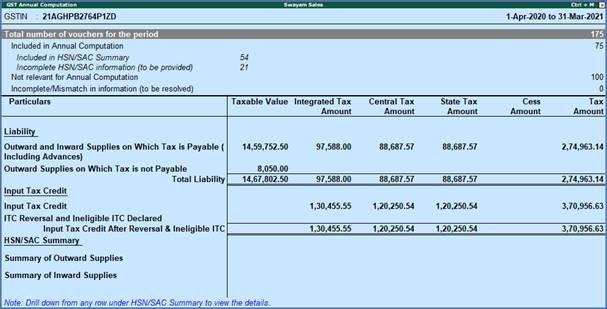

The GST Annual Computation report provides you with a brief view of business transactions recorded during the financial year. The Tax Liability and Input Credit from all the vouchers included in the annual computation is displayed here along HSN/SAC details for outward and inward supplies.

How does this Annual Computation Report help in Filing Annual Returns GSTR-9 ?

GSTR-9 is an Annual Return to be filed by all Registered Taxpayers under GST irrespective of the turnover of an entity. The return consists of details such as inward/outward supplies, taxes paid, refund claimed, demand raised and ITC availed by the taxpayer. All registered taxpayers are required to file GSTR-9.

Composition taxpayers have to file GSTR-9A, and E-commerce operators have to file GSTR-9B.

By providing the GST Annual Computation Report TallyPrime allows you to compare the book values for entire year with uploaded periodic returns. In case of any deviation in both values, you can make the necessary changes either in your books or in the annual return to ensure that the uploaded returns are true to your book values. This also ensures that discrepancy raised out of periodic returns is corrected in annual returns such that book values are same as the uploaded returns for the financial year.

The report focuses on the GST Liability and Input Tax Credit values for entire year, with month wise break-up of the values available on drill down. With the cumulative values and break up details available, you are in a position to compare your book values with uploaded returns and make necessary updates to annual return values.

To start with it is a collection of all the transactions recorded in your books for the return period, and values displayed are from these book transactions only. This gives you the confidence that all your records are being considered. Further, it helps you check details such as:

- Vouchers that are included in the returns computation

- Vouchers that are excluded from the returns computation as they are not relevant

- Vouchers that need updates for inclusion in returns computation as they have incomplete or incorrect GST information

- Financial values for GST liability and input credit with further break down into original invoice values, returns against the invoice, and month-wise details

- HSN/SAC details from all the outward and inward supplies

It also allows you to include, exclude or alters vouchers with real time changes to the liability and input credit values shown. Once all the exceptions are resolved, you can use the values shown in the computation report as the base for filling the GST annual returns.

Go to Gateway of Tally → Display → GST Report → GST Annual Computation

264

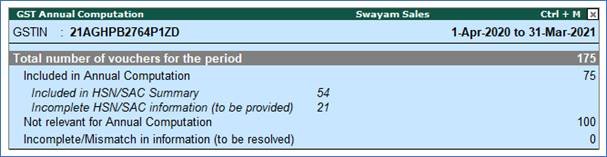

1. Vouchers Recorded for the Period

This part of the report displays the statistics for all vouchers recorded in the period. Apart from providing the details of total number of transactions recorded for the period, this section further divides the information into number of vouchers included in the return, excluded, and also pending for correction. Further, you can drill down from any line to get voucher level information, where you can include or exclude the vouchers after examining. In case of vouchers included in the computation, you can also view the number that has been included in HSN/SAC summary and that is excluded.

265

The different kind of information displayed in this section, are:

>> Total number of voucher for the period :

As the title suggests the number of vouchers recorded in the report period is shown here. It includes all the vouchers and not only GST vouchers or financial vouchers.

Drill down from this line to view the Statistics screen with details of account types and voucher types used to record the total number of vouchers.

>> Included in Annual Computation :

The number of vouchers that are included in the computation out of the total vouchers are displayed here. This includes all those transactions that have complete and correct GST details, and also those transactions that you have manually included.

Drill down from this line to view voucher type-wise break up of all the included vouchers. When you further drill down from any voucher type, the list of vouchers included is displayed.

