MIS Reports are reports required by the management to assess the performance of the organization and allow for faster decision-making.

You can view the following types of MIS Reports in TallyPrime:

- Accounting Reports: To obtain information on the financial position, operational performance and economic activities of the business.

- Financial Reports: To determine the financial condition of an organisation as required by shareholders, creditors and government units.

- Inventory Reports: To manage the Inventory effectively since the actual status of stock items is obtained.

- Management Control Reports: To utilise budgets, cost centre reports, scenario reports etc. for controlling activities.

1. Cost Centre Reports

Cost Centre Reports are primarily performance reports that give a different perspective to transactions.

Ensure the option Enable cost centres is set to Yes in F11: Features .

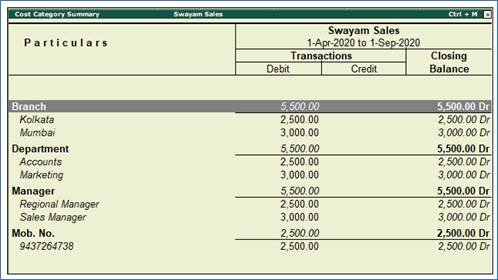

Cost centre Break-up shows the ledger accounts that are used in vouchers, the cost centre they were allocated to, their total transaction values and the balance. If you consider only the revenue accounts, the Cost Centre break-up becomes the Profit or Loss statement of activities for the cost centre, and hence a powerful performance statement.

You can view cost centre vouchers in Cost Category Summary under Category Summary .

1. Go to Gateway of Tally > Display More Reports > Statements of Accounts > Cost centres > Category Summary .

439

2. Ratio Analysis Reports

Ratio analysis is a powerful tool for financial analysis. A meaningful analysis of a financial statement is made possible by the use of ratios.

Ratios are a set of figures compared with another set. The comparison gives an understanding of the financial position of a business unit. There are a number of ratios which can be computed from a single set of financial statements. The ratios to be computed depend on the purpose for which these ratios are required. A single ratio may sometimes give some information, but to make a comprehensive analysis, a set of inter-related ratios are required to be analysed.

The Ratio Analysis Report is divided into two parts, Principal Groups and Principal Ratios. The Principal Groups are the key figures that give perspective to the ratios. Principal Ratios relate two pieces of financial data to obtain a comparison that is meaningful.

You can view this:

Go to Gateway of Tally > Ratio Analysis .

The Ratio Analysis screen is displayed as shown below:

440

Principal Groups and key figures

The principal groups and key figures in TallyPrime are detailed in this topic.

- Working Capital : The Net Working Capital is calculated by subtracting Current Liabilities from Current Assets. Financial Analysts often consider the total Current Assets as the Working Capital. This serves as a measure of how far the firm is protected from liquidity problems.

- Cash in Hand and Bank Balances : This data presents another perspective on the liquidity position.

- Sundry Debtors (due till today) : The list of all the debtors and the total debts due as on the date of the statement, are displayed.

- Sundry Creditors (due till today) : The list of all the creditors and the total credits due as on the date of the statement are displayed.

- Sales and Purchase Accounts : The Sales and Purchase Accounts, which collate the trading activity for the period, are displayed.

- Stock in Hand : This field displays the stock in hand as on the date of the report and together with Cash and Bank Balances and Debtors, completes the Current Assets aspect of the Working Capital.

- Nett Profit : This is derived from the Profit & Loss Account and is the profit after direct and indirect expenses.

- Wkg. Capital Turnover (Sales Accounts/Working Capital) : This is an activity or efficiency ratio that shows the number of times the working capital has been rolled over during a particular period. It depicts how effectively the firm is using its working capital.

- Inventory Turnover (Sales Accounts/Closing Stock) : This is an activity or efficiency ratio that shows the number of times the stock has been rolled over during the period of the report. It depicts how effectively the firm is using its inventories.

3. Cash Flow Reports

Cash Flow is the inflow and outflow of cash during an accounting period.

A cash flow statement concentrates on the transactions that have a direct impact on cash. It deals with the inflow and outflow of cash between two Balance Sheet dates. That is, it explains the changes in cash position between the two periods. Here the term cash stands for cash and bank balances.

Cash flow statements can also be used as receipts and payments statement. This is particularly useful for businesses such as Non Profit Organizations where receipts and payments statements need to be generated.

You can view this:

1. Go to Gateway of Tally > Display More Reports > Cash Flow .

2. Press Alt+F2 , change the period – From: 1-4-2020 to 30-9-2020. The Cash flow statement is displayed as shown:

441

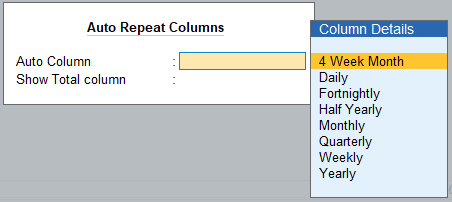

For Quarterly Cash Flow statement:

- Change Period by pressing F2: Period and set the period, e.g., 1-4-2020 to 30-06-2020.

- Select the option Alt+N : Auto Column from the button bar.

442

- You can also select Quarterly (or Monthly or any other period) from the list. The Cash Flow screen appears as shown below:

443

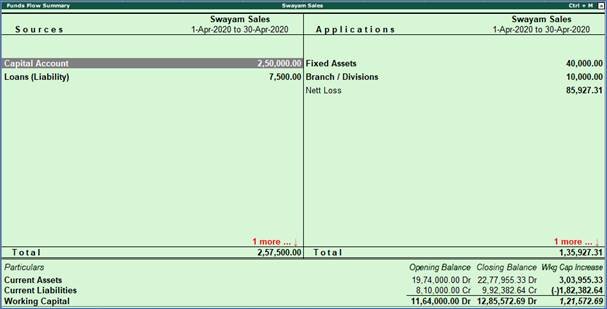

4. Funds Flow Statement Reports

A Fund Flow statement is a report, which explains the movement of funds during an accounting period.

