Creating a Single LEDGER :

A ledger is the actual account head to identify your transactions and are used in all accounting vouchers.

For example, purchase, payments, sales, receipts, and others accounts heads are ledger accounts. Without a ledger, you cannot record any transaction.

All Ledgers have to be classified into Groups. These groups and ledgers are classified into Profit and Loss or Balance Sheet.

The creation and usage of Groups in TallyPrime has been explained earlier. Now you will learn how TallyPrime works with Ledgers.

- Gateway of Tally > Create > type or select Ledger and press Enter.

Alternatively, press Alt+G (Go To) > Create Master > type or select Ledger and press Enter.

[15-Practical Assignment-TallyPrime]

- Name Box : enter the name of ledger, alias is used for short name.

- Select the group under which the ledger will be created.

- You can select Tax Registration type : Regular (required GST No) or Unregistered/Consumer (No GST No require)

[16-Practical Assignment-TallyPrime]

- Enter the Opening Balance.

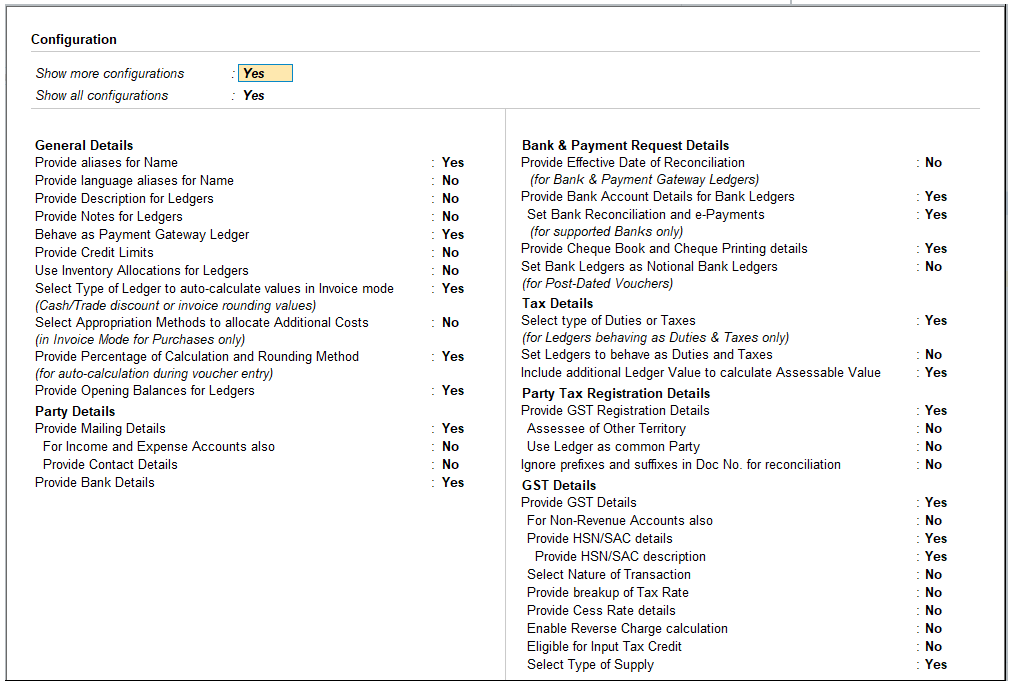

F12: Configure ( Ledger)

Configuring F12 (functional key): You can also configure your ledger creation as per your requirement by using ‘F12’.

To view and show all Configurations…you have to enable Yes of two option inside Configuration screen.

Show more configurations : Yes

Show all configurations : Yes

[17-Practical Assignment-TallyPrime]

Displaying, Altering and Deleting Ledger Accounts

You can alter any information of the ledger master with the except for the closing balance under the group stock-in-hand.

To display/alter a ledger

- Gateway of Tally> Alter > type or select Ledger Name and press Enter to Alter.

Alternatively, press Alt+G (Go To) > Alter Master > type or select Ledger and press Enter.

To delete a ledger

- Press Alt+D andpress ( In Alternation mode screen of Ledger)

[18-Practical Assignment-TallyPrime]

Note: You can delete the ledger if no vouchers have been created under it. If you want to delete a ledger for which vouchers have been created, you have to first delete all the vouchers from that ledger and then delete the ledger account.

Creating Bank Account Ledgers in TallyPrime

You can provide information such as Bank name, Account no., IFS code, and address while creating bank ledgers.

To create a bank ledger

- Gateway of Tally > Create > type or select Ledger and press Enter.

Alternatively, press Alt+G (Go To) > Create Master > type or select Ledger and press Enter.

- Enter the Name of the bank for the bank ledger.

- Select Bank Account from the List of Groups, in the Under field.

Note: The Books Beginning date is pre-filled in Effective Date for Reconciliation field.

- Provide the following details in Bank Accounts details:

o A/C holder’s name – It prefills the company name; however, you can alter this name by pressing Backspace.

o A/c no. – Provide the account number of your bank.

o IFS code – Provide the IFS code for your bank.