- In this Included Vouchers screen, you can select any voucher and click the X : Exclude Vouchers option to exclude it from Annual Computation, thus prohibiting the voucher from participating in GST returns.

>> Included in HSN/SAC Summary :

The number of vouchers that are included in the HSN/SAC Summary in the annual computation, out of the total number of vouchers are displayed here.

Drill down from this line to view the list of vouchers.

>> Incomplete HSN/SAC information (to be provided) :

The number of vouchers that are not included in HSN/SAC Summary due to incomplete details are displayed here.

- Drill down from this line to view the list of vouchers that are not included in HSN/SAC Summary. The type of exception is displayed for each voucher that is excluded.

- You can drill down from any voucher to provide the missing details. Press Ctrl+Enter from any voucher to open the voucher in alteration mode.

- You can also press Ctrl+E to view the list of exception types and provide the missing details for each exception.

>> Not relevant for Annual Computation :

The vouchers that have no GST implication or are manually excluded from GST computation by you are listed here.

- Drill down from this line to view the voucher type-wise list of vouchers excluded. You will also find the category – Excluded by User, which contains the list of vouchers that have been manually excluded by you.

- Press Enter from any category to view the list of vouchers from the respective category.

- Under Excluded by User category, you can select a voucher and click I : Include Voucher to include the selected voucher in the annual computation.

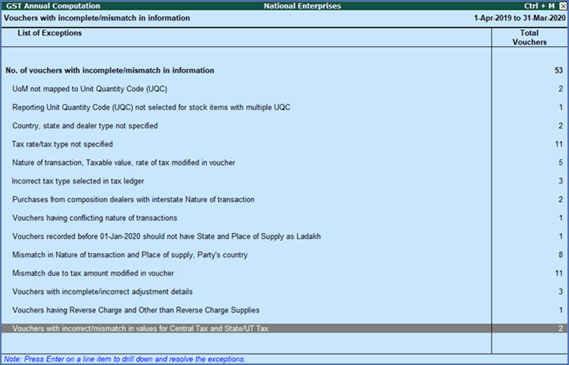

>> Incomplete/Mismatch in information (to be resolved) :

The number of vouchers that have GST implication but are not included in the computation due to incomplete or incorrect GST details are displayed here. These vouchers need updates to be included in annual computation. All such vouchers are separated into different categories based on the type of incomplete or incorrect details.

1.1. Resolution of incomplete/incorrect details

When you have vouchers that are not included in annual computation due to incomplete or incorrect GST details, a part your GST transactions are not included. This will lead to incorrect annual computation. TallyPrime does not only identify these transactions and categorise them based on the type of exception, but allows you to make the necessary corrections to include them in computation.

Drill down from the Incomplete/Mismatch in information (to be resolved) line to view the exceptions grouped into different categories.

266

>> No. of vouchers with incomplete/mismatch in information :

Drill down from this line to view the list of all vouchers with exceptions with description of the exception. Select any voucher and press enter to view the Voucher Details Screen. In this screen you can provide the required details to resolve the exception. Once the exception is resolved, the voucher is included in the annual computation and is not listed as exception. In case voucher has multiple exceptions, it will move to the next category of exception.

>> UoM not mapped to Unit Quantity Code (UQC) :

Drill down from this line to view the units that are not mapped to UQC.

>> Reporting Unit Quantity Code (UQC) not selected for stock items with multiple UQC :

Drill down from this line to view the units for which alternate units are defined but reporting UQC has not been mapped.

- You can map the unit to its RUQC using the A : Map to RUQC option.

>> Country, state and dealer type not specified :

Drill down from this line to view the vouchers of dealers with no information of country, state, dealer type or GSTIN.

- You can resolve the exception by recording the missing information in the respective columns and saving the changes.

- You can exclude the voucher from GST computation using the X : Exclude Vouchers option.

>> Tax rate/tax type not specified :

Drill down from this line to view the vouchers where tax type or rate of tax is missing.

