value.

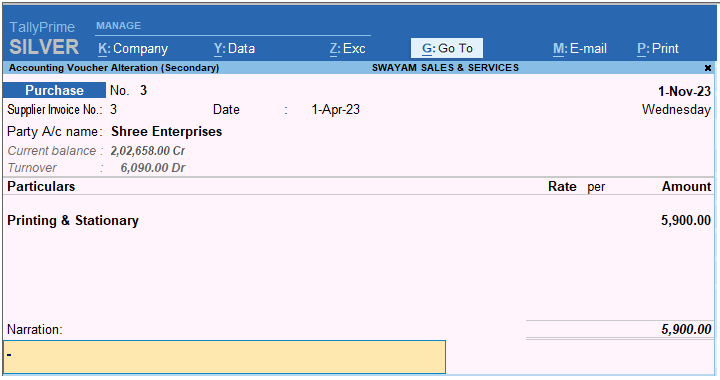

- Open the purchase voucher screen and select the accounting invoice mode.

- Gateway of Tally > Vouchers > press F9 (Purchase).

Alternatively, press Alt+G (Go To) > Create Voucher > press F9 (Purchase).

- Press Ctrl+H (Change Mode) to select the required voucher mode (Accounting Invoice, in this case).

- Specify the supplier details.

- Supplier Invoice No. and Date: The invoice number and date should be the same as given in the corresponding sales bill.

- Party A/c name: Select the supplier ledger.

- Party Details: Enter the supplier’s name and address. Select the State in which the service was availed.

- Select the expense ledger and enter the amount.

- Select the ledger grouped under Indirect Expenses. Ensure the option Is GST applicable is set to No.

- Enter the total amount of taxable value and GST as the expense value. For example, enter Rs. 5,900 (taxable value of Rs. 5,000 + 18% GST of Rs. 900).

[17-1-Record Purchase of Services as Expenses in TallyPrime-3]

- Accept the screen. As usual, you can press Ctrl+A to accept.

Similarly, you can record purchase of goods.

This transaction will appear under Not relevant in this Return section of GSTR-3B.

[Practical Assignment]

[EXPENSES in PURCHASE VOUCHER [F9] – Accounting Invoice ( Ctrl+H)]

Sl. No. Date Transactions

1. 5/4/2023 Purchase Printing & Stationary from Shree Enterprises of Rs.500 on Credit with GST (SGST 12.50 and CGST 12.50)

2. 10/5/2023 Paid the following Expenses with GST (SGST 360 and CGST 360) in cash from Registered Business.

Telephone/Telex/Fax Charges (GST 18%) Rs. 2500

Electricity Bill ( GST 18%) Rs. 1500

3. 15/6/2023 Paid Insurance Premium LIC a Registered with GST by cheque of Axis Bank Ltd. Rs. 5000 ( with SGST 450 and CGST 450)

4. 12/7/2023 Received a Bill from N. Jatania towards following Expenses with GST (CGST 2400 and SGST 2400).

Legal Expenses (GST 12%) Rs.10,000

Professional Fees ( GST 18%) Rs. 20,000

5. 20/7/2023 Advertisement Expenses ( GST 12%) for Rs. 5000 raised by PD Advertising

6. 10/8/2023 There is a Bank Charges ( GST 5%) of Rs. 200 raised by State Bank of India (a registered organization)

7. 15/8/2023 Sales Promotion Expenses ( GST 18%) for the month of July 2023 incurred by Check of State Bank of India from a Registered organization for Rs.3000 with GST (SGST 270 and CGST 270)