to select the required voucher mode (Item Invoice / /Accounting Invoice/ As Voucher) i.e. Accounting Invoice in this case.

[72-Sales Process in TallyPrime-3 & Higher]

Accordingly, Invoice body will converted into – Name of Item, Rate, Amount ( in case of Item Invoice). In this case, list of items will display.

Item Invoice:

[73-Sales Process in TallyPrime-3 & Higher]

Similarly, Invoice body will converted into – Particular , Value ( in case of Accounting Invoice). In this case, list of Ledgers / Accounts will display.

Accounting Invoice:

[74-Sales Process in TallyPrime-3 & Higher]

1. Creating Service Ledger with GST Compliance

In case of Service oriented Business like…Chartered Accountant, Lawyer, Advertising Agency, Consultant, Architectures etc.. they provide Service to the customer and provide Bill / Invoice with GST Compliance. So in this case, TallyPrime provides Accounting Invoice with auto GST Calculations, provided all Service Ledgers has to be created with GST Rate ( as applicable).

For Example:

Create a Ledger – Audit Fee with GST 18%

Setup:

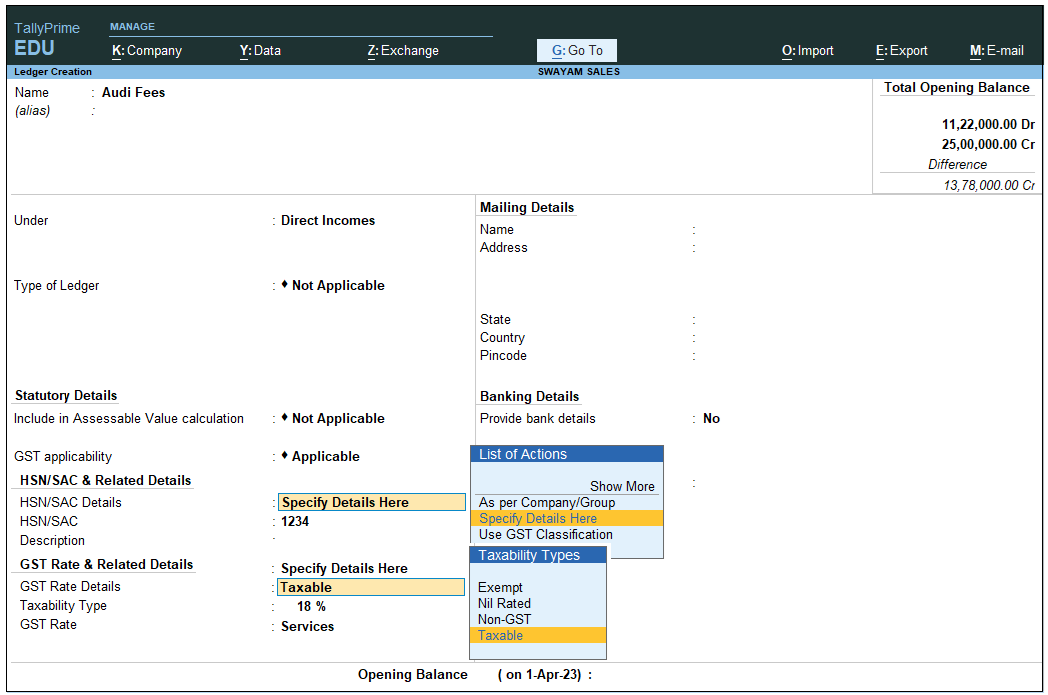

Create a Ledger, ‘Audit Fee’ under Direct Income with GST Applicable and the GST details will be applied seamlessly, with Type of Supply – Service as per screen below:

[75-Sales Process in TallyPrime-3 & Higher]

- Press Alt+G(Go To) > Create/Alter Master > Ledger (under Accounting Master).

Alternatively, go to Gateway of Tally > Create/Alter > Ledger. - Select the required service ledgerfrom the List of Ledgers, or create a new one, as needed.

- Fill in the relevant details for HSN/SAC and GST.

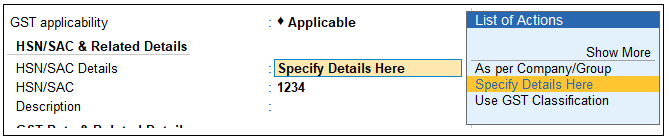

- HSN/SAC Details: You have three options to choose from.

- Specify Details Here: Once you select this option, you will be able to enter the details right here in the service ledger.

[76-Sales Process in TallyPrime-3 & Higher] - Use GST Classification: This option allows you to select a previously created GST Classification, or create one on the spot. The details will be applied accordingly.

- Specify in Voucher: If you are not aware of the details at the moment, and if you want to add the details directly in the transaction, then you can select this option.

- Specify Details Here: Once you select this option, you will be able to enter the details right here in the service ledger.

- HSN/SAC Details: You have three options to choose from.

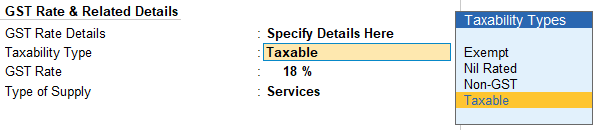

b. GST Rate Details: Like in the previous field (HSN/SAC Details), you have the same three options to choose from.