- You can resolve the exception by selecting the Nature of transaction to identify the tax type and by recording the tax rate.

- You can exclude the voucher from GST computation using the X : Exclude Vouchers option.

>> Nature of transaction, Taxable value, rate of tax modified in voucher :

Drill down from this line to view vouchers in which nature of transaction, assessable value or rate of tax defined in the ledger master was changed during recording of the transaction.

- You can use the option R : Resolve option and select required nature of transaction, enter taxable value and tax rate.

- You can also include the voucher in annual computation with the existing GST details using the A : Accept as is option.

- You can exclude the voucher from GST computation using the X : Exclude Vouchers option.

>> Incorrect tax type selected in tax ledger :

Drill down from this line to view the vouchers in which tax ledgers are not selected or are incorrectly selected.

- Select the correct tax ledgers in the tax type columns provided to resolve the exception

- You can exclude the voucher from GST computation using the X : Exclude Vouchers option.

>> Purchases from composition dealers with interstate Nature of transaction :

Drill down from this line to view the vouchers recorded for interstate purchases made from composition dealer.

- You can resolve the exception by changing the state name to local state and recording a recording GSTIN of local nature or clearing the GSTIN number for the party.

>> Vouchers having conflicting nature of transactions :

Drill down from this line to view the vouchers that have two or more nature of transactions.

- You can select an voucher and drill down to open the voucher alteration screen. Make the changes to ensure only one nature of transaction is applied in the voucher and save the voucher.

- You can exclude the voucher from GST computation using the X : Exclude Vouchers option.

>> Vouchers recorded before 01-Jan-2020 should not have State and Place of Supply as Ladakh :

Drill down from this line to view the vouchers in which Ladakh is selected as the Place of supply and party’s State , in transactions recorded on or before 31-Dec-2019.

- You can select an voucher and drill down to open the voucher alteration screen. Press F12 to view the Voucher Configuration screen of sales invoice, and set the option Enable supplementary details to Yes to update the State and Place of Supply .

- Select the correct Place of supply and party’s State and save the transaction.

>> Mismatch in Nature of transaction and Place of supply, Party’s country :

Drill down from this line to view the transactions having mismatch in the nature of transaction, place of supply and party’s country.

- To resolve each transaction one-by-one, navigate to the required transaction, select the appropriate Country , State , and Place of Supply .

- To resolve multiple transactions in one-go, select the required transactions by pressing Spacebar . Click R : Resolve and provide the details.

>> Mismatch due to tax amount modified in voucher :

Drill down from this line to view the transactions in which there is difference between the calculated and entered tax amount.

- For mismatch due to round-off:

- Click R : Resolve .

- Click F12: Configure and set the option Allocate invoice value difference to the ledger to Yes .

- Click F6: Select ledger to select and allocate the difference in tax amount to the required ledger.

- Click F5: Recompute to recalculate the tax amount, and allocate the difference amount to the required ledger. You can also create the required ledger from this report.

- For transactions with mismatch in Central Tax and State/UT Tax:

- Drill-down to the transaction, and correct the values.

- If you click A : Accept as is , the transaction will be included in the returns with this mismatch.

- For transactions with other mismatches, you can do one of the following:

- Click R : Resolve > F5: Recompute . Press Ctrl+A to accept.

- Click A : Accept as is and press Enter to accept it as is.

>> Vouchers with incomplete/incorrect adjustment details :

Drill down from this line to view the journal vouchers with incorrect or incomplete adjustment details.

- You can resolve the exception by selecting the correct nature of adjustment and additional details for each voucher.

- You can exclude the voucher from GST computation using the X : Exclude Vouchers option.

>> Vouchers having Reverse Charge and Other than Reverse Charge Supplies :

Drill down from this line to view vouchers that contain both reverse charge and other than reverse charge supplies.

- You can resolve the exception by altering the voucher to contain only reverse charge or other than reverse supplies in each voucher.

>> Vouchers with incorrect/mismatch in values for Central Tax and State/UT Tax :

Drill down from this line to view the vouchers in which there is difference in values of Central Tax and State/UT Tax.