This statement consists of two parts

● Sources of funds

● Application of funds

The difference between the two shows the net change in the working capital during the period. Only those transactions that affect the net working capital of the firm, find place in this statement.

The Fund Flow statement is a supplement to the two principal financial statements. While supplementing the position statement, it describes the sources from which additional fund were derived and for which these funds were used. The transactions, which increase working capital, are sources of funds and the transactions, which decrease working capital, are application of funds.

You can view this

1. Go to Gateway of Tally > Display More Reports > Funds Flow .

2. Press Alt+F2, change period -The funds flow statement is displayed as shown below:

444

3. A Monthly Funds Flow Summary with the movement of working capital for each month is displayed. It shows the Opening and Closing Balances of each month with a column for Funds Flow.

4. Select a month and press Enter to drill down.

5. Select Alt+F1: Detailed to see the funds flow for the selected month.

445

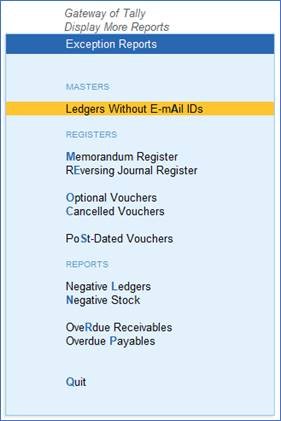

5. Exception Reports

Exception Reports track unusual transactions or balances.

- Go to Gateway of Tally > Display More Reports > Exception Reports . The different kinds of Exception Reports are:

446

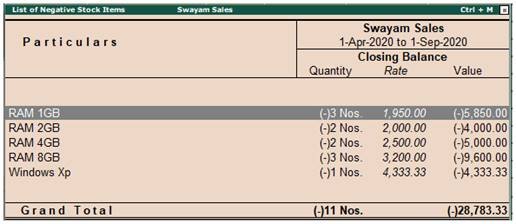

5.1. Negative Stocks Report

This Negative Stock report displays a list of all stock items that have a negative quantity (closing value) balance at the end of a specified period.

- Go to Gateway of Tally > Display More Reports > Exception Reports > Negative Stock .

447

You can use the drill-down feature or view Stock Item display for further details.

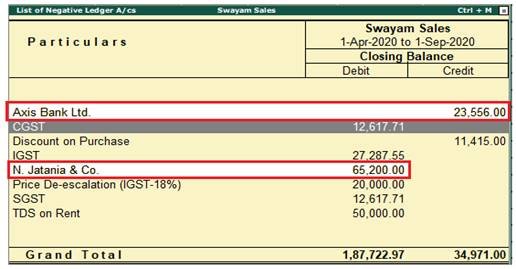

5.2. Negative Ledgers Report

his is a list of ledger accounts balances that is opposite to the nature of the account. For example, a creditor account with a debit balance and a Bank account with a credit balance.

- Go to Gateway of Tally > Display More Reports > Exception Reports > Negative Ledgers .

448

Axis Bank Ltd. Account is a Bank account and is expected to have a debit balance. Supplier Account is a Creditor/Supplier account and should normally have a credit balance.

5.3. Memorandum Voucher Register Report

Memorandum Vouchers is a non-accounting voucher and the entries made using the memo voucher will not affect your accounts. In other words, Tally does not post these entries to ledgers but stores them in a separate Memorandum Register.

To know more …about Memorandum Voucher, See Para – 15.1

To view this Register:

Go to Gateway of Tally > Display More Reports > Exception Reports > Memorandum Register .

You can also view memorandum vouchers from the Day Book. You can alter and convert a Memo voucher into a regular voucher when you decide to consider the entry into your books.

5.4. Reversing Journals Register Report

Reversing Journals are special journals that are automatically reversed after a specified date. They exist only till the specified date and are effective only when they are included in reports like the Balance Sheet. These are used in interim reporting in the course of the financial year where accruals are to be reported. These accruals are usually short term and are cleared in the subsequent period. However, to get a proper perspective, decision makers require the reports with the full impact of all aspects and transactions.

To know more …about Reversing Journals, See Para – 15.4

To view this Register:

1. Go to Gateway of Tally > Display More Reports > Exception Reports > Reversing Journals.

2. Select a month to view the Voucher Register report.

5.5. Optional Vouchers Register Report

This is also a non-accounting voucher, but unlike a Memo voucher. This is not a separate voucher type. You can mark an existing voucher (for example, a payment voucher or a receipt voucher) as Optional . Press CTRL + L or click on Optional from the Button Bar. This button toggles with Regular . By marking a voucher Optional, the voucher does not get posted anywhere but remains in the Optional Register.

To know more …about Optional Vouchers, See Para – 15.2

To view this Register:

1. Go to Gateway of Tally > Display More Reports > Exception Reports > Optional Vouchers.

You can view them from the Day Book as well.

5.6. Post Dated Vouchers Register Report

While entering vouchers, you can mark them as post dated. TallyPrime will not update the vouchers in ledgers until the specified date is approached. This is useful to enter transactions that take place on a regular basis. For example, if you pay for something by instalments, you can set up the payments in advance, and TallyPrime will only enter them in the ledgers as they fall due.

All Post-dated vouchers are maintained in a Post-dated voucher Register.

To know more …about Post Dated Voucher, See Para – 15.3

To view this Register:

1. Go to Gateway of Tally > Display More Reports > Exception Reports > Post-Dated Vouchers.