[77-Sales Process in TallyPrime-3 & Higher]

[Select Sales Exempt , if the type of supply is exempted from tax under GST, or select Sales Nil Rated , if the tax rate applicable to the type of supply is 0% under GST.]

- Type of supply – Services .

- Press Ctrl + A to save.

[Practical Assignment]

(Creation of Service Ledger)

Create the following Service Ledger under Direct Income with GST Compliance :

| Direct Income | GST Rate |

| Service Charges (12%) | 12% |

| Installation Charges (5%) | 5% |

| AMC Charges (18%) | 18% |

2. Sale Invoice with Service Charges within State (CGST / SGST)

Example:

Transactions : An invoice issued for Audit Fee of Rs. 20,000 with GST 28% (within State) to Chitra & Co. on 01/04/2023

Setup:

Create a Ledger, ‘Audit Fee’ under Direct Income with GST Applicable and with Type of Supply – Service as per screen below:

[78-Sales Process in TallyPrime-3 & Higher]

- Select GST Applicability : Applicable, specify the details in the GST Details screen below, and save.

[79-Sales Process in TallyPrime-3 & Higher]

Taxability Type : Select Taxable from Taxability Types Table as below.

[80-Sales Process in TallyPrime-3 & Higher]

[Select Exempt , if the type of supply is exempted from tax under GST, or select Nil Rated , if the tax rate applicable to the type of supply is 0% under GST.]

- Type of supply – Services .

- Press Ctrl + A to save.

- Go to Gateway of TallyPrime → Accounting Voucher → Sales (F8) → Alt+I (Accounting Invoice -if any)

- Go to Gateway of Tally > Vouchers > Press F8 (Sales)

Alternatively, Press Alt+G (Go To) > Create Voucher > Press F8 (Sales)

Press Ctrl+H (Change Mode) to select Accounting Invoice in this case.

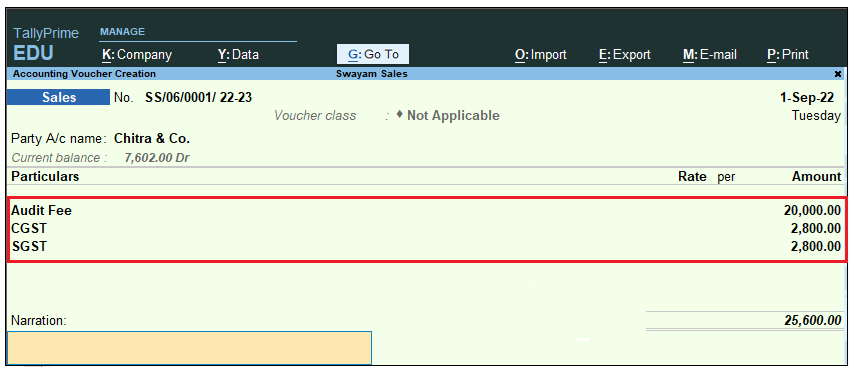

Issue a Bill/Invoice to Chitra & Co. with a Service of Audit Fee Rs. 20,000 with CGST & SGST as given below:

[81-Sales Process in TallyPrime-3 & Higher]

[Practical Assignment]

(Sale of Services-CGST & SGST)

Record the following Service Charges under Sales Accounting Invoice :

Note :

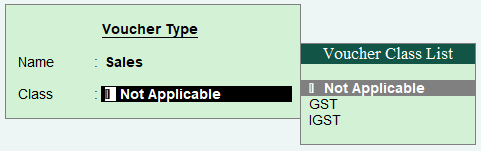

While using Sale Voucher, Don’t use Class of Voucher, select Not Applicable and press Ctrl+H to convert to Accounting Voucher.

[82-Sales Process in TallyPrime-3 & Higher]

SALE OF SERVICE

Sl. No. Date Transactions

- 5/4/2023 Service Charges of Rs. 12000 charged to Adersh and Computers for the first quarter with CGST and SGST

[ Invoice Value Rs. 13,440]

- 10/5/2023 AMC Chagres of Rs. 20,000 is invoiced to Stabilo Computers with CGST & SGST

[ Invoice Value Rs. 23,600 ]

- 15/6/2023 Installation Charges of Rs. 1000 for the customer Tams & Co. is charged and issued a invoice with CGST & SGST.

[ Invoice Value Rs. 1,050 ]

3. Sale Invoice with Service Charges Outside State (IGST)

If you are providing any Service to outside State and want to issue an Invoice outside State with IGST, in this situation, you have create a Ledger as usual under Direct / Indirect Income with GST Applicable as given below:

Create a Ledger : Installation & Service Charges (IGST @ 18%)

[83-Sales Process in TallyPrime-3 & Higher]

[Practical Assignment]

(Sales Transactions of Services)

Record the following Service Charges under Sales Accounting Invoice :

- 20/7/2023 An Invoice is issued of the following Charges to Eric Enterprises (Outside State) with IGST

Installation & Service Charges (IGST @ 18%) Rs. 15,000

[ Invoice Value Rs. 17,700 ]

[84-Sales Process in TallyPrime-3 & Higher]