Note: If the IFS code in incorrect, the system prompts the warning message “Invalid IFS Code. The IFS Code must contain 4 alphabets, followed by 0 and 6 numbers/alphabets. For example, UTIB0000221.”

o Bank name – Select the bank name from the List of Banks.

The Ledger Creation screen appears as shown below:

[19-Practical Assignment-TallyPrime]

[Practical Assignment]

Create the following Assets & Liabilities (Including Bank) Ledgers with Opening Balance as given :

In our given Practical Assignment, you must remember all the Bold Letter are Groups (not required to create) under which you have to create all the Ledgers with given Opening Balance

LIABILITIES

Note :

- All Bold Letters are Pre-defined Groups (Not required to be create) to be select while creating Ledgers.

- Include in Assessable Value Calculation – Not Applicable [Default – Don’t change]

- Tax Registration type of all above Ledgers are Unregistered / Consumers (GST No. Not required)

| CAPITAL ACCOUNT | ||||||

| Sanjay’s Capital Account | 10,00,000 | |||||

| RESERVES & SURPLUS | ||||||

| Investment Allowance Reserve | 1,00,000 | |||||

| CURRENT LIABILITIES | ||||||

| PROVISIONS: | ||||||

| EXPENSES AND OUTSTANDINGS PAYABLE | ||||||

| Salaries / Wages Payable | 8,000 | |||||

| Bonus Payable | 5,000 | |||||

| Expenses Payable | 6,500 | |||||

| Interest Payable | 4,500 | |||||

| Tax Deducted at Source (Payable) | 2,500 | |||||

| GST Payable | 5,500 | |||||

| LOANS (LIABILITY) | ||||||

| LOANS RECEIVED | ||||||

| Loan from Father | 1,75,000 | |||||

| Mr. ABC Loan Account | 20,000 | |||||

| DEPOSITS RECEIVED | ||||||

| Deposits Received form Mr. A | 5,000 | |||||

| Deposits Received form Mr. B | 12,000 | |||||

| ADVANCES RECEIVED | ||||||

| Customer – A Advance | 3,000 | |||||

| Customer – B Advance | 3,000 | |||||

| BANK LOANS AND OVERDRAFTS | ||||||

| Bank Term Loan | 1,50,000 | |||||

| Bank Car / Computer Loan | 1,50,000 | |||||

ASSETS

Note :

- Don’t Create Closing Stock (Stock in Hand) with Opening Balance of Rs.9,50,000 which will automatically displayed from Opening Stock of items and goods

- All Bold Letters are Pre-defined Groups (Not required to be create) to be select while creating Ledgers.

- Include in Assessable Value Calculation – Not Applicable [Default – Don’t change]

- Tax Registration type of all above Ledgers are Unregistered / Consumers (GST No. Not required)

- Alter the Ledger – Cash (Default – Don’t create) and put Opening Balance of Rs.25,000

| FIXED ASSETS | ||||||

| Office Premises | 8,00,000 | |||||

| Furniture and Fixtures | 1,00,000 | |||||

| Office Equipment | 1,50,000 | |||||

| Computers | 50,000 | |||||

| Fax Machines | 20,000 | |||||

| Vehicle | 80,000 | |||||

| Air Conditioners | 30,000 | |||||

| INVESTMENTS | ||||||

| INVESTMENTS IN SECURITIES | ||||||

| Investment in Mutual Fund | 50,000 | |||||

| Investment in Shares | 1,00,000 | |||||

| Investment in Postal | 91,000 | |||||

| CURRENT ASSETS | ||||||

| BANK ACCOUNTS | ||||||

| Axis Bank Ltd. | 50,000 | |||||

| ICICI Bank | 20,000 | |||||

| CASH IN HAND | ||||||

| Cash (Default – Don’t create) | 25,000 | |||||

| Office Petty Cash | 5,000 | |||||

| DEPOSITS (ASSET) | ||||||

| DEPOSITS GIVEN | ||||||

| Fixed Deposits in ICICI Bank | 1,00,000 | |||||

| Deposit with Electric Supply Co. | 3,000 | |||||

| Deposit with Telephone Co. | 2,000 | |||||

| Deposit with Municipality | 1,000 | |||||

| Deposit for Rent | 5,000 | |||||

| LOAN & ADVANCES (ASSETS) | ||||||

| TAX ADVANCES | ||||||

| Income Tax – Advance | 1,500 | |||||

| Tax Deducted at Source | 1,000 | |||||

| LOANS GIVEN | ||||||

| Loan Given to Mr. Clean | 20,000 | |||||

| ADVANCES GIVEN | ||||||

| Advance Against Salary to Staff | 4,000 | |||||

| Advance for Order to Supplier | 6,000 | |||||

| Advance for Expenses | 2,000 | |||||

| REFUNDS / CLAIMS RECEIVABLE | ||||||

| Claims receivable | 3,000 | |||||

| Insurance / Refunds Receivable | 2,000 | |||||