- You need to correct the details as per the Note provided at the end of the Exception Resolution screen.

- Select the transaction and press Enter , to view the voucher alteration screen.

- Correct the details and save the voucher.

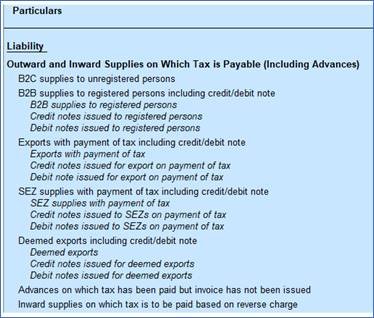

2. Liability, Input Tax Credit, HSN/SAC Summary

267

This is the section where the GST computation is displayed for the previous financial year. The tax liability and input credit from all the vouchers included in the annual computation is displayed here along HSN/SAC details for outward and inward supplies.

By default the net taxable value and tax amount is displayed under different categories. However, you can use the detailed mode to view the sub-categories with respective values.

Under liability section you can also view the original invoice values and debit/credit note values for each sub-category (except for B2C).

Under Input Tax Credit, you will find the values from imports and other applicable inward supplies. Also, ITC reversal and ineligible ITC for different sections as notified by GST.

You can get further details when you drill down from any line. At first level of drill down, you can view monthly summary of the values displayed in the report screen. There on you can drill down from any line to get party-wise break up for some categories, place of supply wise, or supplytype wise break up of monthly value for others. Lastly, drill down to get the list of vouchers. From the Voucher Register, you can open an voucher in alteration mode using the drill down function. In case you make any changes to a voucher, the values are updated in real time in the computation.

Under HSN/SAC Summary, the HSN/SAC details for outward supplies and inward supplies are grouped separately. Drill down from any category to view the HSN/SAC number-wise details. For each HSN/SAC the taxable value and tax amount is further divided on tax rate basis.

The details of type of transaction captured in each category of annual computation report is given here .

Outward and Inward Supplies on Which Tax is Payable (Including Advances)

268

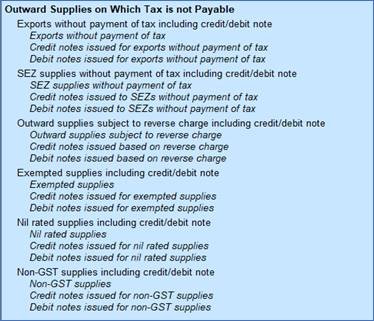

Outward Supplies on Which Tax is not Payable

269

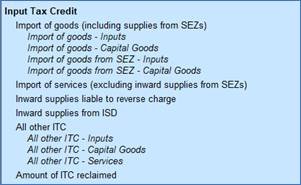

Input Tax Credit

270

ITC Reversal and Ineligible ITC Declared

271

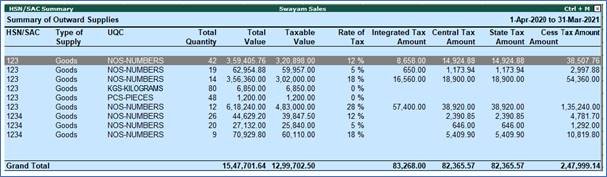

HSN/SAC Summary of Outward Supplies

For each HSN/SAC used in the transactions of outward supplies, displays the corresponding Type of Supply, UQC, quantity details and tax values. In case a HSN/SAC has multiple tax rates, each rate is shown separately.

272

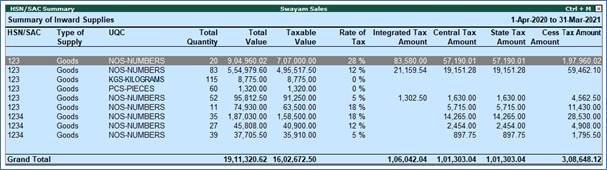

HSN/SAC Summary of Inward Supplies

For each HSN/SAC used in the transactions of inward supplies, displays the corresponding Type of Supply, UQC, quantity details and tax values. In case a HSN/SAC has multiple tax rates, each rate is shown separately.

273